Eutelsat's (EUTLF) OneWeb LEO Services Utilized by Sat One

Eutelsat Group EUTLF recently announced that it inked a multi-year, multi-million dollar agreement with Australia-based Sat One.

Sat One offers enterprise connectivity across Australia and New Zealand with low-earth-orbit (LEO) satellite technology.

Per the agreement, Sat One will be utilizing EUTLF’s OneWeb LEO constellation for the “first-time activation of land-based services” across Australia’s remote northern and southern regions. It will also be used to activate maritime services in Australian waters and commercial services in New Zealand.

As Eutelsat’s OneWeb LEO becomes operational in Australia and New Zealand, Sat One will now be able to provide high-speed, low-latency connectivity services to enterprises, including mine sites, remote communities, and maritime clients.

The company is working on expanding its global footprint. With this alliance with Sat One, Eutelsat has expanded its presence in Australasia. Last month, Australian telecom operator, Telstra along with EUTLF, announced the launch of the biggest rollout of Eutelsat OneWeb LEO backhaul in Australia.

Under this rollout, more than 300 remote mobile base station sites (currently using satellite backhaul) will be connected to Eutelsat’s OneWeb LEO solution over the period of the next 18 months. The increase in capability will enable Telstra to increase mobile coverage as it executes new site deployments.

Eutelsat recently inked an agreement with Africa-based prominent ICT-systems integrator, NEC XON, for connectivity capacity on the Eutelsat OneWeb Low Orbit constellation. With this agreement, NEC XON will be able to integrate satellite capacity into its various systems. This will help it deliver secure connectivity for enterprise clients in areas that have no terrestrial Internet connectivity, including mining, agriculture and oil & gas.

Eutelsat OneWeb, a subsidiary of EUTLF, specializes in delivering Internet connectivity in LEO. The company acquired OneWeb in 2023. With the acquisition, it became a fully integrated GEO-LEO satellite operator. It now boasts a LEO constellation of more than 600 satellites and a fleet of 35 GEO satellites.

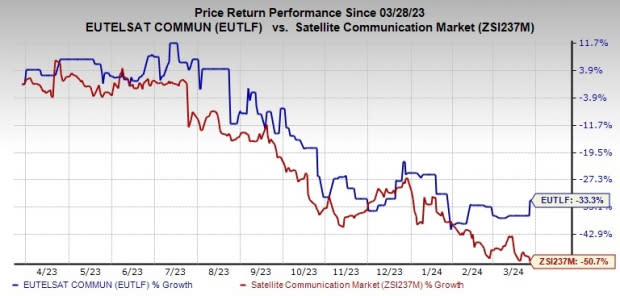

EUTLF carries a Zacks Rank #3 (Hold) at present. Shares of Eutelsat have lost 33.3% compared with industry's decline of 50.7% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Manhattan Associates MANH, Synopsys SNPS and Microsoft MSFT. While MANH and SNPS sport a Zacks Rank #1 (Strong Buy) each, MSFT carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MANH’s 2024 earnings per share (EPS) has increased 3.6% in the past 60 days to $3.76. Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 27.6%. Shares of MANH have surged 67.7% in the past year.

The Zacks Consensus Estimate for SNPS’ fiscal 2024 EPS increased 0.2% in the past 60 days to $13.46. The long-term earnings growth rate is 17.5%. SNPS’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 4.1%. Shares of SNPS have soared 57.9% in the past year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2024 EPS is pegged at $11.63, indicating growth of 18.6% from the year-ago levels. MSFT’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 8.8%. The long-term earnings growth rate is 16.2%. Shares of MSFT have rallied 53.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Eutelsat Communications (EUTLF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance