First Bancorp (FBNC) Q1 Earnings: Misses EPS Estimates, Reports Decline in Net Interest Income

Net Income: Reported $25.3 million, below the estimated $26.01 million.

Earnings Per Share (EPS): Achieved $0.61, falling short of the estimated $0.63.

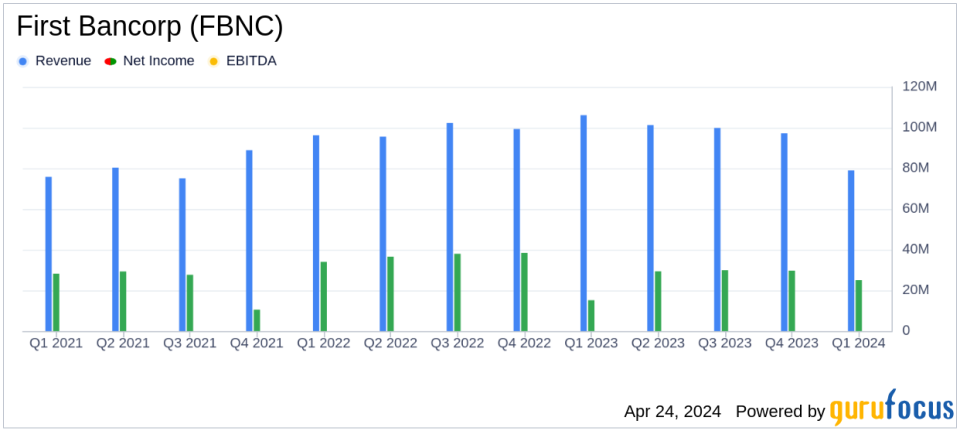

Revenue: Net interest income for the quarter was $79.2 million, indicating a decrease from previous periods.

Loan Portfolio: Total loans reached $8.1 billion, marking a decrease of $73.6 million from the previous quarter but an increase of $277.5 million year-over-year.

Deposits: Grew by $271.7 million during the quarter, with noninterest-bearing demand accounts making up 33% of total deposits.

Capital Ratios: Total risk-based capital ratio improved to 15.85%, indicating a stronger capital position.

Liquidity: On-balance sheet liquidity ratio stood at 15.5%, with total liquidity sources, including available lines of credit, at $2.3 billion.

On April 24, 2024, First Bancorp (NASDAQ:FBNC), the parent company of First Bank, disclosed its financial results for the first quarter ended March 31, 2024, in its 8-K filing. The company reported a net income of $25.3 million, or $0.61 per diluted common share, falling short of analysts' expectations of $0.63 per share. This performance marks a decrease from the $29.7 million, or $0.72 per share, recorded in the preceding quarter and compares to $15.2 million, or $0.37 per share, in the first quarter of the previous year.

Company Overview

First Bancorp, headquartered in Southern Pines, North Carolina, operates as a bank holding company through its subsidiary, First Bank. The company offers a diverse range of banking services including commercial and consumer banking, mortgage lending, SBA lending, accounts receivable financing, and investment advisory services. It operates 118 branches across North Carolina and South Carolina and is listed on the NASDAQ Global Select Market under the symbol "FBNC".

Financial Performance and Challenges

The first quarter saw a contraction in loans by $73.6 million, although there was a year-over-year growth of $277.5 million. Total deposits increased significantly by $271.7 million, driven by market deposit growth and new short-term brokered deposits. Despite these gains, First Bancorp faced challenges in its net interest income, which decreased by 14.3% year-over-year to $79.2 million. This decline was attributed to increased costs of funds, which offset the rises in earning assets. The company's tax-equivalent net interest margin also fell to 2.80% from 3.31% in the previous year, reflecting higher rates on liabilities.

Asset Quality and Credit Performance

First Bancorp continued to maintain strong credit quality, with nonperforming assets (NPA) to total assets ratio improving slightly to 0.39%. The provision for credit losses was substantially lower at $1.2 million compared to $12.5 million in the first quarter of the previous year, indicating a stable credit environment. The company's total risk-based capital ratio stood at 15.85%, showing an increase from both the linked quarter and the previous year, which underscores its solid capital position.

Noninterest Income and Expenses

Noninterest income for the quarter was $12.9 million, a decrease from the previous year, primarily due to a loss on the call of a bond. Noninterest expenses were $59.2 million, reflecting a controlled increase compared to the linked quarter. The primary factors contributing to the rise in expenses were related to adjustments in the company's pension plan and bonus accruals.

Outlook and Strategic Moves

Looking ahead, First Bancorp is focused on optimizing its balance sheet composition by reducing borrowings and high-cost deposits while reallocating funds to higher yielding assets. The company's CEO, Richard H. Moore, emphasized the strength of the balance sheet and the strategic measures being implemented to enhance financial performance. "Your company continues to perform well with increases in our liquidity and capital," Moore stated, highlighting the ongoing efforts to improve financial metrics.

As First Bancorp navigates through the challenges and leverages its strong market position, investors and stakeholders will closely monitor its ability to maintain profitability and capital adequacy in a fluctuating economic environment.

Conclusion

First Bancorp's first-quarter results reflect a mixed financial performance with strong underlying asset quality but pressures on net interest income and earnings per share. The company's strategic initiatives aimed at improving balance sheet efficiency and credit quality will be crucial in driving future growth and stability. For detailed insights and continuous updates, visit www.LocalFirstBank.com.

Explore the complete 8-K earnings release (here) from First Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance