Why is everyone telling me to invest in a low-cost index fund?

It’s Warren Buffett’s favourite way to invest and is considered by many to be the ideal entry vehicle for first-time investors.

But while the benefits of a low-cost product are easy to understand, the way they work can use a little explaining.

First made available to US investors in 1976, low-cost index investing has proven to be a successful investment strategy.

These days, low-cost index investing can be achieved via a low-cost index fund or through an exchange-traded fund (ETF), which also tracks an interest.

According to the largest issuer of ETFs, Vanguard, this strategy has outperformed most active managers since 1976.

What is an index fund?

An index fund tracks a benchmark or index like the S&P 300. Investors gain diversification and lower risk, and because you’re investing via a fund, you’re paying a much lower fee to gain exposure to those shares than if you’d invested directly.

Additionally, investing via an index fund means you’re not paying for a stock-picker to pick your stocks. This saves you a lot of money and prevents erosion of your capital and returns through management fees.

An ETF is another type of investment fund considered to be a simple and low-cost way to invest. Essentially, you invest in a basket of securities which are sold on a securities exchange market like the ETF. Generally, ETFs are passive and track an index, like a low-cost index fund.

What’s the benefit of lower fees?

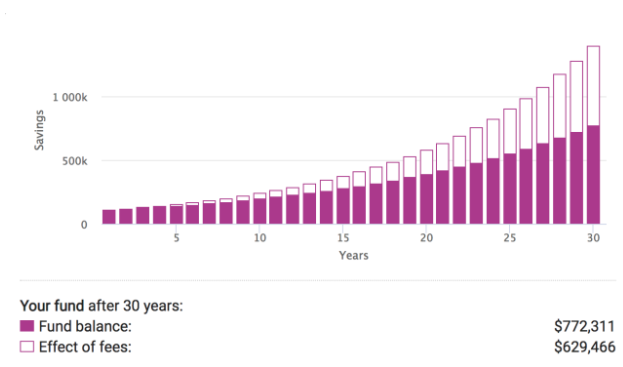

It might not sound like much, but according to ASIC’s managed funds fee calculator, the difference is between a 0.5 per cent management fee (like those charged on low-cost index funds) and a 2 or 3 per cent fee on a managed fund.

This means that if you had a $100,000 investment and were paying a 2 per cent fee, you’d lose $629,466 of potential earnings over 20 years.

Slash that to 0.5 per cent and you’ll find your closing balance significantly higher.

The difference is massive, and is a huge argument in favour of passive and index investing, the CEO of low-cost investment platform InvestSMART, Ron Hodge said recently.

“On the basis that ‘you get what you pay for’, fund managers justify high fees with the promise of higher-than-average returns. But… that promise is rarely met,” Hodge said.

He noted InvestSMART analysis of Morningstar data which found 78 per cent of active managers failed to beat an index in the 10 years to June 2018.

It begs the question: “Why not simply forget about outperformance altogether and concentrate on paying the lowest total percentage fee possible?”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: 12 things that millionaires have in common

Now read: Aussie borrowers have been overcharged $850 by their banks: Here’s how they did it

Now read: Halving migration would cost the NSW economy $130bn and 200,000 jobs

Yahoo Finance

Yahoo Finance