Euro Strength to Extend as Commodity FX Trades into a Top

S&P 500 Index ETF (SPY) & Russell 2000 ETF (IWM)

Prepared by Jamie Saettele, CMT

US equity indexes continue to chop up participants (see explanation from 3 weeks ago on the purpose this serves) as the SPY is at its highest since 5/3. The S&P 500 (SPY ETF shown) has closed the gap at 138.99. 139.96 is a measured level and a potential topping point. The Russell 2000 (IWM ETF) is well below its July high and closing in on its short term trendline once more. In other words, the broad index of small cap stocks is not confirming the new high in the narrow index of the 500 largest companies.

US Dollar Index (ICE) Continuous Contract Weekly

Prepared by Jamie Saettele, CMT

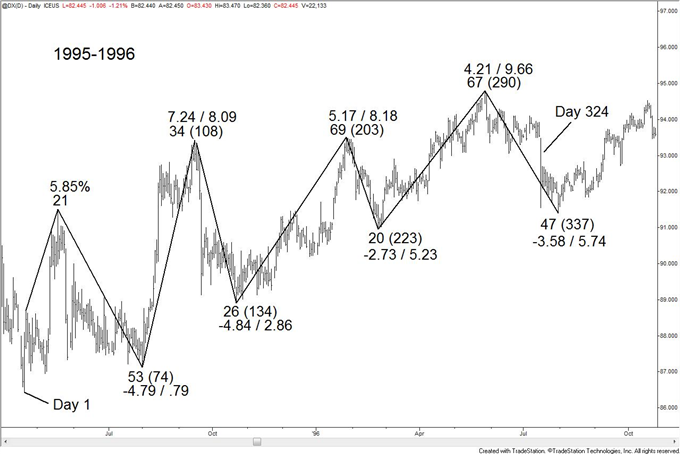

I’m still following the 1995/96 USD model. “IF the current market follows the 1995/96 model then expect weakness into mid-August below 8139. 8082 is former resistance and now potential support. The 1995/96 market endured a deep retracement (in late July and early August of 1996) that nearly touched the previous swing low (February 1996 low). If that happens this time around, then weakness would extend below 80 but a bottom would form before the February low of 7899.” The final swing low in 1996 occurred 337 days after the start of the 1995 low. 337 from the 2011 low is August 22nd. Expect dire prognostications regarding the US dollar in the mainstream media just before it embarks on one of its greatest bull runs of all time.

US Dollar Index (ICE) Continuous Contract Daily

Prepared by Jamie Saettele, CMT

“The relationship between the US Dollar Index in 1995-1996 and now was pointed out to me by ElliottWave-Forecast. The charts tell the story and it’s uncanny. Not only do the patterns show remarkable similarity in form, but also in time and amplitude. The first number denotes the number of days that the specific leg consumed. The second number in parentheses denotes the number of days since the start of the pattern. The numbers with decimal points are percentage and measure the change from low to high of each leg in the pattern with the number after the slash measuring the net change from the start of the pattern. If the pattern continues (and there is no guarantee that it will of course), then the USD would trade sideways to down throughout July and August before bottoming just above the March low. This should be interesting to follow.”

Prepared by Jamie Saettele, CMT

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR)

Weekly

Prepared by Jamie Saettele, CMT

Jamie – The Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) reversed most of Thursday’s gains on Friday and is approaching support from the trendline that extends off of the 2012 lows. Still, a deeper decline into mid-August (as per the 1995/96 model) is possible and could reach the 100% extension of the decline from the June high at 9940. The 52 week average may come into play as well (currently just above 9900). With these figures in mind, the index is probably no more than 1% or so from a swing low. In the current environment, it would only be appropriate for price to trade below Thursday’s large range day and convince the world that the trend is down before staging an impressive bullish reversal.

Euro / US Dollar

Daily

Prepared by Jamie Saettele, CMT

Jamie – Elliott wave guidelines state that wave 4 often alternates with wave 2 of the same degree with respect to character. In other words, if wave 2 is sharp and simple then expect wave 4 to be shallow and complex. Wave 2 (13003-13384) was sharp (retracing 78.6% of wave 1) and simple (3 wave zigzag) thus we should expect wave 4 to be shallow and complex. Shallow means a 38.2% retracement of wave 3, which comes in at 12554. The former 4th wave of one less degree is also of interest at 12746. 12320/40 is early week support.

British Pound / US Dollar

Weekly

Prepared by Jamie Saettele, CMT

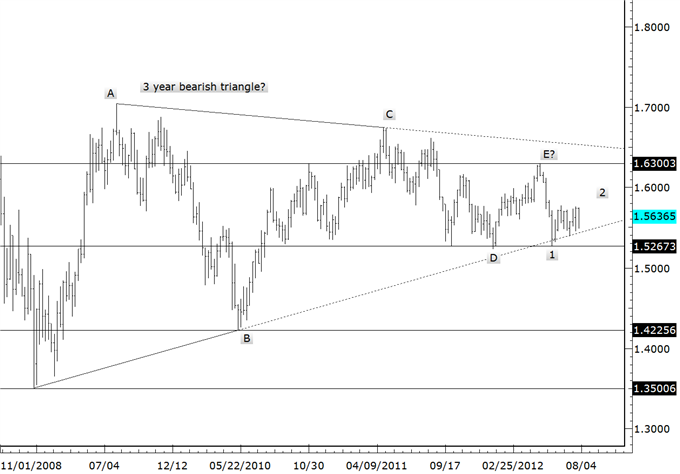

Jamie –15900 remains a level of interest. To review, “15900 is the 100% extension of the rally from 15267 and 61.8% retracement of the decline from 16300.” A triangle (b wave from the 6/20 high) must also be considered in which case the GBPUSD range would tighten for another few days before breaking higher to complete the advance from 15267. The current juncture is not conducive to taking a strong stand but the general outlook, which calls for a weaker USD before an important reversal, is consistent with other USD pairs.

Australian Dollar / US Dollar

Weekly

Prepared by Jamie Saettele, CMT

Jamie – The swings since the 2011 high compose a triangle. The NZDUSD pattern makes it more likely though that the triangle is not bullish but rather forming from the October 2011 low as wave B within an A-B-C decline from the 2011 high. The trendline that extends off of the 2011 and 2012 highs comes in just shy of 10700 next week and may produce the top. Weekly RSI is pressing against 60 which is a level consistent with long term resistance and don’t forget about the similarity with this same period in 2011.

New Zealand Dollar / US Dollar

Weekly

Prepared by Jamie Saettele, CMT

Jamie – The NZDUSD rally from the June 1 low is probably wave c within a triangle from the November low (B wave triangle). Levels to watch for a top are now (61.8% extension of 7455-8075 rally) and trendline and 8240 (October 2011 and April 30, 2012 highs). Like the AUDUSD, weekly RSI is pressing against 60 which is a level consistent with long term resistance.

US Dollar / Japanese Yen

Daily Bars

Prepared by Jamie Saettele, CMT

Jamie – The USDJPY formed a key reversal Wednesday, which happens to also be the first day of the month. This is a powerful combination. It would be much more bullish without the specter of 3 waves up from 7765, which is bearish. Still, the signal is too strong to pass up based on a subjective wave count. Look higher against 7806. 7912 and 7958 may pose problems for bulls if reached.

Euro / Japanese Yen

Daily Bars

Prepared by Jamie Saettele, CMT

Jamie – If I’m looking higher in the EURUSD and USDJPY then the EURJPY pattern should be bullish. Sure enough, the specter of 5 waves down from the March high at 11142 suggests that the next move is higher in at least 3 waves. The opportunity was identified yesterday but upside potential remains towards at least 9830, 100 and perhaps 10162 (much like EURUSD 12750…it’s a stretch but markets tend to go to places that they aren’t expected to go). 9660/80 is early week support.

Euro / Australian Dollar

Daily Bars

Prepared by Jamie Saettele, CMT

Jamie – EURAUD action is conducive to a sharp recovery in the coming weeks. Traps throughout July (notably 7/12 and 7/23) have probably convinced traders that this bottom is not worth picking….which of course makes this the best time to act. The dip yesterday to new lows and today’s rip into Wednesday’s high is enough to turn bullish against 11600. 11680/11700 is early week support.

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow him on Twitter @JamieSaettele

To be added to Jamie’s e-mail distribution list, send an e-mail with subject line "Distribution List" to jsaettele@dailyfx.com

Jamie is the author of Sentiment in the Forex Market.

Meet the DailyFX team in Las Vegas at the annual FXCM Traders Expo, November 2-4, 2012 at the Rio All Suite Hotel & Casino. For additional information regarding the schedule, workshops and accommodations, visit the FXCM Trading Expo website.

Yahoo Finance

Yahoo Finance