With EPS Growth And More, Rand Mining (ASX:RND) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Rand Mining (ASX:RND). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Rand Mining

How Fast Is Rand Mining Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Rand Mining's EPS went from AU$0.37 to AU$1.12 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

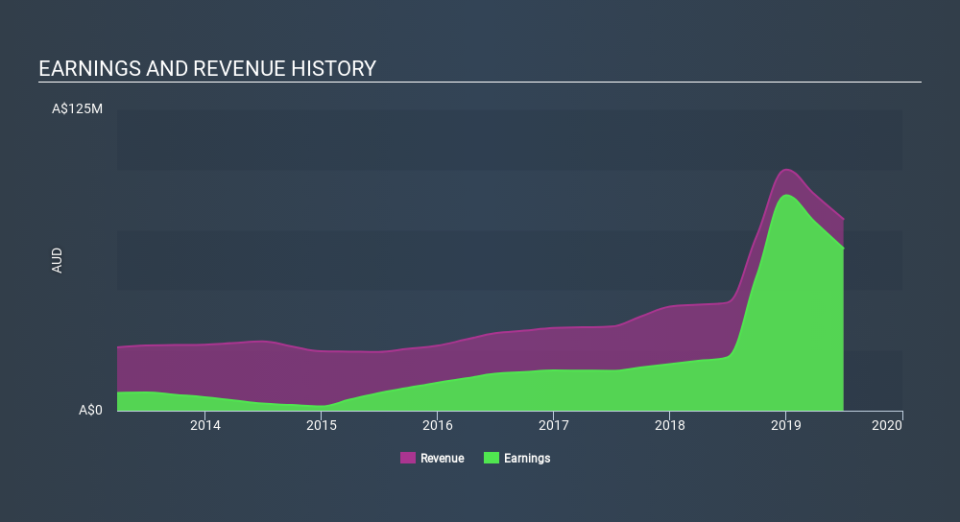

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Rand Mining maintained stable EBIT margins over the last year, all while growing revenue 77% to AU$79m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Rand Mining isn't a huge company, given its market capitalization of AU$137m. That makes it extra important to check on its balance sheet strength.

Are Rand Mining Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Rand Mining with market caps under AU$290m is about AU$379k.

The Rand Mining CEO received total compensation of just AU$184k in the year to June 2019. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Rand Mining To Your Watchlist?

Rand Mining's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. So Rand Mining looks like it could be a good quality growth stock, at first glance. That's worth watching. Of course, profit growth is one thing but it's even better if Rand Mining is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Rand Mining certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance