Exploring Top Dividend Stocks For June 2024

As the FTSE 100 shows signs of fluctuation amidst global economic shifts and policy changes, investors remain keenly attuned to market dynamics. In this context, understanding the attributes that define a strong dividend stock—such as stable earnings, a solid track record of payouts, and resilience in various market conditions—becomes crucial for those looking to enhance their portfolios in June 2024.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.07% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.66% | ★★★★★☆ |

DCC (LSE:DCC) | 3.46% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.22% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.05% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.77% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.67% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.28% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.06% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.61% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

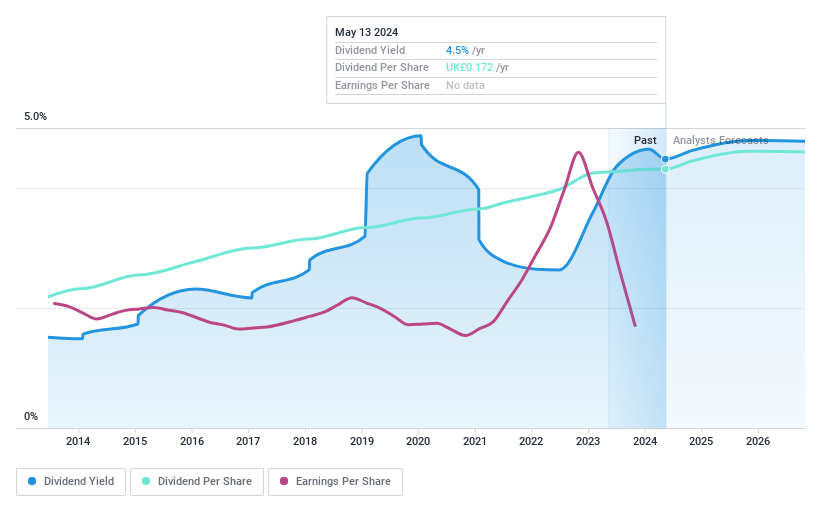

Wynnstay Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wynnstay Group Plc is a UK-based company that manufactures and supplies agricultural products, with a market capitalization of approximately £89.68 million.

Operations: Wynnstay Group Plc generates its revenue primarily from two segments: Agriculture, which brought in £584.31 million, and Specialist Agricultural Merchanting, contributing £151.48 million.

Dividend Yield: 4.4%

Wynnstay Group offers a consistent dividend yield of 4.42%, though it's below the top tier in the UK market. Despite lower profit margins this year at 0.9% compared to last year's 2.4%, dividends remain well-supported by both earnings and cash flows, with payout ratios of 56.1% and 34.6% respectively, suggesting sustainability. Dividend stability is evidenced by a decade of reliable payouts without reductions, alongside an increase over the same period, although shareholder dilution has occurred within the last year.

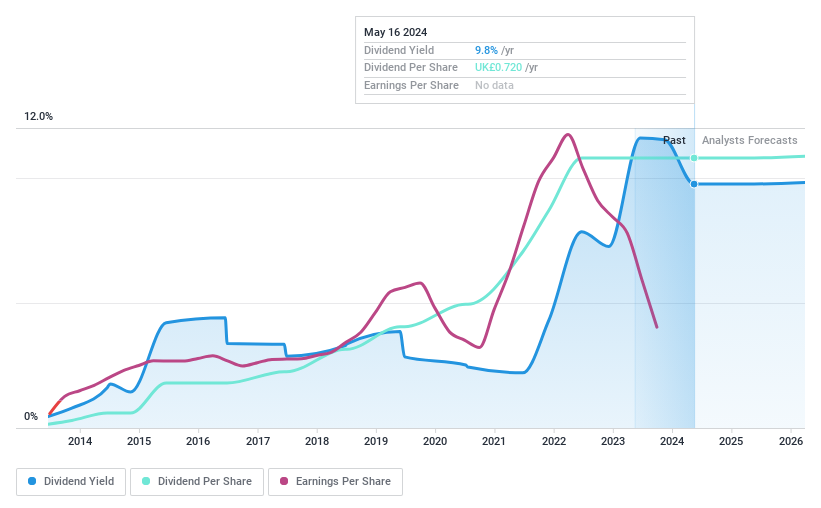

Liontrust Asset Management

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liontrust Asset Management Plc is a publicly owned investment manager, with a market capitalization of approximately £484.80 million.

Operations: Liontrust Asset Management generates its revenue primarily through investment management services, totaling £231.10 million.

Dividend Yield: 9.3%

Liontrust Asset Management has maintained a consistent dividend over the past decade, with an increase in payments during this period. However, the sustainability of these dividends is questionable as they are not well-covered by earnings or cash flows, with high payout ratios of 267% and cash payout ratios of 121.6%. Recent restructuring and strategic hires indicate efforts to stabilize after significant outflows totaling £5.4 billion over the past 15 months, which could impact future dividend reliability despite currently trading at a significant discount to estimated fair value.

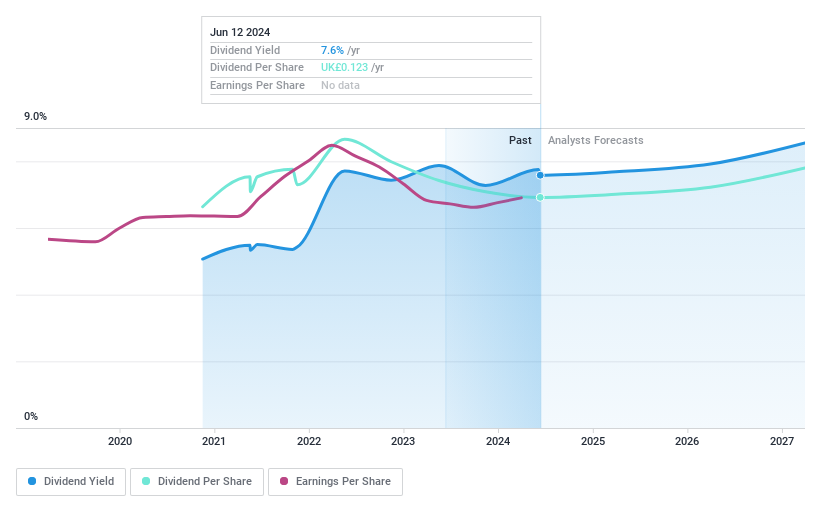

Ninety One Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group is an independent global asset manager with operations worldwide and a market capitalization of approximately £1.41 billion.

Operations: Ninety One Group generates its revenue primarily through its investment management business, which brought in £588.50 million.

Dividend Yield: 7.6%

Ninety One Group offers a solid dividend yield of 7.58%, ranking it among the top quartile in the UK market, supported by earnings and cash flows with payout ratios at 66.8% and 65.5% respectively. Despite its relatively short dividend history of four years, payments have shown growth; however, recent financials reveal a slight dip in revenue and net income year-over-year, alongside a decrease in dividends announced on June 5, 2024, which may raise concerns about future dividend sustainability.

Click here to discover the nuances of Ninety One Group with our detailed analytical dividend report.

Our valuation report here indicates Ninety One Group may be undervalued.

Make It Happen

Take a closer look at our Top Dividend Stocks list of 59 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:WYN LSE:LIO and LSE:N91.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance