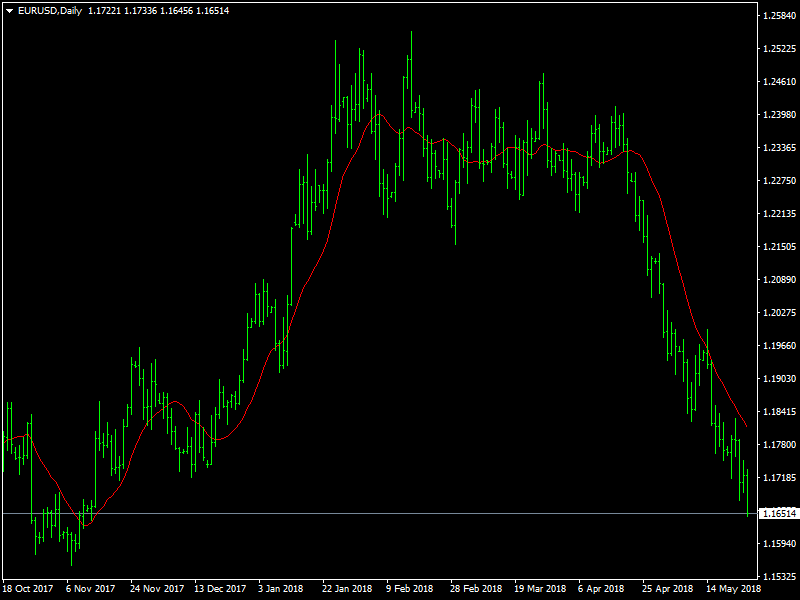

EUR/USD Fundamental Analysis – week of May 28, 2018

The EURUSD continued to weaken through the week that has passed us by as the data from the Eurozone continued to be weak and choppy and this has pushed the prices towards the 1.16 region during this period. We also saw the dollar continue with its strength though the Fed did not add anything new to their view.

EURUSD Likely to See Some Support

The past week saw the pair moving down to the 1.1650 region and end the week in a weak manner which points to further losses in the coming weeks. The focus was on the dollar and the FOMC meeting minutes but the Fed did not inform the markets about anything new that the market did not already know. This led to some disappointment among the dollar bulls who were expecting a hawkish Fed to give a timeline for further rate hikes. But the impact of this on the markets was minimal and this only led to some choppiness in the markets for some time.

The other focus was on the geopolitical developments as the US cancelled the scheduled summit between Trump and the leader of North Korea and this has once again led to some serious increase of risk in that region. This has led to a fall in the stock markets around the world and the safe havens have benefited due to that, including the dollar. This explains the fall in the euro over the last week.

Looking ahead to the coming week, it is likely to be a week of 2 halves with the week starting in a slow manner with a holiday in the US on Monday and the markets heading towards the end of the month in the coming week. This is likely to see some month end currency flows. Also, towards the end of the week, we are going to see the NFP data being released and after the choppy data from the US over the last couple of months, the investors and traders would be looking ahead for some strong data. On the other hand, technically, the euro is near a strong support region between the 1.1550 and 1.1650 region and we believe that this support region should hold for the short term and lead to a rebound in the coming days.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance