Extended Stay (STAY) Q4 Earnings Match Estimates, Down Y/Y

Extended Stay America, Inc. STAY reported fourth-quarter 2019 earnings, which matched the Zacks Consensus Estimate. However, both earnings and revenues declined on a year-over-year basis thanks to decrease in comparable company-owned RevPAR.

Adjusted earnings during the reported quarter came in at 14 cents per share, which matched the Zacks Consensus Estimate but declined 33.3% year over year. The downside can primarily be attributed to lower revenues and hotel operating margin, partially mitigated by decrease in effective tax rate.

Detailed Revenue Discussion

Extended Stay reported total revenues of $284.2 million in the quarter, down 1.9% from year-ago figure of $289.7 million due to asset dispositions in 2018 and decline in comparable company-owned RevPAR. When adjusted for asset disposition, the company’s revenues fell 1.1% from the prior year.

Comparable system-wide RevPAR of $46.94 fell 0.8% on a year-over-year basis, owing to a 4% drop in average daily rate (ADR), offset by an increase of 240 basis points (bps) in occupancy.

Meanwhile, comparable company-owned RevPAR declined 1.7% to $48.13 from the prior-year quarter.

Operating Highlights

In the quarter under review, Extended Stay’s hotel operating margin came in at 48.3%, reflecting a decline of 280 bps from the prior-year quarter. The decline can be attributed to increase in hotel payroll and property insurance expenses, property taxes and maintenance expenses, and decline in comparable company-owned RevPAR.

Adjusted EBITDA totaled $108.8 million, down 14.1% from the comparable year-ago period due to CEO and related transition costs, legal settlement expenditure and other unexpected net expense.

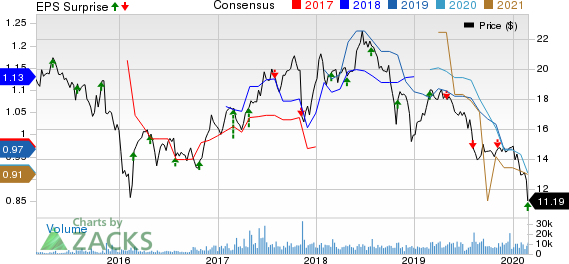

Extended Stay America, Inc. Price, Consensus and EPS Surprise

Extended Stay America, Inc. price-consensus-eps-surprise-chart | Extended Stay America, Inc. Quote

Balance Sheet

Cash and cash equivalents as of Dec 31, 2019 was $346.8 million compared with $287.5 million on Dec 31, 2018. At the end of the fourth quarter, total debt (net of unamortized deferred financing costs and debt discounts) amounted to $2,639.8 million, up from $2,402.6 million at 2018-end.

Extended Stay invested $83.3 million in capital expenditures in the quarter under review. On Feb 26, the company’s board of directors announced cash distributions totaling 23 cents per share, payable on Mar 26, 2020 to shareholders of record as of Mar 12, 2020. The company repurchased 2.2 million shares during the reported quarter for an aggregate purchase of $31 million. At the end of the fourth quarter, total shares remaining under its share repurchase authorization were approximately $101.1 million.

2020 Outlook

Extended Stay expects total revenues within $1,226-$1,246 million. Moreover, comparable system-wide RevPAR is envisioned in the range of down 0.5% to up 1.5%.

Adjusted EBITDA is projected between $505 million and $525 million. Adjusted earnings per share are anticipated between 78 cents and 90 cents. The mid-point of the guidance range of 84 cents is well below the Zacks Consensus Estimate of 91 cents. Capital expenditure for 2020 is anticipated in the band of $210-$240 million.

Zacks Rank & Peer Releases

Extended Stay currently carries a Zacks Rank #4 (Sell).

Hyatt Hotels Corporation H reported better-than-expected fourth-quarter 2019 results. Notably, the company’s bottom line has surpassed the Zacks Consensus Estimate for the 16th straight quarter, while the top line has outpaced the same for the fourth consecutive quarter. Adjusted earnings came in at 47 cents per share, which outpaced the Zacks Consensus Estimate of 20 cents. In the prior-year quarter, the company reported earnings of 62 cents per share. Total revenues were $1,275 million, beat the Zacks Consensus Estimate of $1,182 million and improved 12% from the prior-year quarter.

Choice Hotels International, Inc. CHH reported better-than-expected fourth-quarter 2019 results. The lodging franchisor reported adjusted earnings of 92 cents per share, which beat the consensus mark of 84 cents and rose 4.5% year over year. Notably, this marked the eighth straight quarter of earnings beat. In the quarter under review, total revenues came in at $268.1 million. The figure increased 9% from the year-ago quarter’s level and topped the consensus mark of $258 million.

Hilton Worldwide Holdings Inc. HLT reported fourth-quarter 2019 results, wherein both earnings and revenues came ahead of the Zacks Consensus Estimate. Hilton’s adjusted earnings of $1.00 per share surpassed the consensus mark of 95 cents and improved 6.4% on a year-over-year basis. Further, it came above management’s forecasted range of 91-96 cents per share. Revenues totaled $2,369 million, which surpassed the consensus mark of $2,337 million.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Extended Stay America, Inc. (STAY) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance