Equity Residential (NYSE:EQR) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Most readers would already be aware that Equity Residential's (NYSE:EQR) stock increased significantly by 19% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to Equity Residential's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Equity Residential

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Equity Residential is:

8.7% = US$963m ÷ US$11b (Based on the trailing twelve months to December 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.09 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Equity Residential's Earnings Growth And 8.7% ROE

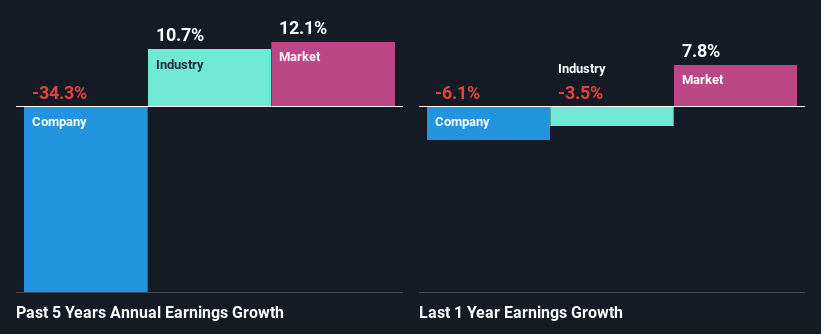

At first glance, Equity Residential's ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 5.0%, is definitely interesting. But seeing Equity Residential's five year net income decline of 34% over the past five years, we might rethink that. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

So, as a next step, we compared Equity Residential's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 11% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Equity Residential's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Equity Residential Making Efficient Use Of Its Profits?

Equity Residential seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 64% (meaning, the company retains only 36% of profits). However, this is typical for REITs as they are often required by law to distribute most of their earnings. So this probably explains the company's shrinking earnings.

Additionally, Equity Residential has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 80% over the next three years. Consequently, the higher expected payout ratio explains the decline in the company's expected ROE (to 4.6%) over the same period.

Conclusion

On the whole, we feel that the performance shown by Equity Residential can be open to many interpretations. Specifically, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return. Investors may have benefitted, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. With that said, we studied current analyst estimates and discovered that analysts expect the company's earnings growth to improve slightly. This could offer some relief to the company's existing shareholders. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance