Flexion (FLXN) to Report Q3 Earnings: What's in the Cards?

Flexion Therapeutics, Inc. FLXN will provide updates on revenues from Zilretta and its other pipeline developments when it reports third-quarter 2021 results.

The company’s earnings history has been mixed so far with its bottom line beating estimates in two of the trailing four quarters and missing the same on the other two occasions, delivering an earnings beat of 0.68%, on average. In the last reported quarter, Flexion reported an earnings surprise of 12.00%.

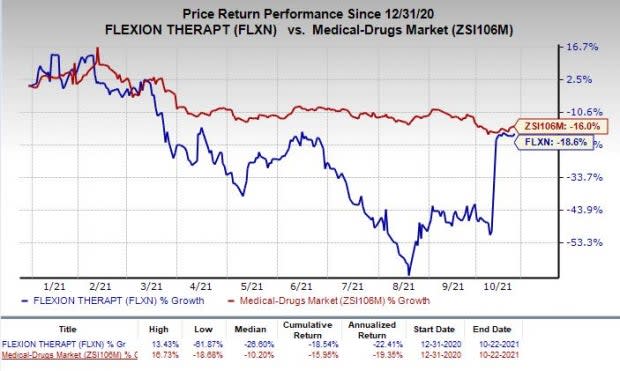

Shares of Flexion have plunged 18.6% so far this year compared with the industry’s decrease of 16%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors at Play

Flexion’s topline solely comprises sales of its only marketed drug Zilretta (triamcinolone acetonide extended-release injectable suspension). In the last reported quarter, revenues increased year over year, a trend that most likely continued in the third quarter as well.

Zilretta was approved in 2017 as the first and the only extended-release intra-articular therapy providing relief to osteoarthritis (OA) patients with knee pain.

This apart, Flexion is evaluating FX301 in a phase Ib study to address post-operative pain following bunionectomy surgery. The company is also investigating FX201, an intra-articular gene therapy candidate in an early-stage study for OA knee pain. Data from both studies are expected by 2021 end.

The activities related to the development of pipeline candidates are likely to have escalated operating expenses in the to-be-reported quarter.

In October 2021, Flexion entered into a definitive agreement with Pacira BioSciences PCRX whereby the latter will acquire the former for $8.50 per share in cash plus one non-tradeable contingent value right worth up to $8 in cash. The transaction is expected to close later in the fourth quarter of 2021. We expect management to provide a thorough update on the same on the upcoming earnings call.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Flexion this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Flexion has an Earnings ESP of -4.13% as the Most Accurate Estimate currently stands at a loss of 55 cents per share while the Zacks Consensus Estimate is pegged at a loss of 53 cents.

Zacks Rank: Flexion has a Zacks Rank #4 (Sell), currently.

Flexion Therapeutics, Inc. Price and EPS Surprise

Flexion Therapeutics, Inc. price-eps-surprise | Flexion Therapeutics, Inc. Quote

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

Gemini Therapeutics, Inc. GMTX has an Earnings ESP of +17.61 % and a Zacks Rank #2, currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ardelyx, Inc. ARDX has an Earnings ESP of +2.22% and a Zacks Rank #3 at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

Flexion Therapeutics, Inc. (FLXN) : Free Stock Analysis Report

Ardelyx, Inc. (ARDX) : Free Stock Analysis Report

Gemini Therapeutics, Inc. (GMTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance