What to Expect From Republic Services' (RSG) Q1 Earnings?

Republic Services, Inc. RSG is scheduled to release its first-quarter 2023 results on Apr 27, after market close.

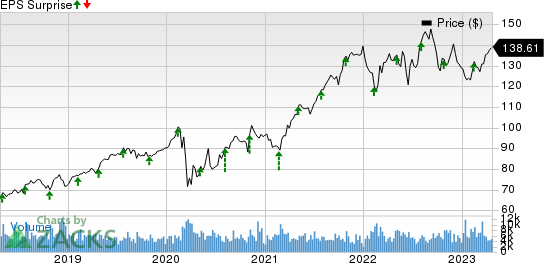

The company has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in all four trailing quarters, with an average surprise of 10.5%.

The Zacks Consensus Estimate for the bottom line is pegged at $1.14, which has been unchanged in the past 60 days.

Republic Services, Inc. Price and EPS Surprise

Republic Services, Inc. price-eps-surprise | Republic Services, Inc. Quote

Q1 Expectations

The Zacks Consensus Estimate for the top line is pegged at $3.4 billion, up 14.9% from the year-ago actual. The likely uptick can be due to various value-adding acquisitions and healthy organic growth.

Segmental Information

Revenues from the Environmental Solutions segment are likely to rise 100% on a year-over-year basis, the Zacks Consensus Estimate of which is pinned at $295 million. The expected increase can be correlated to the acquisition of US Ecology.

The consensus mark for the Collections service segment’s revenues in the to-be-reported quarter is pegged at $2.3 billion, indicating a 7.8% year-over-year increase. Continued effortsto deploy RISE tablets is expected to have increased operational efficiency.

Net Revenues from the Landfill segment are likely to rise 11.4% on a year-over-year basis, the Zacks Consensus Estimate of which is pegged at $388 million. The consensus mark for the Transfer Services unit’s revenues in the to-be-reported quarter is pegged at $182 million, indicating a 10.4% year-over-year increase.

Operational efficiency and cost-saving initiatives are likely to have positively impacted the bottom line. The Zacks Consensus Estimate for earnings suggests no change from the year-ago reported figure.

What Our Model Says

Our proven model predicts an earnings beat for RSG this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

RSG has an Earnings ESP of +0.39% and a Zacks Rank of 3.

Other Stocks to Consider

Here are a few other stocks from the broader Business Services sector, which according to our model, have the right combination of elements to beat on earnings this season.

Charles River Associates CRAI currently has an Earnings ESP of +2.63% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

It is scheduled to report its first-quarter 2023 results on May 4, before market open.

The ZacksConsensus Estimate for the bottom line is pegged at $1.33 per share, down 13.1% from the year-ago figure. The consensus mark for revenues is pegged at $152.6 million, up 2.8% from the figure reported a year ago. CRAI had an average surprise of 19.8% in the previous four quarters.

Waste Management WM currently has an Earnings ESP of +0.63% and a Zacks Rank of 3. It is scheduled to report its first-quarter 2023 results on Apr 26, after market close.

The Zacks Consensus Estimate for earnings is pegged at $1.27 per share, down 1.6% from the year-ago figure. The consensus mark for revenues is pegged at $4.84 billion, up 3.9% from the prior-year figure. WM had an average surprise of 4.7% in the previous four quarters.

Avis Budget CAR currently has an Earnings ESP of +24.29% and a Zacks Rank of 3. It is scheduled to report its first-quarter 2023 results on May 1, after market close.

The Zacks Consensus Estimate for earnings is pegged at $3.27 per share, down 67.3% from the year-ago figure. The consensus mark for revenues is pegged at $2.5 billion, up 2.9% from the prior-year figure. CAR had an average surprise of 78% in the previous four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance