Exploring Gujarat State Fertilizers & Chemicals Plus Two More Elite Dividend Stocks

India's benchmark indexes recently soared to record highs, buoyed by optimistic data from China and a favorable U.S. inflation report, signaling robust market sentiment and potential for growth across various sectors. In this climate, identifying dividend stocks like Gujarat State Fertilizers & Chemicals that offer both stability and potential income becomes even more pertinent for investors seeking to capitalize on the current market dynamics.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Castrol India (BSE:500870) | 3.55% | ★★★★★☆ |

Balmer Lawrie Investments (BSE:532485) | 5.20% | ★★★★★☆ |

VST Industries (BSE:509966) | 4.16% | ★★★★★☆ |

Swaraj Engines (NSEI:SWARAJENG) | 3.92% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.40% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.05% | ★★★★★☆ |

Balmer Lawrie (BSE:523319) | 3.00% | ★★★★★☆ |

Ruchira Papers (NSEI:RUCHIRA) | 4.18% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.91% | ★★★★★☆ |

Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.78% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gujarat State Fertilizers & Chemicals (BSE:500690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gujarat State Fertilizers & Chemicals Limited, operating in India, focuses on the manufacturing and sale of fertilizers and industrial products, with a market capitalization of approximately ₹88.00 billion.

Operations: Gujarat State Fertilizers & Chemicals Limited generates its revenue primarily from two segments: fertilizers, contributing ₹72.64 billion, and industrial products, adding another ₹23.10 billion.

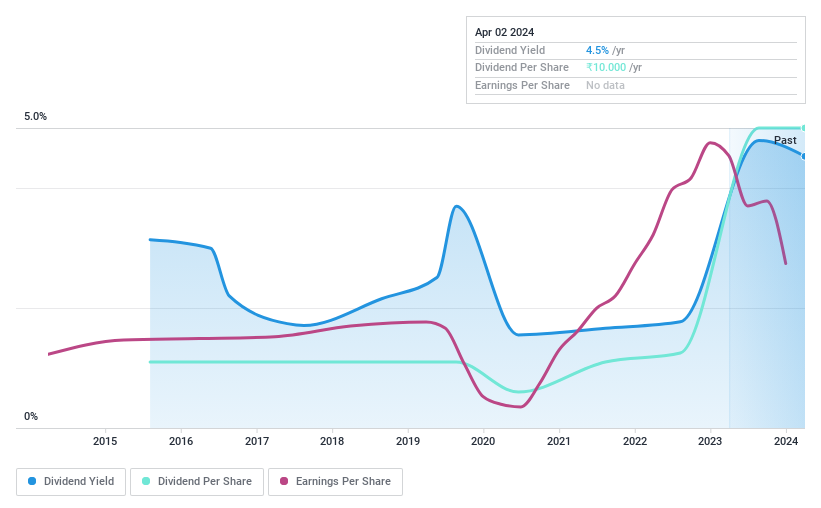

Dividend Yield: 4.5%

Gujarat State Fertilizers & Chemicals presents a nuanced case for dividend investors. While its dividend yield of 4.53% stands in the top 25% in the Indian market, its track record for dividend payments is less stable, having experienced significant volatility over the past 9 years. The company's payout ratios—31.5% based on earnings and 44.2% on cash flows—suggest dividends are well-covered, indicating sustainability from a cash perspective despite recent financial performance showing a decline in net income from INR 10,410.1 million to INR 5,393.6 million year-over-year for the nine months ending December 2023. Additionally, leadership changes with Shri Kamal Dayani taking over as Managing Director could signal strategic shifts ahead.

Castrol India (BSE:500870)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castrol India Limited specializes in manufacturing and marketing automotive and industrial lubricants, serving both the Indian market and international customers, with a market capitalization of approximately ₹208.85 billion.

Operations: Castrol India Limited generates its revenue primarily from the lubricants segment, amounting to ₹50.75 billion.

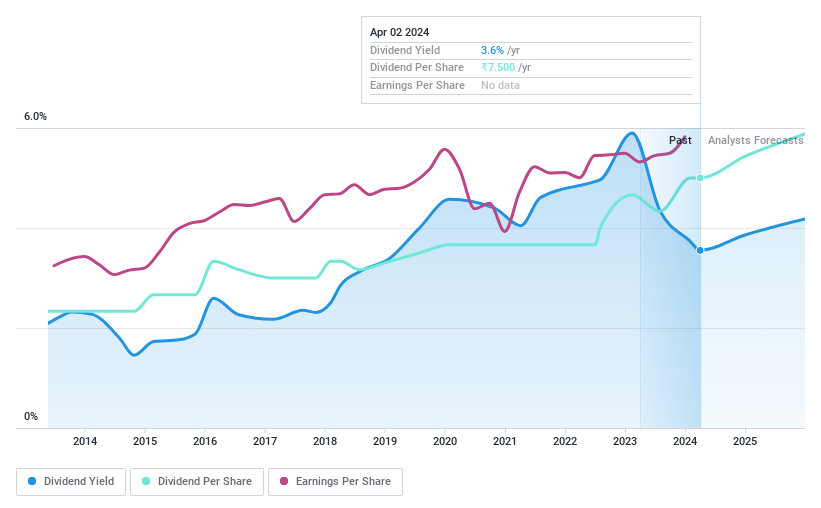

Dividend Yield: 3.6%

Castrol India, despite a commendable increase in quarterly sales from INR 11,760.1 million to INR 12,640.4 million and net income growth to INR 2,419.4 million from the previous year, faces challenges with its dividend sustainability due to a high cash payout ratio of 97.9%. While it has maintained stable dividends over the past decade and proposed a final dividend of INR 4.50 per share for FY2023, this generosity is not fully backed by cash flows or earnings growth projections (9.56% per year). The company's price-to-earnings ratio at 24.2x sits below the Indian market average, suggesting some value potential despite concerns over dividend coverage and sustainability.

Balmer Lawrie (BSE:523319)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Balmer Lawrie & Co. Ltd. is a diversified company operating in sectors such as industrial packaging, greases and lubricants, chemicals, logistics services and infrastructure, refinery and oil field services, along with travel and vacation services across India and globally, with a market capitalization of approximately ₹42.74 billion.

Operations: Balmer Lawrie & Co. Ltd. generates its revenue primarily from industrial packaging (₹8.22 billion), greases and lubricants (₹6.74 billion), logistics services (₹4.48 billion), travel and vacations (₹2.04 billion), and logistics infrastructure (₹2.20 billion).

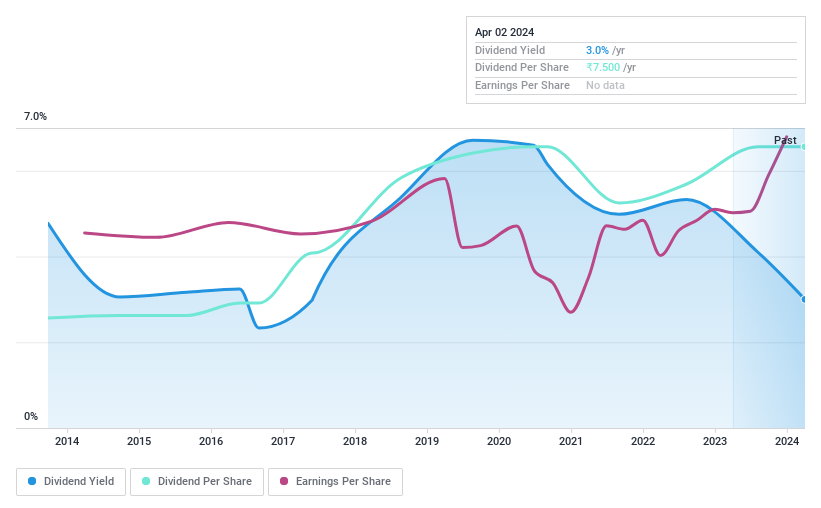

Dividend Yield: 3%

Balmer Lawrie's recent strategic move to set up a FTWZ in SEZ of JNPA, with an investment of INR 2300 million, underscores its commitment to diversifying and generating additional revenue. This initiative is expected to enhance value for customers and create employment opportunities. Financially, the company reported a significant increase in net income to INR 666.2 million for Q3 2023 from the previous year, alongside a notable improvement in earnings per share from INR 2.1 to INR 3.89. Despite these positive developments, the dividend payments' sustainability is under scrutiny due to a history of volatility over the past decade; however, its current dividend yield stands competitively at 3% within the Indian market context.

Key Takeaways

Delve into our full catalog of 33 Top Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance