Fed Signals Three Cuts; Gold Keeps Its Shine

Although the results of the meeting of the Federal Reserve (‘the Fed’) on 20 March weren’t very surprising and generally in line with December’s quarterly forecast, gold moved up to a fresh all-time high while the dollar declined. Participants in major markets seem to be positive due to the stability of the Fed’s projections; sentiment on gold in particular is strong. This article summarises recent events leading to the Fed’s latest hold and looks briefly at the charts of XAUUSD and EURUSD.

Projections of nine total cuts by the end of 2026 would take the funds rate to 3-3.25%, still moderately restrictive. That scenario would be very likely to prevent a significant resurgence of inflation unless there were strong external influences, such as the price of oil. A fairly large majority of participants now expects a cut in June, around 68% according to CME FedWatch Tool.

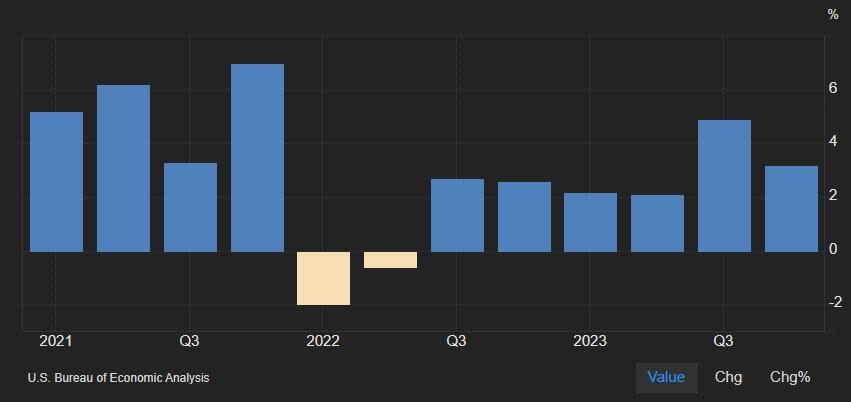

Overall, the USA seems to be doing the best among major, advanced economies. ‘Necessary economic slowdown’ has been dropped; there’s no indication from GDP data that the Fed needs to cut more rapidly to avoid a recession:

Although the second estimate of the fourth quarter’s GDP at 3.2% was negligibly lower than the advance, it remains much stronger than any other large economy. The Fed revised estimates for the next three years upward at its latest meeting. Sustaining this level of growth despite restrictive monetary policy shows the resilience of the American economy and reduces the pressure on the Fed to loosen quickly now that inflation has stabilised:

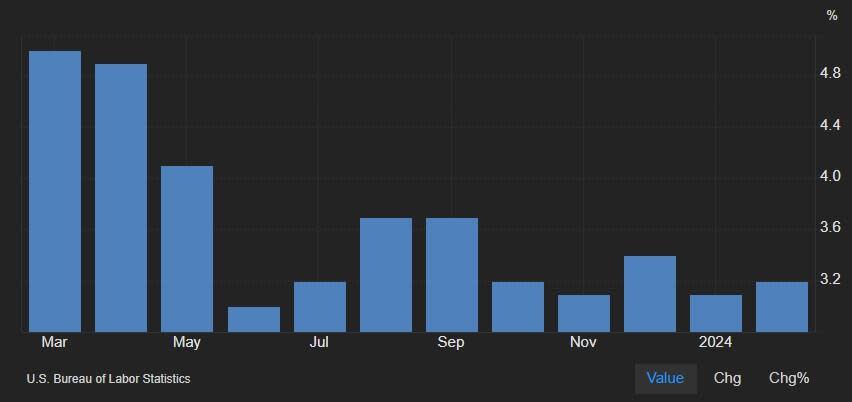

Headline inflation has been consistently higher than the consensus since late 2023, which seems likely to continue, but in most cases there hasn’t been a large surprise. The rate has generally settled around 3-4% but has some way to go before reaching 2% consistently. As noted above, general economic conditions aren’t putting strong pressure on the Fed to get the job done as soon as possible; so far, a patient approach is working. This has some support from job data too:

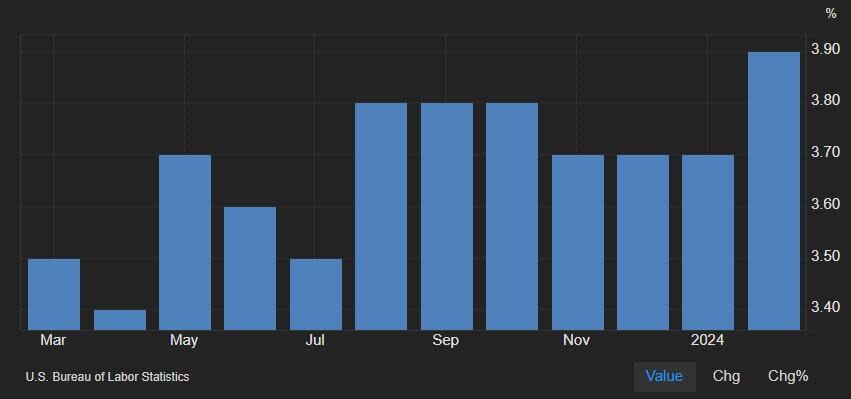

The gradual slowdown in the job market since this time last year is one factor the Fed has been looking for to support intentions to loosen monetary policy. Growth in average earnings has also slowed down somewhat since 2022, but this hasn’t been a very consistent trend. A sudden spike in unemployment seems very unlikely now given the strength of GDP data.

It’s probably too early to start looking very closely at polling for the upcoming presidential election in November, so for the moment sentiment remains key for gold. In the absence of significant new information or narratives from economic data and monetary policy, gold might be expected to continue upward and the dollar down, but the latter depends also on how other major central banks act this summer. The European Central Bank might also start cutting in June, but the Bank of England is more likely to commence in August, while the Bank of Japan only just called for its first hike for 14 years earlier this week.

Gold, Daily

Gold posted its biggest daily gain since December 2023 in the aftermath of the Fed’s meeting this week, so it certainly seems that the uptrend is still active. However, now that the price has reached the next psychological area of $2,200 and buying saturation is visible again, the next possible round of gains could be more modest than early March’s nearly vertical movement.

The next obvious target for buyers would be the 100% Fibonacci extension around $2,310. That aligns with the next round number too. However, it remains to be seen whether the price will consolidate around $2,200 or instead retrace lower, confirming that area as a resistance. Usually in this situation buyers would prefer to enter at least somewhat lower; a retracement below $2,200, possibly even to $2,150, in the next few days might provide a more favourable entry to buy.

Euro-dollar, Daily

EURUSD seems quite ambiguous over the longer term, which is essentially a ‘normal’ situation for a major forex pair. The lower high in early March probably suggests a sideways trend rather than an upcoming downtrend: the slow stochastic is close to neutral and the price hasn’t been able to break below the 100% monthly Fibonacci retracement area around $1.07.

$1.10 seems like a significant resistance which could resist testing in the runup to American final GDP on 28 March. However, a significant downward movement is also questionable. Before the clear support around $1.07 it’d be likely to see buying demand to push the price back up.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance