First Majestic (AG) Q3 Earnings Miss Estimates, Shares Dip

Shares of First Majestic Silver Corp AG have declined since the company reported an adjusted loss per share of 9 cents in third-quarter 2022, which compared unfavorably with the Zacks Consensus Estimate of a loss of 3 cents mainly due to lower metal prices. The company had reported a loss of 7 cents per share in the year-ago quarter.

Including one-time items, the company delivered a loss of 8 cents per share in the reported quarter compared with a loss per share of 7 cents in the year-earlier quarter.

First Majestic’s revenues improved 28% year over year to $160 million in the quarter under review. The upside was primarily driven by higher production at San Dimas and Santa Elena, partially offset by the decrease in the average price per silver equivalent ounce sold and lower production at Jerritt Canyon due to the maintenance shutdown.

The average realized silver price was $19.74 per payable silver equivalent ounce in the quarter, down 15% year over year, reflecting the ongoing downtrend in metal prices.

First Majestic Silver Corp. Price, Consensus and EPS Surprise

First Majestic Silver Corp. price-consensus-eps-surprise-chart | First Majestic Silver Corp. Quote

First Majestic’s total production in third-quarter 2022 was a record 8.8 million silver equivalent ounces comprising 2.7 million ounces of silver and 67,072 ounces of gold. Overall silver equivalent ounces improved 20% from the prior-year quarter, due to higher production at San Dimas and Santa Elena driven by an increase in silver and gold grades.

Operational Update

The company recorded cash costs per silver equivalent ounce of $13.34, down 5% from the year-ago quarter. Consolidated all-in-sustaining costs (AISC) of $17.38 per silver equivalent ounce came in 11% lower than the prior-year quarter.

First Majestic reported a mine-operating profit of $3.3 million in the quarter, which reflected a 5% drop from the year-ago quarter. Lower metal prices, higher cost of sales as well as depreciation and depletion from San Dimas, Santa Elena and La Encantada, offset by an increase in silver equivalent ounces sold, led to the decline in operating profit.

Financial Position

First Majestic ended the third quarter of 2022 with $149 million of cash in hand, and restricted cash of $101.2 million, totaling $250.0 million. Operating cash flow before movements in working capital and taxes was $27.7 million in the quarter under review compared with the prior year's $22.6 million.

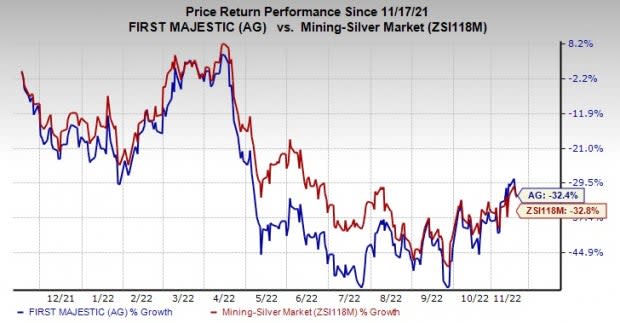

Price Performance

Image Source: Zacks Investment Research

Shares of the company have fallen 32.4% in the past year compared with the industry’s decline of 32.8%.

Zacks Rank & Stocks to Consider

First Majestic currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Sociedad Quimica y Minera de Chile S.A. SQM, Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS. While SQM and CMC sport a Zacks Rank #1 (Strong Buy), RS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sociedad has a projected earnings growth rate of 538.1% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.2% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied around 60% in a year.

The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days. Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters.

CMC has a trailing four-quarter earnings surprise of roughly 19.7%, on average. The company’s shares have gained around 38% in a year.

Reliance Steel has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 23% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

First Majestic Silver Corp. (AG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance