If EPS Growth Is Important To You, Monadelphous Group (ASX:MND) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Monadelphous Group (ASX:MND). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Monadelphous Group

How Fast Is Monadelphous Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. In previous twelve months, Monadelphous Group's EPS has risen from AU$0.50 to AU$0.55. That amounts to a small improvement of 10.0%.

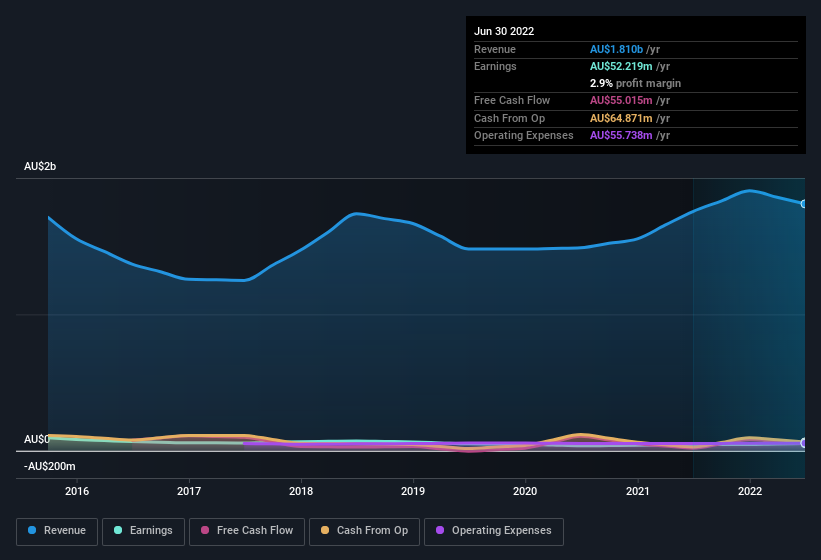

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Monadelphous Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.2% to AU$1.8b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Monadelphous Group's future EPS 100% free.

Are Monadelphous Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Monadelphous Group insiders have stood united by refusing to sell shares over the last year. But more importantly, Independent Deputy Chair & Lead Independent Non-Executive Director Sue Murphy spent AU$78k acquiring shares, doing so at an average price of AU$9.79. Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, it's good to see that Monadelphous Group insiders have a valuable investment in the business. To be specific, they have AU$54m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 4.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Monadelphous Group Worth Keeping An Eye On?

One important encouraging feature of Monadelphous Group is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Even so, be aware that Monadelphous Group is showing 1 warning sign in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Monadelphous Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance