Examining Three UK Dividend Stocks With Yields Up To 5.7%

As the FTSE 100 navigates through a challenging period with a looming third consecutive week of losses, investor focus in the United Kingdom remains keenly attuned to market dynamics and regulatory developments. In this context, dividend stocks continue to be a point of interest for those looking for potential stability and income amidst uncertainty. A good dividend stock typically combines reliable payouts with strong business fundamentals, which can be particularly appealing in the current economic landscape where cautious optimism among British businesses is on the rise.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.15% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.42% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.12% | ★★★★★☆ |

DCC (LSE:DCC) | 3.44% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.64% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.62% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.03% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.95% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.25% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

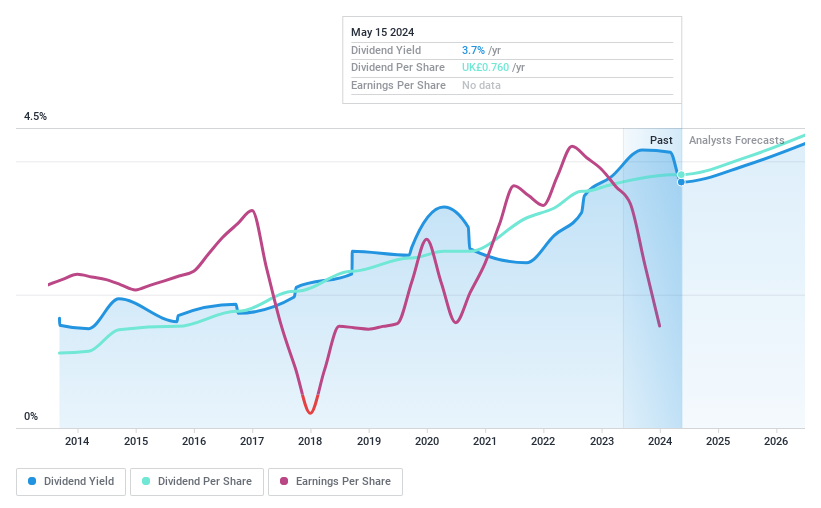

Brooks Macdonald Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees primarily in the UK, Isle of Man, and Channel Islands, with a market capitalization of approximately £330.20 million.

Operations: Brooks Macdonald Group plc generates revenue primarily from its international operations, which contributed £19.62 million.

Dividend Yield: 3.7%

Brooks Macdonald's recent appointment of Alex Charalambous as head of wealth and Maarten Slendebroek as chairman highlights strategic leadership enhancements. Despite a dividend increase to £0.29, the firm's financial health is concerning, with a reported net loss of £3.38 million and a significant profit decline from the previous year. The sustainability of its dividends is questionable due to a high payout ratio (162.6%) and earnings not covering dividend payments, compounded by substantial one-off charges impacting profitability.

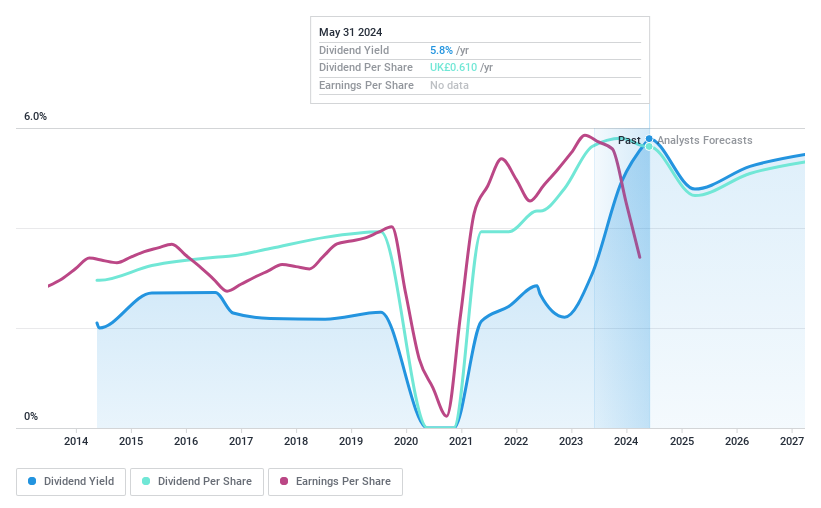

Burberry Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burberry Group plc operates in the luxury goods sector, manufacturing, retailing, and wholesaling products under the Burberry brand, with a market capitalization of approximately £3.76 billion.

Operations: Burberry Group plc generates £2.91 billion from its retail and wholesale operations, along with £63 million from licensing activities.

Dividend Yield: 5.8%

Burberry Group plc recently proposed a slightly reduced final dividend of 42.7 pence per share, totaling £151 million, reflecting a cautious approach amid declining net income and sales for FY 2024, with net income falling to £270 million from £490 million the previous year. Despite these challenges, the dividend is supported by a reasonable cash payout ratio of 73% and an earnings coverage at 82.5%, although historical volatility in dividend payments suggests some risk to future stability.

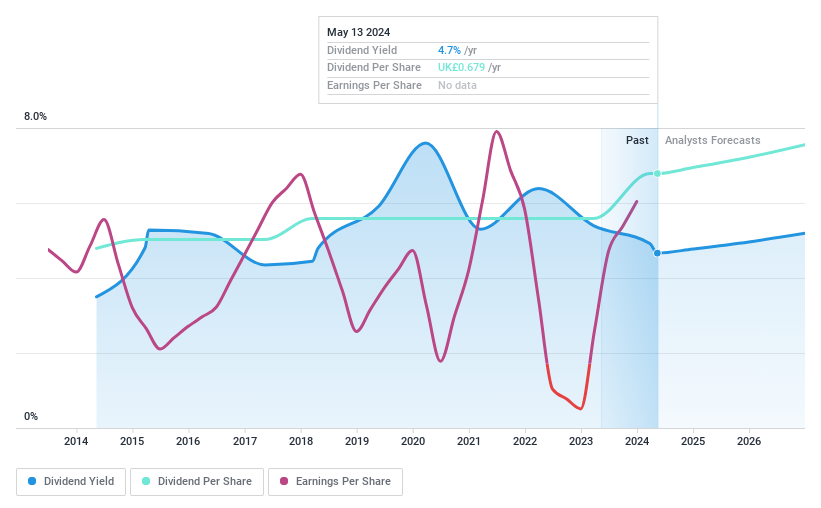

Ocean Wilsons Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited, operating primarily in Brazil, is an investment holding company specializing in maritime and logistics services with a market capitalization of approximately £459.72 million.

Operations: Ocean Wilsons Holdings Limited generates $486.65 million in revenue from maritime services in Brazil.

Dividend Yield: 5.1%

Ocean Wilsons Holdings Limited has shown a notable turnaround, reporting a net income of US$67.05 million for 2023 after a previous year's loss. The company increased its annual dividend to US$0.85 per share, supported by a sustainable payout ratio of 44.8% and cash payout ratio of 48.1%. Despite this positive shift and a dividend yield of 5.13%, it remains below the top UK dividend payers' average yield of 5.76%. The firm's dividends have demonstrated stability over the past decade, underpinned by consistent earnings growth and prudent financial management reflected in its below-market P/E ratio of 8.7x.

Taking Advantage

Click this link to deep-dive into the 56 companies within our Top Dividend Stocks screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:BRK LSE:BRBYLSE:OCN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance