Exploring Top Dividend Stocks In May 2024

As the S&P 500 reached unprecedented heights, surpassing the 5,300 mark for the first time amid cooling inflation and optimistic market sentiment, investors are keenly observing opportunities within this buoyant landscape. In such a market environment, dividend stocks can be particularly appealing as they offer potential for steady income alongside capital appreciation possibilities.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.04% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.90% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.95% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.74% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.17% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.86% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.42% | ★★★★★☆ |

West Bancorporation (NasdaqGS:WTBA) | 5.63% | ★★★★★☆ |

Evans Bancorp (NYSEAM:EVBN) | 4.84% | ★★★★★☆ |

Union Bankshares (NasdaqGM:UNB) | 5.64% | ★★★★★☆ |

Click here to see the full list of 197 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

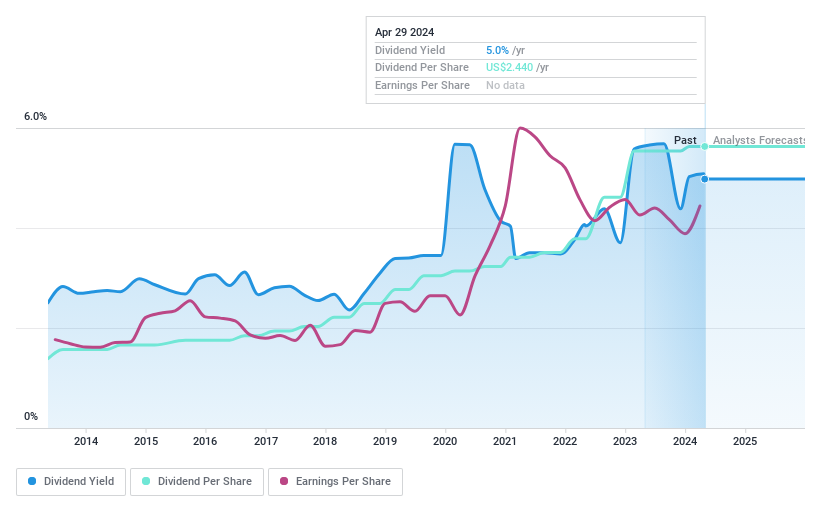

Northrim BanCorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northrim BanCorp, Inc., functioning as the bank holding company for Northrim Bank, offers commercial banking products and services to businesses and professional individuals, with a market capitalization of approximately $295.11 million.

Operations: Northrim BanCorp, Inc. generates its revenue primarily through two segments: Community Banking, which brought in $106.27 million, and Home Mortgage Lending, contributing $24.08 million.

Dividend Yield: 4.3%

Northrim BanCorp reported a positive earnings trajectory in Q1 2024, with net interest income rising to US$26.45 million from US$25.03 million year-over-year and net income increasing to US$8.2 million from US$4.83 million. The company's dividend reliability is underscored by a decade of stable payouts, supported by a reasonable payout ratio of 46.7%, ensuring coverage by earnings despite a yield (4.32%) slightly below the top quartile for U.S dividend stocks (4.65%). Additionally, dividends have shown growth over the past ten years, aligning with Northrim’s ongoing share repurchase program which completed significant buybacks totaling US$74.57 million since 2002.

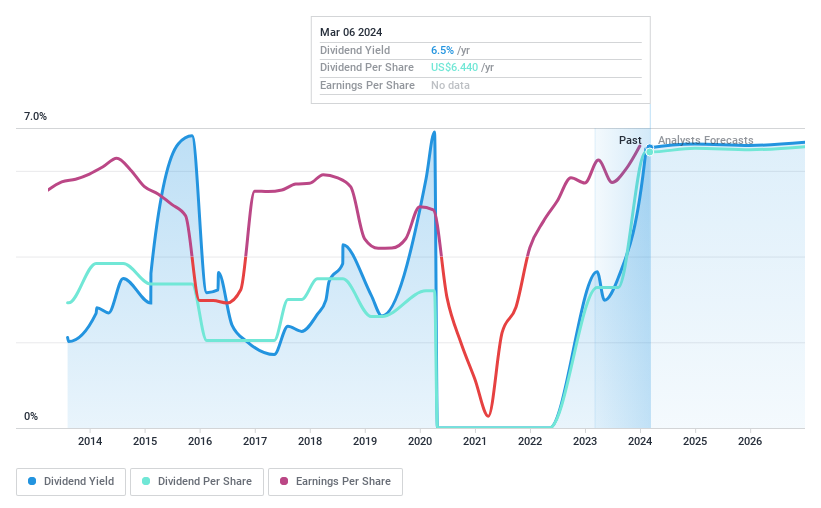

Copa Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A., operating through its subsidiaries, offers airline passenger and cargo services with a market capitalization of approximately $4.53 billion.

Operations: Copa Holdings, S.A. generates its revenue primarily from air transportation services, totaling approximately $3.46 billion.

Dividend Yield: 5.9%

Copa Holdings, despite a dividend yield of 5.86%, faces challenges with its sustainability, as both earnings and cash flows currently do not cover its payouts, reflected by a high cash payout ratio of 126.3%. However, the company's price-to-earnings ratio stands at 9x, indicating good value relative to the broader US market. Recent operational data show increased activity with ASM and RPM rising year-over-year in April 2024, suggesting some positive business momentum.

Take a closer look at Copa Holdings' potential here in our dividend report.

Our valuation report unveils the possibility Copa Holdings' shares may be trading at a discount.

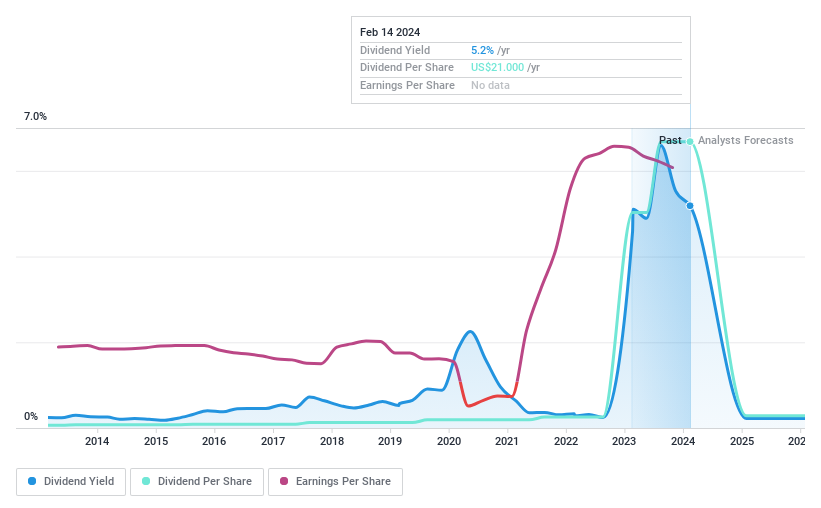

Dillard's

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dillard's, Inc. operates retail department stores primarily in the southeastern, southwestern, and midwestern United States, with a market capitalization of approximately $7.45 billion.

Operations: Dillard's, Inc. generates revenue primarily through its retail operations and construction segments, with retail operations contributing approximately $6.48 billion and construction adding about $320.77 million.

Dividend Yield: 4.6%

Dillard's offers a stable dividend with a yield of 4.61%, supported by a low payout ratio of 2% and cash payout ratio of 45.4%, ensuring sustainability from both earnings and cash flow perspectives. Despite trading at 28.1% below estimated fair value, suggesting attractiveness to value investors, the company faces challenges with an expected average earnings decline of 30.6% annually over the next three years, which could pressure future dividend growth and stability. Recent initiatives like The Cabana swim shop may bolster brand visibility but are unlikely to immediately impact dividends.

Turning Ideas Into Actions

Investigate our full lineup of 197 Top Dividend Stocks right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:NRIM NYSE:CPA and NYSE:DDS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance