Exploring Three Australian Dividend Stocks

The Australian stock market recently showed a positive trend, with the ASX closing up nearly 0.9% as every sector turned green, highlighted by a standout performance in real estate. Amidst these broader market movements, understanding the characteristics of strong dividend stocks becomes crucial, especially in an environment where sectors like nickel face challenges and telecommunications show robust deals and expansions.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Nick Scali (ASX:NCK) | 4.55% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.74% | ★★★★★☆ |

Auswide Bank (ASX:ABA) | 9.86% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.61% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.73% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.49% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.89% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 8.09% | ★★★★☆☆ |

New Hope (ASX:NHC) | 9.47% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Nick Scali

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in the sourcing and retailing of household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.28 billion.

Operations: Nick Scali Limited generates its revenue primarily through the furniture retail segment, which amounted to A$450.45 million.

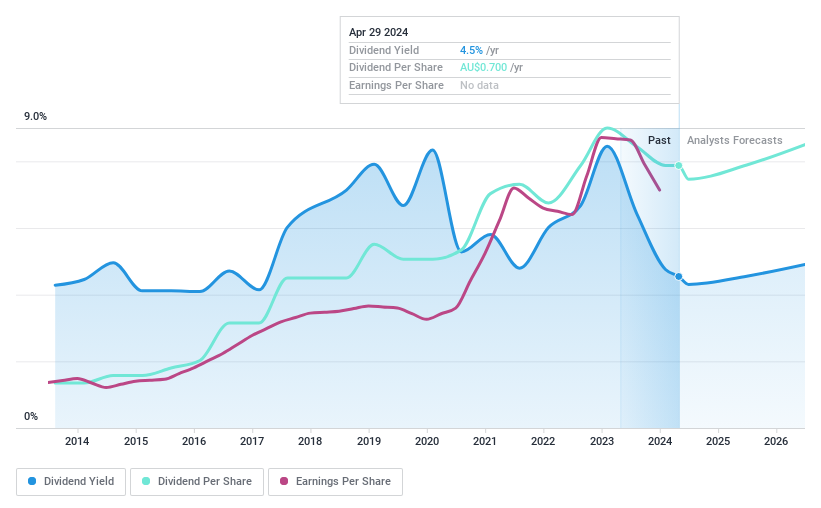

Dividend Yield: 4.5%

Nick Scali Limited, despite a recent follow-on equity offering raising A$60 million, shows a mixed outlook for dividend investors. The company's dividends are supported by a payout ratio of 67.9% and cash payout ratio of 43.4%, indicating sustainability from both earnings and cash flow perspectives. However, its dividend yield at 4.55% falls below the top quartile in the Australian market (6.25%). Recent financials reveal a downturn with sales dropping to A$226.63 million from A$283.91 million year-over-year, and net income decreasing to A$43.01 million from A$60.57 million, impacting basic EPS which declined to A$0.531 from A$0.748.

Fenix Resources

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fenix Resources Limited is a company focused on the exploration, development, and mining of mineral tenements in Western Australia, with a market capitalization of approximately A$194.49 million.

Operations: Fenix Resources Limited generates revenue primarily from the exploration, development, and mining of mineral tenements, totaling approximately A$311.38 million after adjustments.

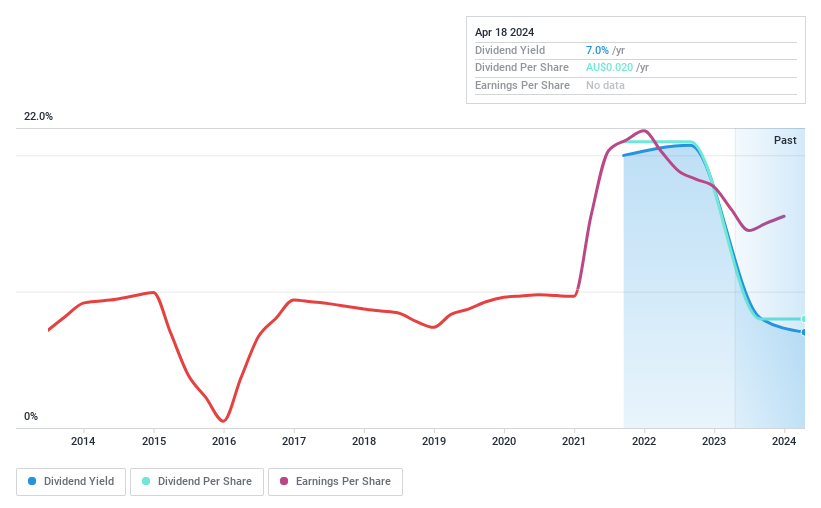

Dividend Yield: 7.0%

Fenix Resources, recently added to the S&P/ASX All Ordinaries Index, reported a substantial increase in sales and net income for the half-year ended December 31, 2023. With a dividend yield of 7.02%, it ranks well above the Australian market average of 6.25%. The dividends are supported by both earnings and cash flows with payout ratios at 31.5% and 34.2%, respectively, suggesting sustainability despite its short history and past volatility in dividend payments. Trading at a significant discount to estimated fair value also highlights potential relative value compared to peers.

Dive into the specifics of Fenix Resources here with our thorough dividend report.

Our valuation report unveils the possibility Fenix Resources' shares may be trading at a discount.

Ricegrowers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, trading as ASX:SGLLV, is a rice food company with operations in Australia and internationally, boasting a market capitalization of approximately A$437.11 million.

Operations: Ricegrowers Limited generates its revenue through various segments, with Riviana contributing A$219.12 million, Cop Rice A$253.52 million, Rice Food A$115.93 million, Rice Pool A$487 million, and International Rice A$821.54 million.

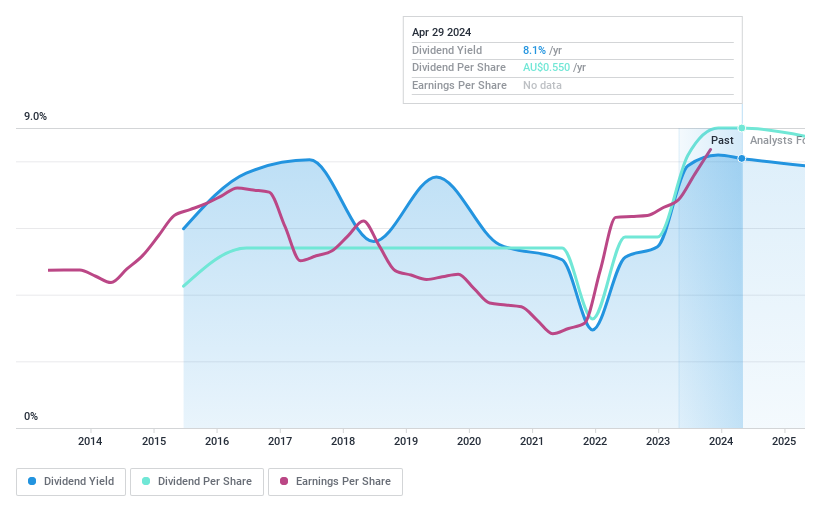

Dividend Yield: 8.1%

Ricegrowers, despite a volatile dividend history over the past 9 years, offers a high yield of 8.09%, ranking in the top 25% of Australian dividend payers. The dividends are reasonably covered by both earnings and cash flows, with payout ratios at 53.9% and 43.1%, respectively. However, its trading value is significantly below our fair value estimate by 52.8%. Earnings have expanded by an average of 16.2% annually over the last five years, indicating some growth potential despite past inconsistencies in dividend payments.

Click here to discover the nuances of Ricegrowers with our detailed analytical dividend report.

Our valuation report here indicates Ricegrowers may be undervalued.

Turning Ideas Into Actions

Click this link to deep-dive into the 31 companies within our Top Dividend Stocks screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NCKASX:FEX ASX:SGLLV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance