With EPS Growth And More, Trinity Exploration & Production (LON:TRIN) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Trinity Exploration & Production (LON:TRIN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Trinity Exploration & Production

Trinity Exploration & Production's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Trinity Exploration & Production to have grown EPS from US$0.011 to US$0.15 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

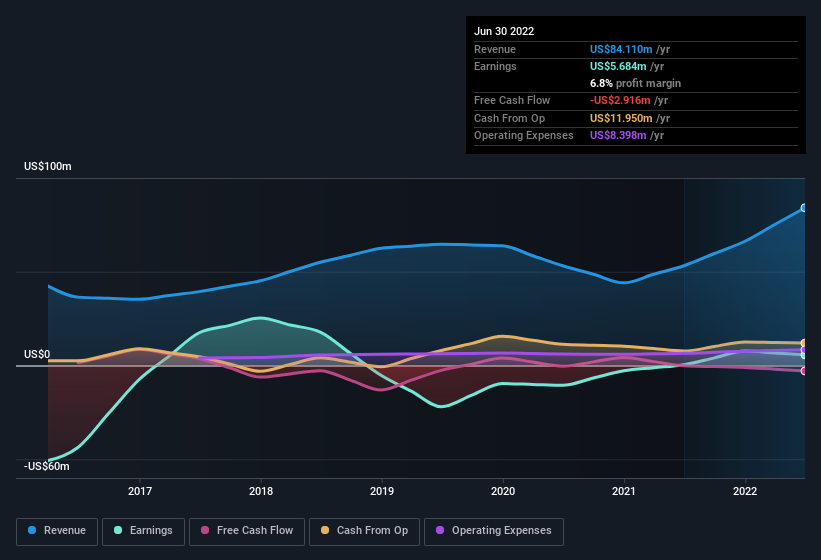

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Trinity Exploration & Production shareholders is that EBIT margins have grown from -1.5% to 4.5% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Trinity Exploration & Production is no giant, with a market capitalisation of UK£35m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Trinity Exploration & Production Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Trinity Exploration & Production insiders spent US$36k on stock; good news for shareholders. While this isn't much, we also note an absence of sales. It is also worth noting that it was Independent Non-Executive Chairman Nicholas Clayton who made the biggest single purchase, worth UK£20k, paying UK£1.02 per share.

On top of the insider buying, we can also see that Trinity Exploration & Production insiders own a large chunk of the company. Actually, with 36% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only UK£35m Trinity Exploration & Production is really small for a listed company. So this large proportion of shares owned by insiders only amounts to US$12m. That might not be a huge sum but it should be enough to keep insiders motivated!

Does Trinity Exploration & Production Deserve A Spot On Your Watchlist?

Trinity Exploration & Production's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Trinity Exploration & Production deserves timely attention. You should always think about risks though. Case in point, we've spotted 2 warning signs for Trinity Exploration & Production you should be aware of, and 1 of them is potentially serious.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Trinity Exploration & Production, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance