Financial Institutions Inc. (FISI) Faces Setbacks in Q1 2024 Amid Fraud Event

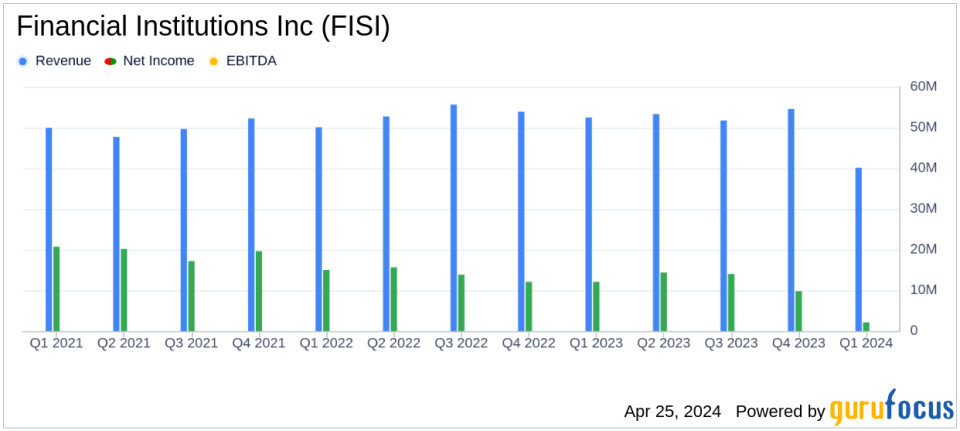

Net Income: Reported at $2.1 million for Q1 2024, a significant decrease from $9.8 million in Q4 2023 and $12.1 million in Q1 2023, falling short of the estimated $9.69 million.

Earnings Per Share (EPS): Recorded at $0.11 per diluted share, significantly below the estimated $0.59 and down from $0.61 in Q4 2023 and $0.76 in Q1 2023.

Revenue: Net interest income was $40.1 million in Q1 2024, slightly above the estimated $39.52 million, up from $39.886 million in Q4 2023 but down from $41.815 million in Q1 2023.

Noninterest Expense: Increased to $54.0 million, up 54.1% from Q4 2023, largely due to an $18.4 million loss from a deposit-related fraud event.

Deposits and Loans: Total deposits grew to $5.40 billion, a 3.5% increase from the end of 2023, while total loans slightly decreased by 0.5% to $4.44 billion.

Asset Quality: Non-performing loans were $26.7 million, maintaining a stable ratio of 0.60% of total loans from Q4 2023, but significantly higher than 0.21% in Q1 2023.

Capital and Liquidity: Ended Q1 2024 with a strong liquidity position, nearly $1.5 billion available, and regulatory capital ratios continuing to exceed requirements.

On April 25, 2024, Financial Institutions Inc. (NASDAQ:FISI), the parent company of Five Star Bank and Courier Capital, LLC, disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a net income of $2.1 million, a stark decline from $9.8 million in Q4 2023 and $12.1 million in Q1 2023. This downturn was primarily due to a deposit-related fraud event, significantly impacting the financial standing of the company.

Financial Institutions Inc operates as a financial holding company, providing a broad range of consumer and commercial banking services across Western and Central New York. Its operations are streamlined under its Banking segment, which encompasses all retail and commercial banking activities.

Comprehensive Financial Analysis

The first quarter of 2024 was challenging for FISI, with earnings per share plummeting to $0.11 from $0.76 in the same quarter the previous year, falling significantly short of the estimated $0.59. This decline was largely attributed to an $18.4 million pre-tax loss from deposit-related charge-offs and approximately $660 thousand in legal and consulting expenses due to the fraud event. Despite these setbacks, the company saw a silver lining with a $5.5 million benefit for credit losses, reflecting improved qualitative factors and a reduction in consumer indirect loan delinquencies.

Total deposits and loans showed mixed results; deposits grew by 3.5% to $5.40 billion, while total loans slightly decreased by 0.5% to $4.44 billion compared to the previous quarter. The net interest income was $40.1 million, marginally up by 0.5% from the previous quarter but down by 4.1% year-over-year. Noninterest income fell by 29.1% from the previous quarter to $10.9 million, influenced by strategic shifts including the surrender of company-owned life insurance policies.

Noninterest expenses surged to $54.0 million, up 54.1% from the last quarter, driven again by the fraud-related losses. The company's efforts to mitigate the impact included legal pursuits to recover lost funds and strategic asset sales, such as the divestiture of SDN Insurance Agency, LLC, which generated approximately $27 million.

Strategic Moves and Market Position

Amid these challenges, FISI has taken strategic steps to stabilize its financial position. The sale of SDN Insurance Agency, LLC assets early in the second quarter of 2024 is a pivotal move, expected to bolster the company's capital and liquidity. Furthermore, strong deposit growth and a proactive approach to managing credit quality underscore the company's resilience in face of adversity.

Financial Institutions Inc. continues to exceed all regulatory capital requirements, maintaining a well-capitalized status, which is crucial for sustaining investor and customer confidence during turbulent times.

The company's management remains committed to navigating through the complexities of the current economic landscape, focusing on strategic growth and maintaining robust credit discipline. The upcoming quarters will be critical for FISI as it works to overcome the current challenges and harness potential growth opportunities.

For more detailed financial insights and the latest updates on Financial Institutions Inc., visit our comprehensive analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Financial Institutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance