Flexsteel Industries Inc (FLXS) Surpasses Analyst Revenue Forecasts with Strong Q3 Performance

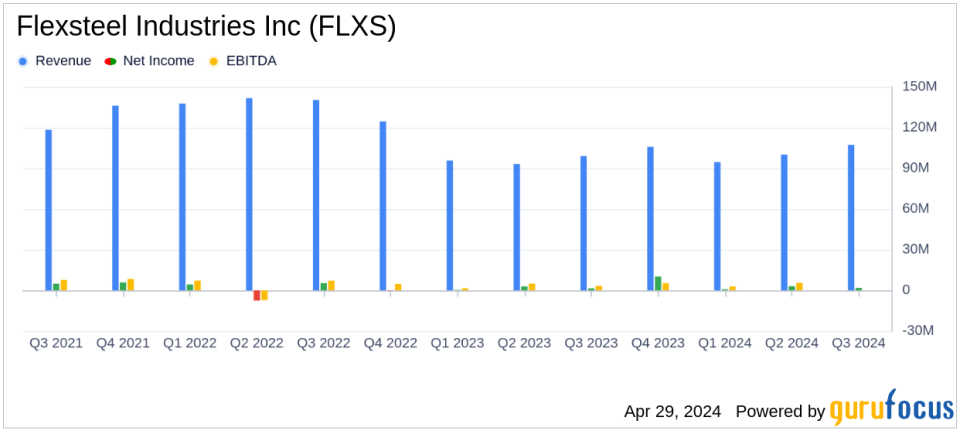

Revenue: Reported at $107.2 million, up 8.2% year-over-year, surpassing estimates of $102.11 million.

Net Income: Reached $1.8 million, compared to $1.5 million in the prior year quarter, falling short of estimates of $3.04 million.

Earnings Per Share (EPS): GAAP EPS at $0.33, below the estimated $0.56; adjusted EPS at $0.67, showing significant growth from $0.28 year-over-year.

Gross Margin: Expanded significantly to 21.7% from 18.8% in the prior year quarter, indicating improved operational efficiency.

Operating Income: GAAP operating income increased to $3.0 million from $2.1 million in the prior year quarter; adjusted operating income more than doubled to $5.6 million.

Debt Reduction: Achieved a 21% reduction in borrowings under the line of credit, emphasizing strong financial management.

Cash Flow: Generated $7.2 million from operations during the quarter, contributing to a robust year-to-date total of $24.4 million.

Flexsteel Industries Inc (NASDAQ:FLXS) released its 8-K filing on April 29, 2024, announcing a notable third-quarter fiscal performance for 2024. The company reported an 8.2% increase in sales, achieving $107.2 million against the estimated $102.11 million, thereby surpassing analyst expectations. This performance underscores Flexsteel's resilience and strategic execution amidst challenging market conditions.

Flexsteel Industries Inc, a prominent player in the U.S. furniture market, specializes in the manufacturing, importing, and marketing of residential furniture. Their diverse product range includes sofas, chairs, desks, and bedroom furniture, with a unique selling proposition in their durable Blue Steel Spring component. The company operates primarily in the residential furniture segment, although it also caters to office, hotel, healthcare, and other contract applications.

Financial and Operational Highlights

The third quarter saw Flexsteel achieve not only growth in revenue but also substantial improvements in gross margin and operating income. Gross margin expanded to 21.7% from 18.8% in the previous year, driven by fixed cost leverage and efficiency improvements. GAAP operating income rose to $3.0 million, or 2.8% of net sales, with an adjusted figure of $5.6 million or 5.2% of net sales, reflecting strong operational execution.

Net income for the quarter stood at $1.8 million, or $0.33 per diluted share, compared to $1.5 million, or $0.28 per diluted share in the prior year. Adjusted net income was significantly higher at $3.6 million, or $0.67 per diluted share, demonstrating robust profitability. These figures indicate a solid performance against the backdrop of ongoing macroeconomic challenges.

Strategic Initiatives and Future Outlook

CEO Jerry Dittmer expressed satisfaction with the quarter's outcomes, citing effective strategy implementation and market outperformance. The company's focus on new product development, innovation, and growth initiatives has been pivotal in driving sales and profitability. Moreover, Flexsteel's commitment to operational efficiency and cost management has allowed it to expand margins and reduce debt, with a 21% reduction in borrowings under the line of credit this quarter.

Looking ahead, Flexsteel reaffirms its sales guidance for Q4 2024 and adjusts its operating margin projections, reflecting confidence in continued operational success and market strength. The company also anticipates a smooth transition with the upcoming CEO change, ensuring stability and continued growth.

Investor Implications

Flexsteel's Q3 performance, characterized by revenue growth and enhanced profitability, positions the company favorably in the eyes of investors. The successful execution of strategic initiatives and the positive adjustment in future earnings guidance suggest potential value creation for shareholders. Investors and stakeholders may look forward to sustained growth and operational efficiency as Flexsteel navigates the evolving market landscape.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and investor presentation available on Flexsteel's website.

Explore the complete 8-K earnings release (here) from Flexsteel Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance