Exploring Three US Growth Companies With High Insider Ownership

The United States stock market has shown robust performance, with a 1.2% increase over the last week and a significant 21% rise over the past 12 months, alongside forecasts of annual earnings growth at 15%. In such thriving conditions, companies with high insider ownership can be particularly appealing as they often demonstrate aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.7% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

BBB Foods (NYSE:TBBB) | 18.1% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here's a peek at a few of the choices from the screener.

Oddity Tech

Simply Wall St Growth Rating: ★★★★☆☆

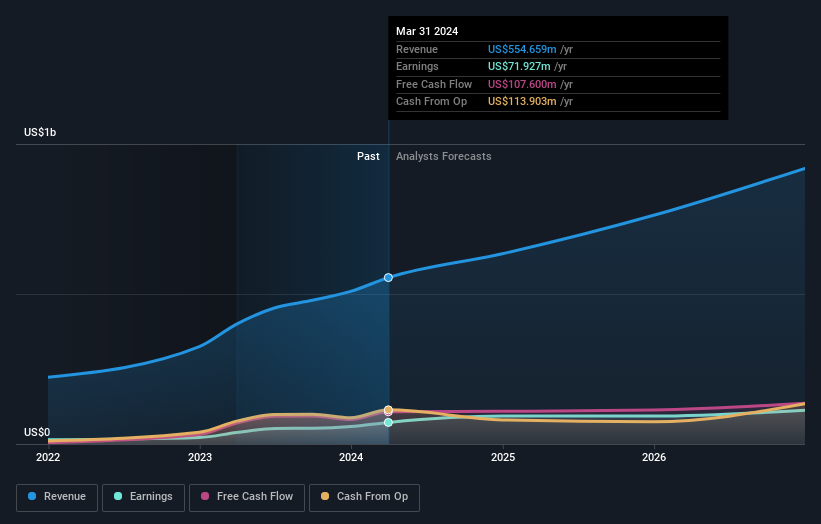

Overview: Oddity Tech Ltd. is a consumer technology company that develops digital-first brands in the beauty and wellness sectors, operating both in the United States and internationally, with a market capitalization of approximately $2.48 billion.

Operations: The company generates revenue primarily through its personal products segment, which amounted to $554.66 million.

Insider Ownership: 29.3%

Earnings Growth Forecast: 18.7% p.a.

Oddity Tech, a company with high insider ownership, recently raised its Q2 2024 earnings guidance to US$189 million, signaling a 25% year-over-year growth. This adjustment follows robust Q1 results with sales up significantly to US$211.63 million and net income rising to US$32.98 million. Despite its highly volatile share price, Oddity Tech is trading at a substantial discount against fair value and shows promising revenue growth forecasts outpacing the broader U.S. market's average. Additionally, the board has authorized a significant share buyback plan of up to US$150 million by mid-2027, underscoring confidence in the company’s financial health and future prospects.

Click here to discover the nuances of Oddity Tech with our detailed analytical future growth report.

Ameresco

Simply Wall St Growth Rating: ★★★★☆☆

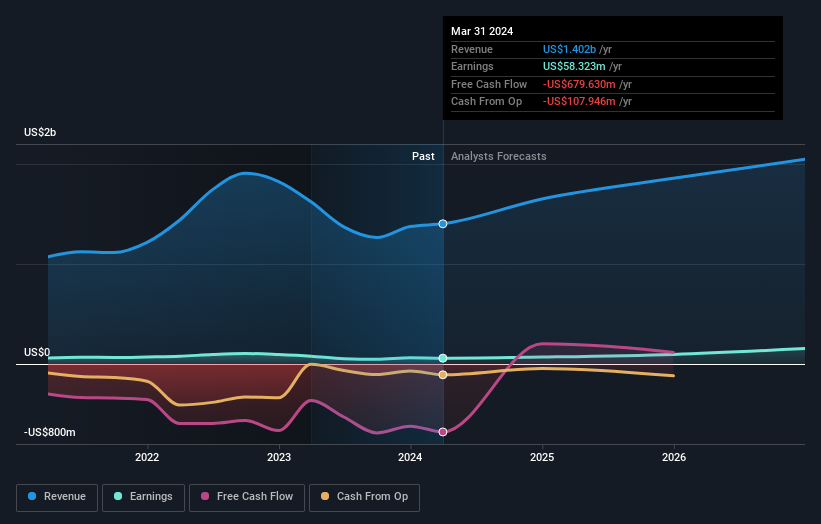

Overview: Ameresco, Inc., a clean technology integrator, offers energy efficiency and renewable energy solutions across the U.S., Canada, Europe, and other international markets, with a market capitalization of approximately $1.81 billion.

Operations: The company's revenue streams include $404.22 million from U.S. Federal projects, $177.87 million from European operations, and $121.60 million from Alternative Fuels.

Insider Ownership: 38.2%

Earnings Growth Forecast: 29.7% p.a.

Ameresco, a growth company with significant insider ownership, is actively expanding its portfolio of energy efficiency projects. Recent initiatives include a US$33 million project to enhance energy systems at U.S. National Archives facilities and a major UK energy storage project expected to bolster grid reliability and support net-zero goals. Despite these positive developments, Ameresco faces challenges such as a recent quarterly loss and forecasts indicating lower than average return on equity in the coming years. The company's revenue growth is expected to outpace the market, yet earnings projections suggest substantial growth, highlighting its potential amidst financial pressures.

RingCentral

Simply Wall St Growth Rating: ★★★★☆☆

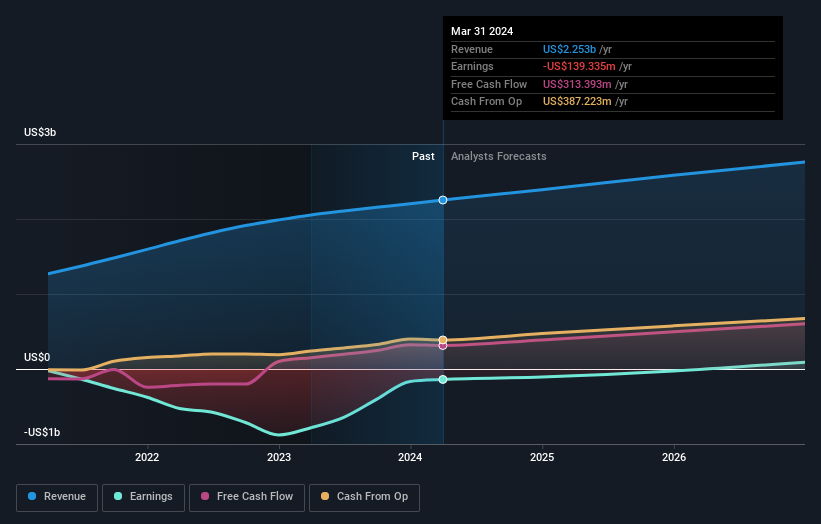

Overview: RingCentral, Inc. operates globally, offering cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions with a market capitalization of approximately $3.16 billion.

Operations: The company generates its revenue primarily from internet software and services, totaling approximately $2.25 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 70.5% p.a.

RingCentral, a company with significant insider ownership, is enhancing its market position through strategic expansions and technological advancements. Recent collaborations with Vodafone Business Ireland and Avaya introduce hybrid work solutions across Europe, leveraging RingCentral's AI-driven communication technologies. Despite these positive developments, the company's revenue growth of 7.2% per year trails the U.S. market forecast of 8.5%. However, its return on equity is expected to be very high at 54.7% in three years, indicating strong potential for profitability and shareholder value creation in a competitive industry.

Click here and access our complete growth analysis report to understand the dynamics of RingCentral.

Summing It All Up

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 181 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:ODD NYSE:AMRC and NYSE:RNG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance