Exploring Dividend Stocks On Euronext Paris Featuring Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative And 2 Others

Amidst a backdrop of fluctuating European indices with France's CAC 40 Index recently experiencing a modest decline, investors continue to navigate through the complexities of market dynamics influenced by monetary policy signals from the European Central Bank. In such an environment, dividend stocks like those on Euronext Paris offer potential avenues for steady income, which can be particularly appealing in times of economic uncertainty and shifting central bank policies.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.10% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.63% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.37% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 6.58% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.23% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.18% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.58% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.04% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.62% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.30% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative operates as a cooperative bank in France, offering a range of banking products and services, with a market capitalization of approximately €0.48 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative generates revenue primarily through its Proximity Bank segment, which contributed €253.67 million, and its Management for Own Account and Miscellaneous activities, which added another €92.57 million.

Dividend Yield: 4.2%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou has demonstrated a solid track record with its dividends, showing growth and stability over the past decade. Despite a recent drop in net interest income to €137.76 million from €179.31 million, net income rose to €111.84 million, up from €93.62 million last year, supporting ongoing dividend reliability with a low payout ratio of 17.9%. However, its dividend yield of 4.17% trails behind the top quartile of French dividend stocks at 5.19%.

Oeneo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA is a global company operating in the wine industry with a market capitalization of approximately €750.42 million.

Operations: Oeneo SA generates its revenue primarily through two segments: Aging (€103.16 million) and Corking (€226.21 million).

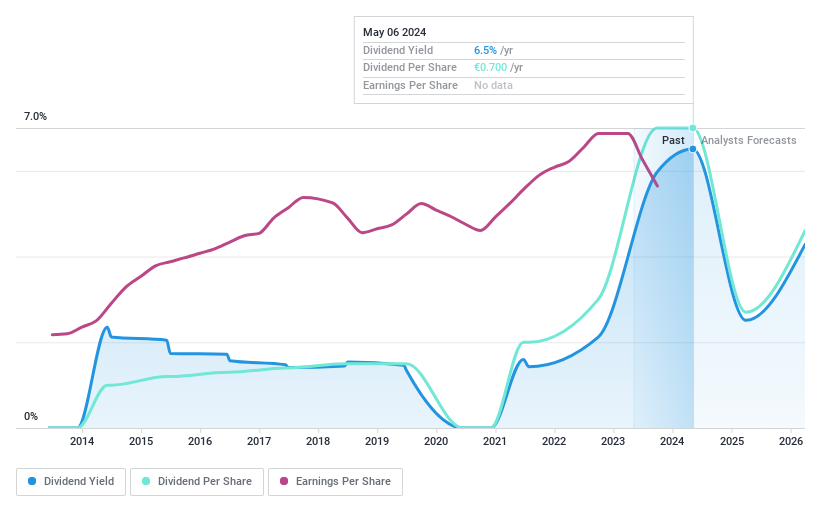

Dividend Yield: 6%

Oeneo has shown a mixed performance in its dividend strategy. Despite a 10-year increase in dividend payments, the sustainability is questionable with a high cash payout ratio of 302.4% and dividends not well covered by cash flows. The volatility is evident with significant annual drops exceeding 20%. While the yield of 6.03% ranks in the top quartile for French stocks, inconsistencies and underperformance in coverage metrics suggest caution for dividend-focused portfolios.

Click here and access our complete dividend analysis report to understand the dynamics of Oeneo.

Our valuation report unveils the possibility Oeneo's shares may be trading at a premium.

Teleperformance

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE operates globally, offering customer consultancy services, with a market capitalization of approximately €6.52 billion.

Operations: Teleperformance SE generates revenue through various segments, including Specialized Services at €1.36 billion, Core Services & D.I.B.S in LATAM at €1.57 billion, Core Services & D.I.B.S in North America & Asia-Pacific at €2.53 billion, and Core Services & D.I.B.S in Europe, Middle East & Africa (EMEA) at €2.54 billion.

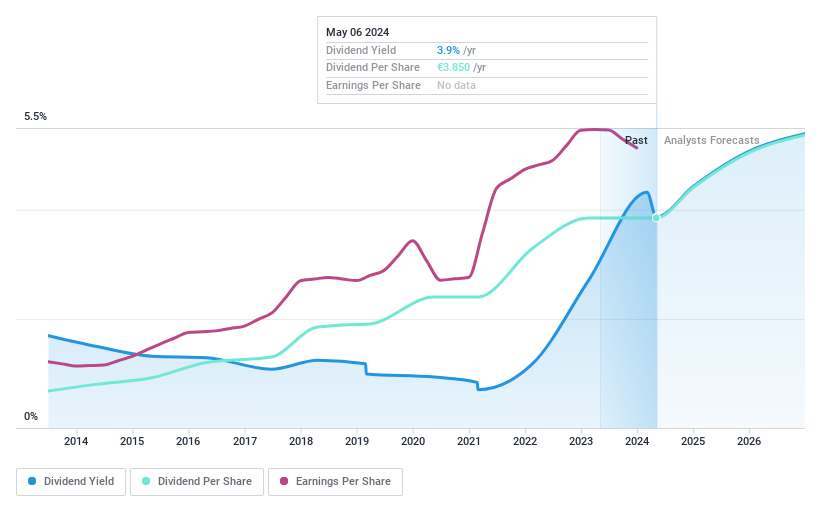

Dividend Yield: 3.6%

Teleperformance SE, while offering a moderate dividend yield of 3.58%, maintains reliable payouts supported by a 10-year history of consistent dividends. The company's dividend sustainability is bolstered by earnings and cash flows, with payout ratios at 37.5% and 20.5% respectively, indicating strong coverage. Despite its high debt levels, Teleperformance trades at a significant discount to estimated fair value and anticipates earnings growth of approximately 12.71% per year. Recent guidance predicts modest revenue growth for 2024, between +2% to +4%.

Taking Advantage

Access the full spectrum of 32 Top Euronext Paris Dividend Stocks by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CRTO ENXTPA:SBT and ENXTPA:TEP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance