With EPS Growth And More, Vertex Resource Group (CVE:VTX) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Vertex Resource Group (CVE:VTX), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Vertex Resource Group

How Fast Is Vertex Resource Group Growing Its Earnings Per Share?

In the last three years Vertex Resource Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. It's good to see that Vertex Resource Group's EPS has grown from CA$0.019 to CA$0.022 over twelve months. This amounts to a 13% gain; a figure that shareholders will be pleased to see.

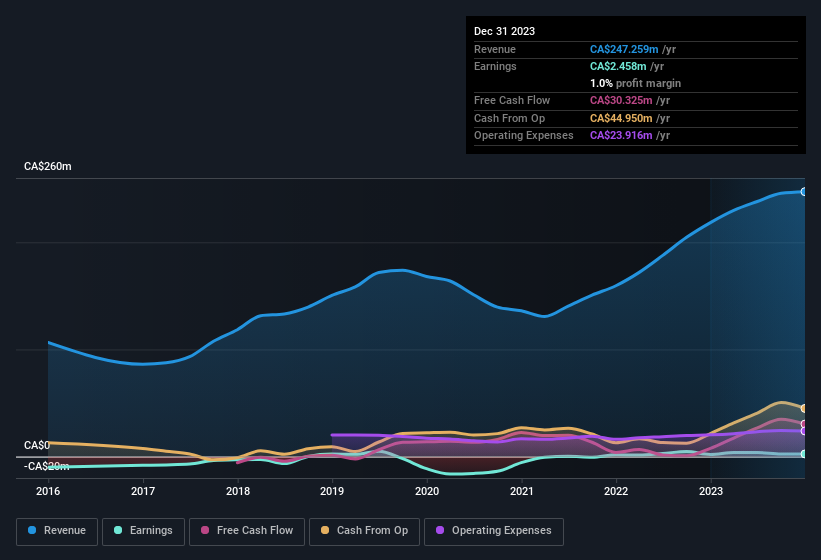

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Vertex Resource Group maintained stable EBIT margins over the last year, all while growing revenue 13% to CA$247m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Vertex Resource Group isn't a huge company, given its market capitalisation of CA$45m. That makes it extra important to check on its balance sheet strength.

Are Vertex Resource Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though some insiders sold down their holdings, their actions speak louder than words with CA$494k more invested than sold by people who know they company best. An optimistic sign for those with Vertex Resource Group in their watchlist. It is also worth noting that it was President Terry Stephenson who made the biggest single purchase, worth CA$221k, paying CA$0.34 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Vertex Resource Group insiders own more than a third of the company. Actually, with 39% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Although, with Vertex Resource Group being valued at CA$45m, this is a small company we're talking about. That means insiders only have CA$17m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is Vertex Resource Group Worth Keeping An Eye On?

One positive for Vertex Resource Group is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Vertex Resource Group (at least 1 which is concerning) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Vertex Resource Group, you'll probably love this curated collection of companies in CA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance