Exploring Three SEHK Growth Companies With Significant Insider Ownership

As global markets navigate through varying performances, with significant movements noted in major indices like the Dow Jones and Nasdaq, the Hong Kong market has faced its own challenges marked by a notable decline in the Hang Seng Index. In such an environment, identifying growth companies with high insider ownership can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 33.7% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Beijing Airdoc Technology (SEHK:2251) | 27.2% | 83.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

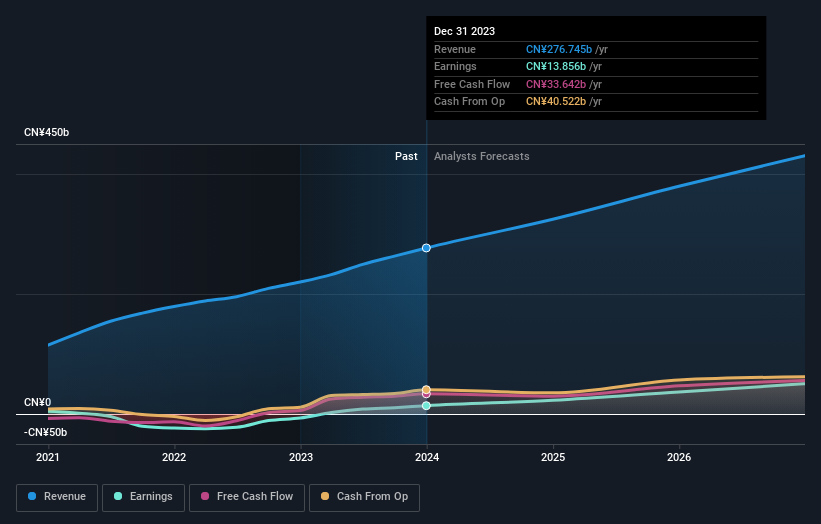

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$630.45 billion.

Operations: The company's revenue is generated from its automobile and battery sectors across various regions including China, Hong Kong, Macau, and Taiwan.

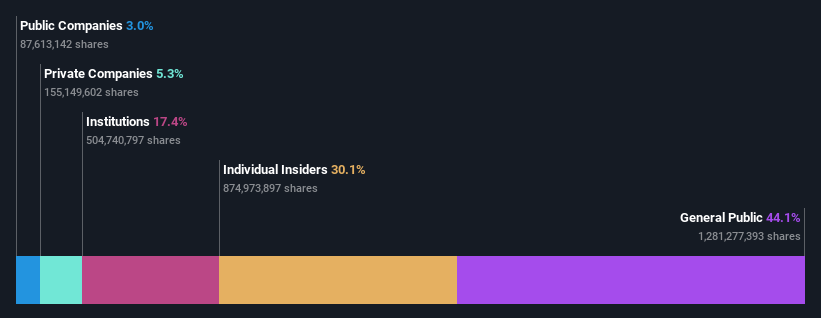

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.6% p.a.

BYD, a prominent player in the electric vehicle sector, has demonstrated robust growth with its recent global product launches and strategic partnerships enhancing its market presence. Notably, the launch of BYD SHARK in Mexico marks a significant expansion outside China. Despite substantial insider ownership, BYD's financial performance shows promising trends with a 52.7% earnings increase over the past year and revenue forecasted to grow at 14.5% annually, outpacing the Hong Kong market average. However, while insider buying is not pronounced in recent months, their commitment remains integral to corporate governance and strategic direction.

Meituan

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People's Republic of China, with a market capitalization of approximately HK$737.37 billion.

Operations: The company's revenue is primarily generated through two segments: Core Local Commerce, which brought in CN¥206.91 billion, and New Initiatives, contributing CN¥69.84 billion.

Insider Ownership: 12.2%

Earnings Growth Forecast: 37.8% p.a.

Meituan, transitioning into profitability this year, shows a promising growth trajectory with earnings expected to surge by 37.83% annually, outpacing the Hong Kong market's average. Despite revenue growth forecasts being less aggressive at 12.9% annually, they still exceed local market expectations. Recent corporate governance enhancements and no significant insider sales underscore a stable ownership environment, although substantial insider purchases have not been observed lately. The company's strategic amendments aim to align its operations with evolving regulatory standards and enhance transparency.

Get an in-depth perspective on Meituan's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

CanSino Biologics

Simply Wall St Growth Rating: ★★★★★☆

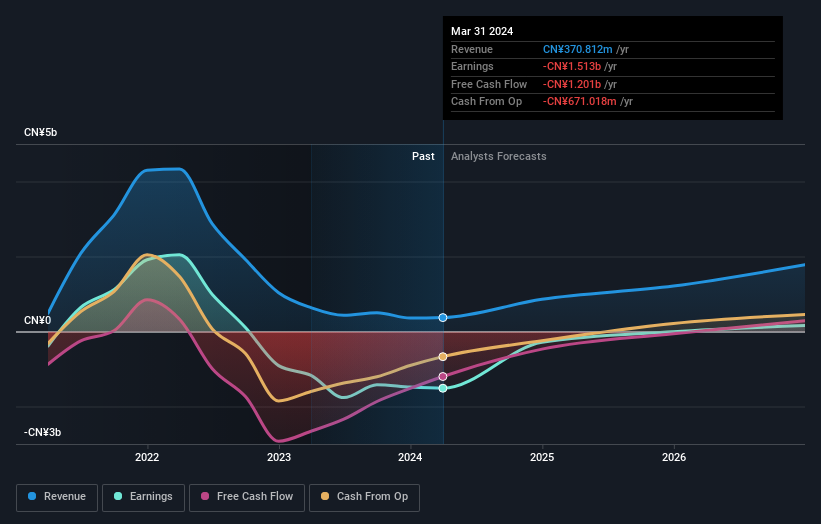

Overview: CanSino Biologics Inc. is a company based in the People's Republic of China that focuses on developing, manufacturing, and commercializing vaccines, with a market capitalization of approximately HK$9.29 billion.

Operations: The company generates revenue primarily through its research and development of vaccine products for human use, totaling CN¥370.81 million.

Insider Ownership: 27.9%

Earnings Growth Forecast: 124.6% p.a.

CanSino Biologics, a growth-oriented firm with high insider ownership, is poised for significant advancements. Forecasted to grow revenue by 34.3% annually, it outstrips the broader Hong Kong market's 7.9%. Despite a current net loss of CNY 170.1 million, the company is expected to turn profitable within three years, with earnings potentially increasing by a very large margin annually. Recent developments include approvals for clinical trials of its innovative vaccines, indicating potential future revenue streams and strengthening its market position.

Key Takeaways

Click through to start exploring the rest of the 49 Fast Growing SEHK Companies With High Insider Ownership now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:6185.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance