Even Through Significant Acquisitions, salesforce.com (NYSE:CRM) is Keeping Debt Reasonable

This article first appeared on Simply Wall St News.

While weaker earnings reports often create an inconvenient price dip, the results can be more severe when it aligns with an overall market correction.

Salesforce.com, inc.(NYSE: CRM) experienced such a situation, falling 20% off the fresh high in a matter of days. Yet, in such situations market often overreacts, creating new opportunities.

See our latest analysis for salesforce.com.

Q3 Earnings Results

Non-GAAP EPS: US$1.27 (beat by US$0.35)

GAAP EPS: US$0.47 (beat by US$0.50)

Revenue: US$6.68b (beat by US$60m)

For Q4, the company is expecting revenue around US$7.22-7.23b, and earnings around US$0.72-73, below the expectations at US$0.81.

Furthermore, it was announced that current COO and president Bret Taylor would assume a co-CEO role, along with the current CEO Marc Benioff. Interestingly, Mr.Taylor has also been announced as Twitter's new board chairman.

Despite solid results, the sell-off is driven mainly by conservative guidance, well below the analyst expectations. Analyst Brad Sills of Bank of America recognized this, pointing out that the company typically guides the fourth quarter more on the conservative side. Mr.Sills keeps a Buy rating with a price target of US$360.

Examining Salesforce Balance Sheet

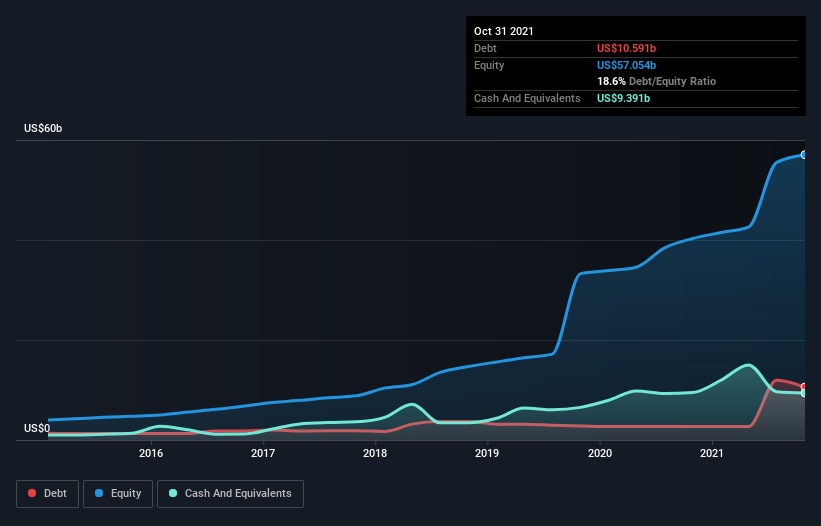

You can click the graphic below for the historical numbers, but it shows that as of October 2021, salesforce.com had US$10.6b of debt, an increase of US$2.68b, over one year. However, it does have US$9.39b in cash, offsetting this, leading to net debt of about US$1.20b.

It is important to note that the company recently closed a huge acquisition of Slack for US$27b - the largest acquisition in its history by far.

How Healthy Is salesforce.com's Balance Sheet?

According to the last reported balance sheet, salesforce.com had liabilities of US$15.0b due within 12 months and liabilities of US$15.3b due beyond 12 months. Offsetting these obligations, it had cash of US$9.39b as well as receivables valued at US$4.02b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$17.0b.

Given salesforce.com has a large market capitalization of US$246.2b, it's hard to believe these liabilities pose much threat. However, we think it is worth keeping an eye on its balance sheet strength, as it may change over time. But either way, salesforce.com has virtually no net debt, so it's fair to say it does not have a heavy debt load.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt and the interest rates paid on it.

With net debt sitting at just 0.30 times EBITDA, salesforce.com is arguably pretty conservatively geared. And it boasts an interest cover of 7.3 times, which is more than adequate. Even more impressive was the fact that salesforce.com grew its EBIT by 245% over twelve months. That boost will make it even easier to pay down debt from now on.

When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the future profitability of the business will decide if salesforce.com can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, salesforce.com produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Impressive Acquisitions with Debt Under Control

Happily, salesforce.com's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And that's just the beginning of the good news since its EBIT growth rate is also very heartening.

Over the last few years, the company made some impressive acquisitions like Slack, Tableau, Mulesoft, or Demandware - totaling over US$50b. Yet, the company seems to have handled the debt reasonably well. Considering this range of factors, it appears that salesforce.com is quite handy with its debt, and the risks seem well managed. So we're not worried about the use of a bit of leverage on the balance sheet.

There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - salesforce.com has 3 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Finance

Yahoo Finance