EUR/USD Extends Post-ECB Rally; 1.1500 on Tap?

DailyFX.com -

Talking Points:

- EUR/USD Advances for Seventh-Consecutive Day Despite Dovish ECB Rate Decision.

- AUD/USD Mounts Larger Rebound Ahead of RBA Meeting Minutes.

- USDOLLAR Downside Targets in Focus as Bearish Formation Continues to Take Shape.

For more updates, sign up for David's e-mail distribution list.

EUR/USD

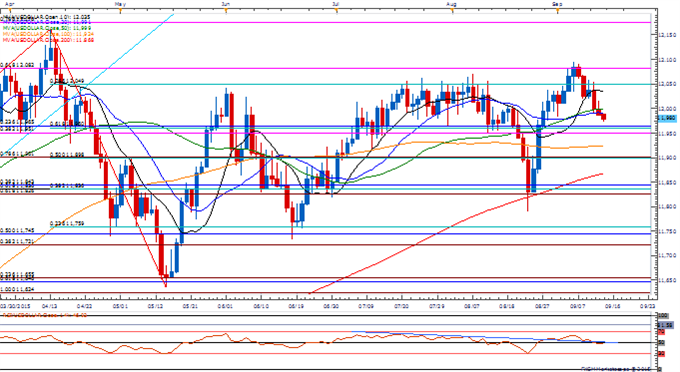

Chart - Created Using FXCM Marketscope 2.0

EUR/USD extends the advance following the European Central Bank’s (ECB) September 3 interest rate decision even as the Governing Council endorses a dovish outlook for monetary policy; may see the pair continue to retrace the decline from the August high (1.1712) as market participants treat the Euro as a funding-currency.

With Euro-Zone Industrial Production expected to rebound 0.3% in July, may see EUR/USD continue to carve a string of higher highs & lows, with a break/close above 1.1370 (38.2% retracement) opening up the door for 1.1500 (23.6% retracement).

DailyFX Speculative Sentiment Index (SSI)shows retail crowd remains net-short EUR/USD since March 9, and the ratio appears to be approaching recent extremes as it widens to -2.01, with 33% of traders long.

AUD/USD

With AUD/USD trading back above former-support around 0.7080 (38.2% expansion) to 0.7090 (78.6% retracement), the pair remains at risk for a larger rebound especially if the Relative Strength Index (RSI) fails to retain the bearish pattern carried over from April.

Even though the Reserve Bank of Australia (RBA) retains the verbal intervention on the local currency, the meeting minutes may increase the appeal of the higher-yielding currency as Governor Glenn Stevens endorses a wait-and-see approach.

Failure to retain the bearish pattern in price & RSI may bring up the next region of interest around 0.7220 (23.6% expansion) to 0.7240 (100% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Euro ‘Funding-Currency’ Status at Risk on Hawkish Fed Outlook

The Weekly Volume Report: Sterling Rallies on Strong Turnover

USDOLLAR(Ticker: USDollar):

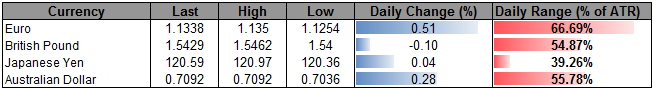

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11980.80 | 12016.48 | 11985.83 | -0.12 | 53.20% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar may continue to lose ground ahead of the Federal Reserve’s September 17 interest rate decision amid the ongoing series of lower highs & lows, with near-term support coming in around 11,951 (38.2% expansion) to 11,965 (23.6% retracement).

Even though the Fed is widely expected to keep the 2015 liftoff on the table, updated projections pointing to a slower pace of normalization may dampen the appeal of the greenback as it drags on interest rate expectations.

Failure to find support around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) may open up the next downside region of interest coming in around 11,898 (50% retracement) to 11,901 (78.6% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance