Equinor (EQNR) Submits Funding Bid for UK Hydrogen Project

Equinor ASA EQNR made a funding bid to develop a second hydrogen production facility in northeast England to further reduce emissions across the region.

The company submitted a £16.4-million bid to the U.K. government’s Net Zero Hydrogen Fund. About 50% of the bid would be privately funded.

Equinor is working with the University of Sheffield’s Advanced Manufacturing Research Centre on the Hydrogen to Humber (H2H) production 2 project in the Humber region. The Humber industrial area is one of the largest carbon dioxide emitter in the U.K. There are various emitters, which could capitalize on the hydrogen to reduce emissions from their processes.

The H2H production 2 project is scheduled to be up and running by 2028. The project will produce 1.2 gigawatts (GW) of low-carbon hydrogen for use across various sectors in the region. This involves decarbonizing heavy industry, power generation, low-carbon chemical production and domestic heating trials.

Equinor also submitted a funding bid for the nearby H2H Saltend project this year, which has a hydrogen production capacity of 0.6 GW. The two projects could deliver 18% of the U.K.’s target of 10 GW of hydrogen production capacity by 2030.

Equinor has been working on other decarbonization projects in the Humber region. The company, along with SSE Thermal, is planning to build the world’s first at-scale 100% hydrogen power station at Keadby in Lincolnshire and a hydrogen storage facility at Aldbrough in East Yorkshire. It is also planning for potential hydrogen town trials in northern Lincolnshire.

The co-funded bid will help maintain and unlock private investment in low-carbon hydrogen projects in the Humber region. The H2H Production 2 project will help create a major hydrogen economy in the Humber region.

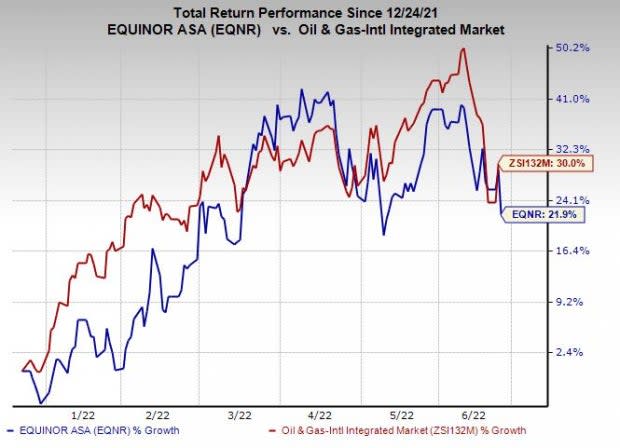

Price Performance

Shares of Equinor have underperformed the industry in the past six months. The stock has gained 21.9% compared with the industry’s 30% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Suncor Energy, Inc. SU is Canada’s premier integrated energy company. In 2021, Suncor reduced net debt by almost C$4 billion and returned it to shareholders through dividends and share repurchases.

Suncor’s robust liquidity position will allow it to sustain its dividend even if oil prices stay lower for longer. In fact, the company recently hiked its dividend by 12% to 47 Canadian cents per share (after doubling it previously) and increased the buyback authorization to 10% of its public float.

Kinder Morgan, Inc. KMI is a leading midstream energy infrastructure provider in North America. KMI expects to generate a net income of $2.5 billion in 2022. The company anticipates DCF and adjusted EBITDA of $4.7 billion and $7.2 billion for the year, respectively.

With a strong focus on returning capital back to shareholders, Kinder Morgan projects annual dividend for the year at $1.11 per share. The company’s board of directors approved a cash dividend of 27.75 cents per share for the first quarter of 2022. This suggests a 2.8% increase from the prior dividend of 27 cents per share.

Antero Resources Corporation AR is among the fast-growing natural gas producers in the United States. For 2022, AR expects to generate more than $2.5 billion of free cash flow, suggesting a significant improvement from $849 million reported last year.

Antero Resources is targeting a capital return program of 25%-50% of free cash flow annually, beginning with the implementation of the share repurchase program. The company’s board authorized a share repurchase program that enables it to repurchase up to $1 billion of outstanding common stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance