eXp World (NASDAQ:EXPI) Beats Q1 Sales Targets

Real estate technology company eXp World (NASDAQ:EXPI) announced better-than-expected results in Q1 CY2024, with revenue up 10.9% year on year to $943.1 million. It made a GAAP loss of $0.10 per share, down from its profit of $0.01 per share in the same quarter last year.

Is now the time to buy eXp World? Find out in our full research report.

eXp World (EXPI) Q1 CY2024 Highlights:

Revenue: $943.1 million vs analyst estimates of $893.2 million (5.6% beat)

Adjusted EBITDA: $11.0 million vs analyst estimates of $6.5 million ($4.5 million beat)

EPS: -$0.10 vs analyst estimates of -$0.06 (-$0.04 miss)

Gross Margin (GAAP): 8.3%, down from 8.6% in the same quarter last year

Free Cash Flow of $59.33 million, up 88.7% from the previous quarter

Agents and Brokers: 85,780

Market Capitalization: $1.51 billion

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

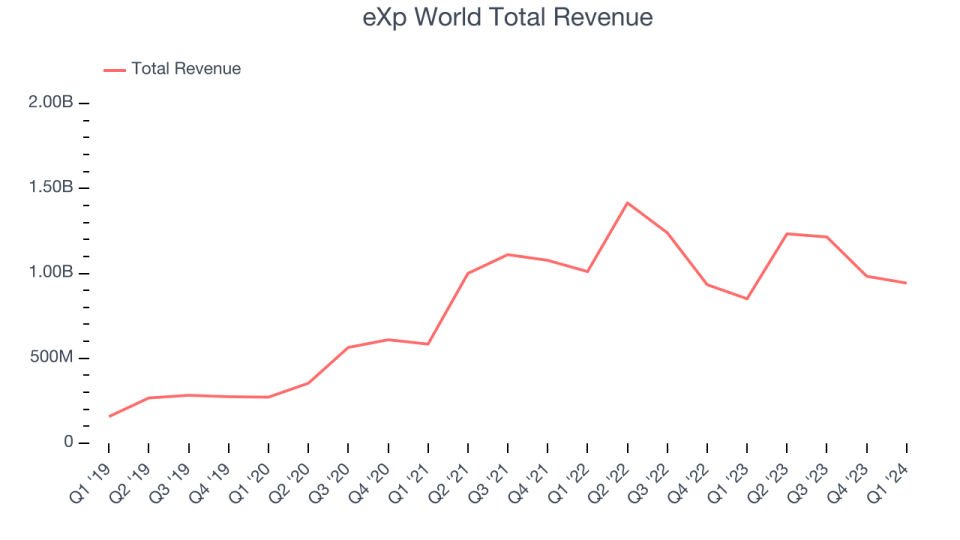

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. eXp World's annualized revenue growth rate of 49% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. eXp World's recent history shows its momentum has slowed as its annualized revenue growth of 2.1% over the last two years is below its five-year trend.

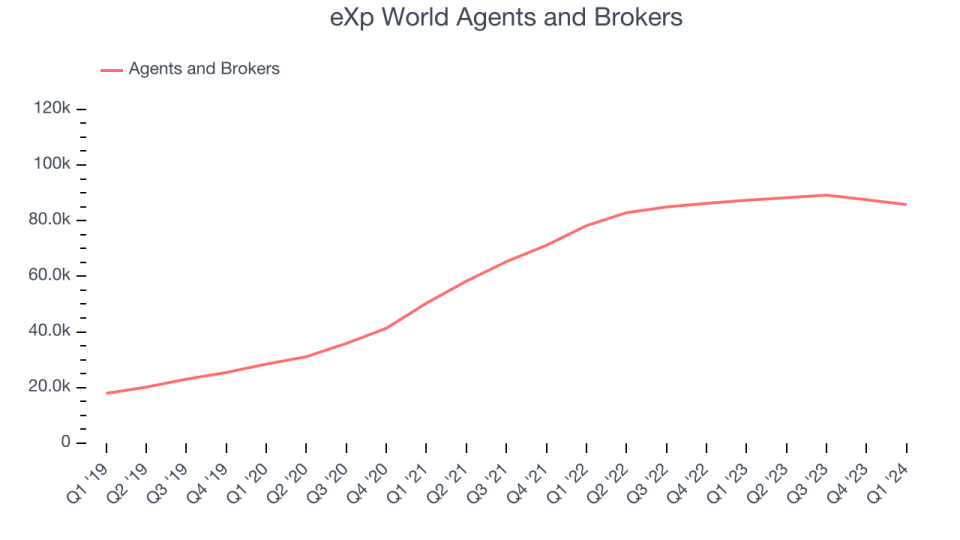

We can dig even further into the company's revenue dynamics by analyzing its number of agents and brokers, which reached 85,780 in the latest quarter. Over the last two years, eXp World's agents and brokers averaged 14.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, eXp World reported robust year-on-year revenue growth of 10.9%, and its $943.1 million of revenue exceeded Wall Street's estimates by 5.6%. Looking ahead, Wall Street expects sales to grow 4.7% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

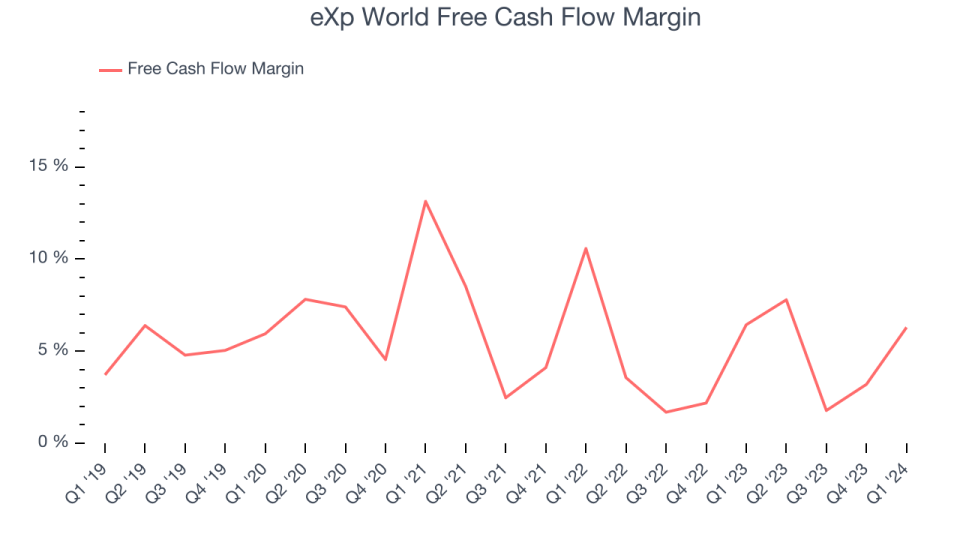

Over the last two years, eXp World has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 4%, subpar for a consumer discretionary business.

eXp World's free cash flow came in at $59.33 million in Q1, equivalent to a 6.3% margin and up 8.4% year on year.

Key Takeaways from eXp World's Q1 Results

We enjoyed seeing eXp World exceed analysts' revenue and adjusted EBITDA expectations this quarter. Overall, this was a solid quarter for eXp World. The stock is flat after reporting and currently trades at $10.15 per share.

So should you invest in eXp World right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance