Factors That Underscore McDonald's (MCD) Solid Prospects

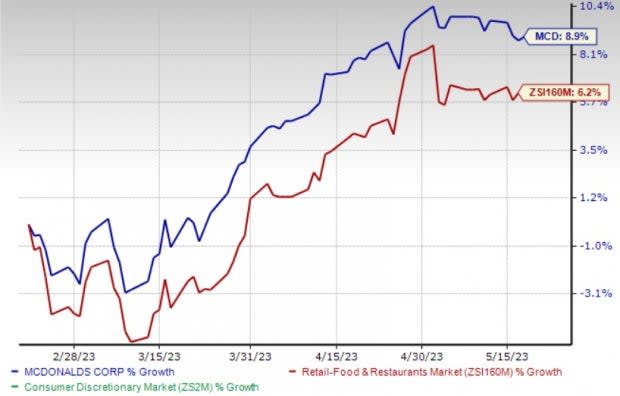

McDonald's Corporation MCD stock is riding on solid expansion efforts, comp growth, menu innovation and digitalization. Shares of MCD have gained 8.9% in the past three months compared with the industry’s growth of 6.2%.

The Zacks Rank #1 (Strong Buy) company has an impressive long-term earnings growth rate of 8.6%. Our models predicts MCD’s earnings and sales in 2023 to increase 4.9% and 8% year over year, respectively.

Growth Drivers

McDonald’s is focused to seize huge opportunity by growing all its brands globally. It continues to expand its presence in existing and new markets to drive performance.

Despite unfavorable scenario, MCD is amplifying its global footprint. It is planning to open more than 1,900 restaurants globally in 2023. This includes 400 openings in the United States and IOM segment and 1,500 (including nearly 900 in China) inaugurations in the IDL market.

Management expects net restaurant unit expansion to contribute nearly 1.5% to 2023 systemwide sales growth in constant currencies.

The company continues to impress investors with robust comp growth. In first-quarter 2023, global comps increased 12.6% compared with 11.8% reported in the prior-year quarter. This marks the ninth consecutive quarter of comp growth.

Image Source: Zacks Investment Research

In the first quarter, comps in the United States, international operated markets and international developmental licensed segment rose 12.6% each, respectively. MCD gained from robust performance in Germany, the U.K., France, Australia and Canada. Comps benefited from an increase in menu price, positive guest counts and marketing initiatives.

Continued digital and delivery growth contributed to the upside as well. McDonald’s is also gaining from robust loyalty program. It has already introduced a loyalty program in more than 50 markets, including the United States, Germany, Canada, U.K., Australia and France.

The company reported accelerated digital engagement across the markets. It reported more frequent visits and incremental sales on the back of tailored loyalty messages, a strong lineup of mobile app offers and content offerings.

During the first quarter of 2023, digital sales (from top six markets) rose 30% year over year to $7.5 billion. Notably, this contributed almost 40% of MCD’s system-wide sales. Given a rise in digital adoption, the company remains optimistic and anticipates the initiatives to drive sales and average checks in the upcoming periods.

Other Key Picks

Some other top-ranked stocks in the Zacks Retail-Wholesale sector are Chipotle Mexican Grill, Inc. CMG, Arcos Dorados Holdings Inc. ARCO and Chuy's Holdings, Inc. CHUY. While CMG carries a Zacks Rank #1, ARCO and CHUY carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chipotle has a long-term earnings growth rate of 31.8%. The stock has improved 62% in the past year.

The Zacks Consensus Estimate for CMG’s 2024 sales and EPS suggests growth of 12.4% and 19.7%, respectively, from the year-ago period’s levels.

Arcos Dorados has a long-term earnings growth rate of 7.8%. The stock has gained 19.5% in the past year.

The Zacks Consensus Estimate for ARCO’s 2023 sales suggests improvement of 13.4% from the year-ago period’s levels.

Chuy’s Holdings has a trailing four-quarter earnings surprise of 23.4%, on average. The stock has increased 82% in the past year.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS suggests gains of 10.1% and 23.4%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance