Euronext Paris Growth Companies With High Insider Ownership And Up To 102% Earnings Growth

As global markets navigate through varying economic signals, France's CAC 40 Index has recently seen a modest decline amid cautious sentiments from the European Central Bank. In this context, identifying growth companies with high insider ownership in France could offer investors particular insights into firms with potentially robust internal confidence and strategic alignment. Understanding companies with substantial insider ownership can be advantageous, especially when these insiders are seen doubling down on their investments during uncertain times. Such actions often signal a strong belief in the company’s future prospects and resilience, aligning well with current market dynamics where discerning stability and growth potential is key.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 26% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.5% | 68.8% |

Underneath we present a selection of stocks filtered out by our screen.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

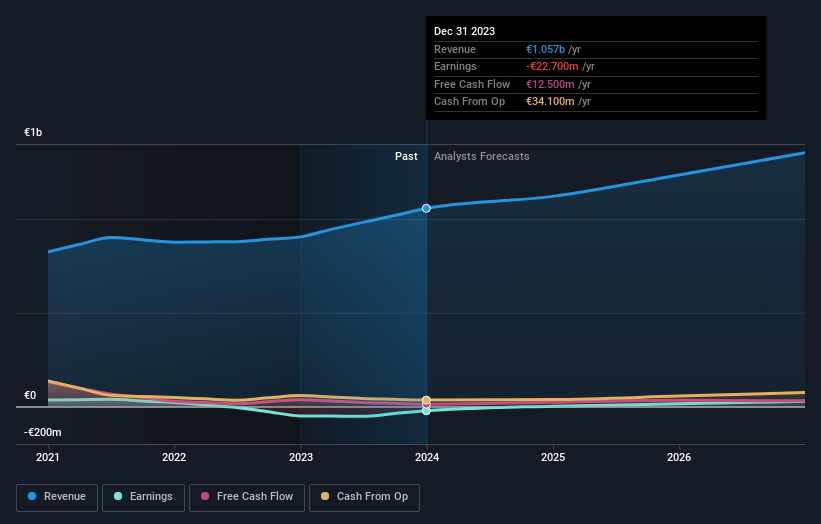

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.24 billion.

Operations: OVH Groupe's revenue is segmented into public cloud (€140.71 million), private cloud (€514.59 million), and web cloud (€179.45 million).

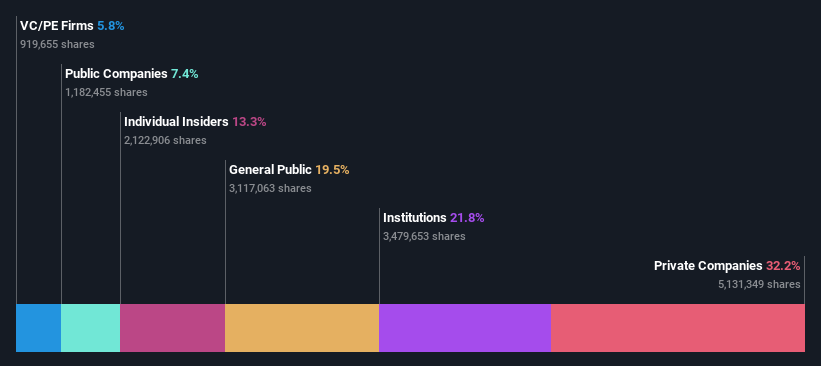

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.5% p.a.

OVH Groupe, a French cloud service provider, is navigating a challenging growth trajectory with high insider ownership. Despite recent financial improvements—sales rising to €486.09 million and reducing net losses—its revenue growth forecast of 11.3% per year trails behind the desired 20% benchmark for high-growth companies. However, OVH's anticipated profitability within three years and its market outpacing revenue growth projections (11.3% vs. 5.8%) reflect positively on its strategic direction under new leadership focused on innovation and international expansion.

Click to explore a detailed breakdown of our findings in OVH Groupe's earnings growth report.

The valuation report we've compiled suggests that OVH Groupe's current price could be inflated.

Solutions 30

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solutions 30 SE offers support solutions for new digital technologies across multiple European countries including France, Italy, Germany, the Netherlands, Belgium, Luxembourg, Poland, and Spain, with a market capitalization of approximately €231.82 million.

Operations: The company generates €1.06 billion in revenue from its computer services segment.

Insider Ownership: 16.2%

Earnings Growth Forecast: 102.6% p.a.

Solutions 30 SE, despite its volatile share price, is anticipated to experience robust growth with revenue forecasts exceeding the French market average. The company has recently reaffirmed its earnings guidance for 2024, expecting higher revenue growth rates particularly in Germany, Italy, and Belgium. A significant contract with Fluvius to upgrade Flanders' electricity network underscores its strategic expansion efforts. Although currently trading below estimated fair value and facing a net loss in the previous year, Solutions 30's path to profitability within three years highlights its potential recovery and growth trajectory.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. is a company that offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.53 billion.

Operations: The company generates revenue by providing digitalization solutions for commerce across Europe, Asia, and North America.

Insider Ownership: 13.3%

Earnings Growth Forecast: 26% p.a.

VusionGroup S.A. has shown impressive performance with a substantial increase in both sales and net income, reporting EUR 801.96 million and EUR 79.77 million respectively for the year ending December 2023. The company's earnings per share also saw significant growth, indicating robust profitability improvements. Forecasted to grow earnings by approximately 26% annually, VusionGroup's revenue growth is expected to outpace the French market significantly at around 24.4% per year, highlighting its potential as a high-growth entity with considerable insider ownership stability despite its highly volatile share price recently.

Click here and access our complete growth analysis report to understand the dynamics of VusionGroup.

Our expertly prepared valuation report VusionGroup implies its share price may be too high.

Make It Happen

Dive into all 21 of the Fast Growing Euronext Paris Companies With High Insider Ownership we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:OVH ENXTPA:S30 and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance