Exploring June 2024's Top Three Dividend Stocks In Hong Kong

As global markets navigate a landscape of mixed economic signals and fluctuating interest rates, Hong Kong's stock market has shown resilience, with the Hang Seng Index rising by 1.59%. This backdrop sets an intriguing stage for investors focusing on dividend stocks, which can offer potential stability and income amid such uncertainty. In this context, understanding what constitutes a strong dividend stock becomes crucial—factors like consistent dividend history, robust financial health, and alignment with current economic trends are key considerations.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.82% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.95% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.84% | ★★★★★★ |

Best Pacific International Holdings (SEHK:2111) | 7.87% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.23% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.82% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.83% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.44% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.06% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.75% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

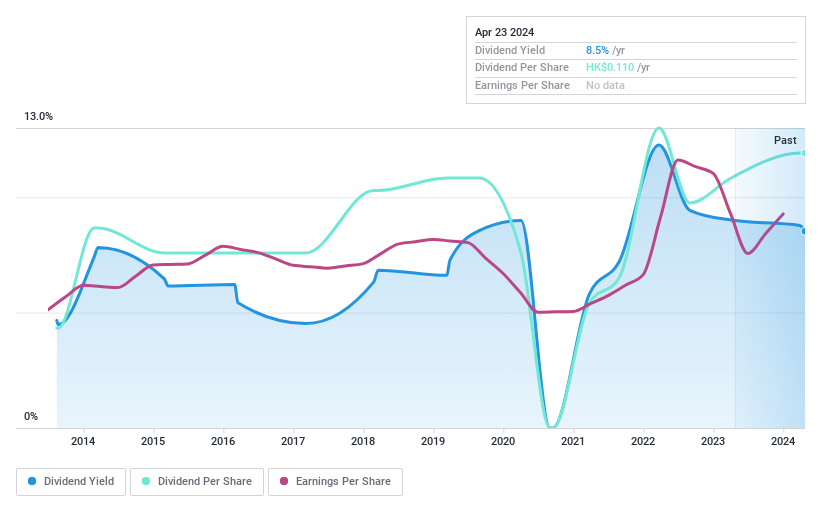

Lion Rock Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lion Rock Group Limited, an investment holding company, offers printing services to various publishers and print media companies, with a market capitalization of approximately HK$1.14 billion.

Operations: Lion Rock Group Limited generates revenue primarily through its printing and publishing segments, with HK$1.77 billion from printing services and HK$948 million from publishing activities.

Dividend Yield: 7.4%

Lion Rock Group's dividends are supported by a payout ratio of 44.1% and a cash payout ratio of 31.2%, indicating sustainability from both earnings and cash flow perspectives. However, the dividend yield at 7.43% is slightly below the top quartile in Hong Kong’s market, and the company has experienced volatility in its dividend payments over the past decade. Recently, Lion Rock declared an annual final dividend of HK$0.08 per share for 2023, aligning with its financial results where net income was HK$185.25 million on sales of HK$2.56 billion.

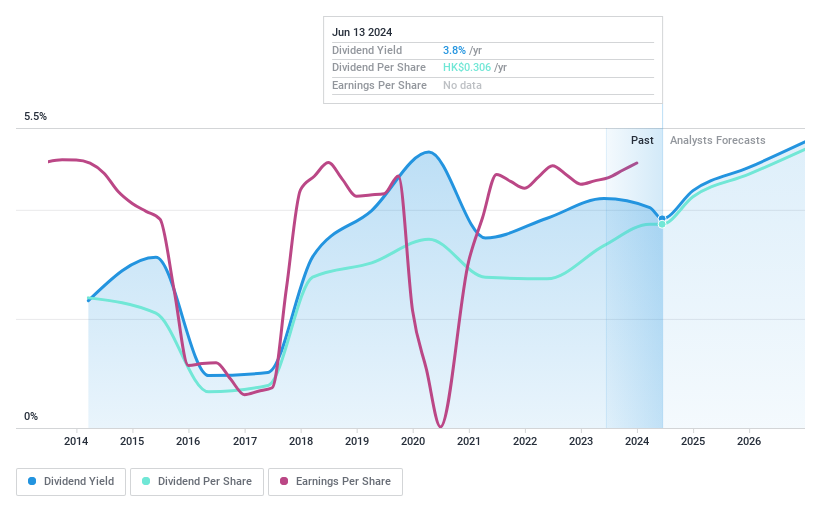

Kunlun Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kunlun Energy Company Limited operates as an investment holding company, primarily involved in the exploration, development, production, and sale of crude oil and natural gas, with a market capitalization of approximately HK$69.01 billion.

Operations: Kunlun Energy Company Limited generates revenue through the sales of LPG (CN¥26.90 billion), exploration and production (CN¥0.91 billion), LNG processing and terminal operations (CN¥12.17 billion), and natural gas sales excluding LPG (CN¥142.89 billion).

Dividend Yield: 3.8%

Kunlun Energy recently approved a final dividend of RMB 28.38 per share, reflecting its solid financial health with FY2023 sales reaching CNY 177.35 billion and net income of CNY 5.68 billion. While the dividend is covered by earnings (payout ratio: 43.2%) and cash flows (cash payout ratio: 26.6%), its historical dividend performance has been inconsistent, indicating potential volatility in future payouts. The recent resignation of an executive director and auditor changes add elements of uncertainty to its governance stability.

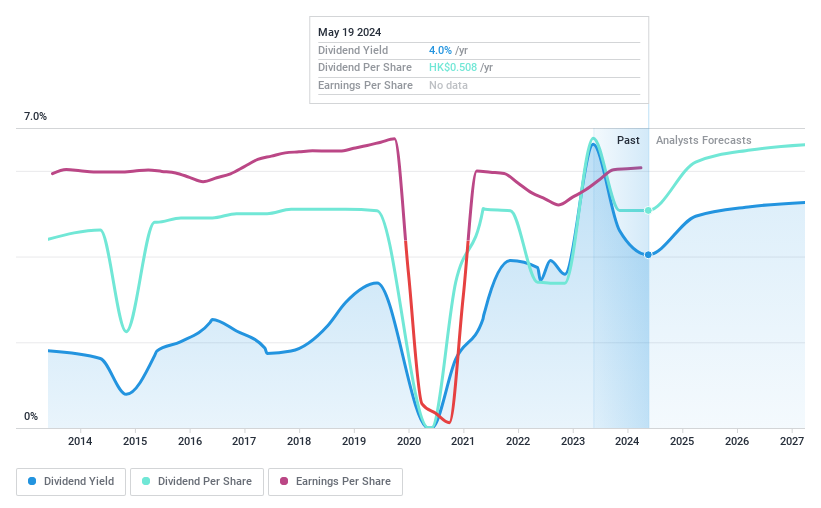

Johnson Electric Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Johnson Electric Holdings Limited operates globally in the manufacturing and sale of motion systems, with a market capitalization of approximately HK$11.14 billion.

Operations: Johnson Electric Holdings Limited generates revenue primarily from its Auto Parts & Accessories segment, totaling approximately HK$3.81 billion.

Dividend Yield: 5.1%

Johnson Electric Holdings recently proposed a final dividend of HK$0.44 per share for FY2024, with a payout ratio of 31.5% and cash payout ratio of 18.3%, indicating strong coverage by earnings and cash flows. Despite this, its dividend yield at 5.06% remains below the top-tier in Hong Kong's market at 7.77%. The company's dividends have shown growth over the past decade but have been marked by volatility, reflecting some inconsistency in its dividend policy. Additionally, Johnson Electric reported a significant increase in net income to US$229.23 million from US$157.81 million year-over-year and expects low single-digit sales growth for the next fiscal year.

Key Takeaways

Click this link to deep-dive into the 89 companies within our Top Dividend Stocks screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1127 SEHK:135 and SEHK:179.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance