Ennis Inc (EBF) Reports Fiscal Year Earnings: Aligns with EPS Projections but Misses Revenue ...

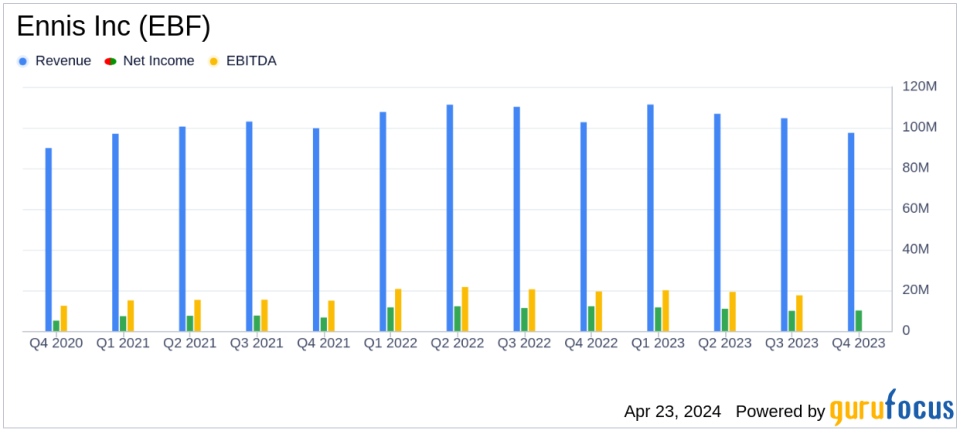

Quarterly Revenue: $97.4 million, down 5.2% year-over-year, falling short of estimates of $101.4 million.

Annual Revenue: $420.1 million, decreased by 2.7% from the previous fiscal year, below the estimated $422.85 million.

Quarterly Earnings Per Share (EPS): $0.39, meeting the estimated EPS of $0.39, but down from $0.47 year-over-year.

Annual Earnings Per Share (EPS): $1.64, slightly below the estimated $1.65, and down from $1.82 in the previous fiscal year.

Quarterly Net Income: $10.1 million, slightly below the estimate of $10.23 million, and down from $12.2 million in the same quarter last year.

Annual Net Income: $42.6 million, slightly below the estimated $43.16 million, and down from $47.3 million in the previous fiscal year.

Gross Profit Margin: Increased to 28.4% for the quarter from 27.6% year-over-year, but showed a slight decline from 29.8% to 29.2% on a sequential quarterly basis.

On April 22, 2024, Ennis Inc (NYSE:EBF), a prominent manufacturer and supplier of print products for the wholesale trade, disclosed its financial results for the quarter and fiscal year ended February 29, 2024, through its 8-K filing. The company reported quarterly revenues of $97.4 million and annual revenues of $420.1 million, falling short of the analyst estimates of $101.40 million for the quarter and $422.85 million for the year. However, earnings per share (EPS) for the year aligned closely with projections at $1.64, just shy of the anticipated $1.65.

Company Overview

Founded in 1909 and headquartered in Midlothian, Texas, Ennis Inc serves a national network of distributors with a broad range of products including business forms, commercial printing, and custom products. The company operates production and distribution facilities across the USA, ensuring efficient service delivery and maintaining its position as one of the largest private-label printed business product suppliers in the country.

Fiscal Year Performance Highlights

For the fiscal year, Ennis Inc reported a slight decrease in revenue, down 2.7% from the previous year, totaling $420.1 million. The company experienced a dip in net earnings to $42.6 million from $47.3 million in the prior year, reflecting a decrease in EPS from $1.82 to $1.64. Despite the revenue shortfall, the gross profit margin showed marginal resilience, standing at 29.8% compared to 30.3% last year.

Quarterly Financial Insights

The fourth quarter saw a revenue decline of 5.2% year-over-year, amounting to $97.4 million. Net earnings for the quarter were reported at $10.1 million, or $0.39 per diluted share, compared to $12.2 million, or $0.47 per diluted share for the same quarter last year. The company highlighted an 80-basis point increase in the gross profit margin compared to the prior year's quarter, although it noted a sequential decline from the third quarter of 2023.

Strategic and Operational Challenges

Keith Walters, Chairman, CEO, and President of Ennis Inc, acknowledged the competitive pressures in the print market which have continued to impact operating margins. The company is in the early stages of implementing ERP systems for its recent acquisitions, which are expected to improve margins once fully operational. Additionally, Ennis Inc has strategically reduced inventory by $6.8 million to enhance cash flow and repurchased over 29,000 shares during the quarter.

Financial Position and Future Outlook

Ennis Inc maintains a robust financial stance with $110.9 million in cash and short-term investments, and no debt. This strong position supports ongoing operations and strategic acquisitions without the need for incurring debt. The company also benefits from increased interest income due to higher rates on its cash and short-term investments, reporting $1.3 million for the quarter compared to $0.5 million in the same quarter last year.

Investor Considerations

The company's commitment to returning value to shareholders remains steadfast, as evidenced by its consistent dividend payments and strategic share repurchases. While the print industry faces digital disruption, Ennis Inc's diversified product offerings and strategic management practices provide a buffer against sector-wide challenges. Investors should consider both the resilience of Ennis Incs business model and the broader industry trends when evaluating the company's stock.

For detailed financial tables and further information, investors and stakeholders are encouraged to review the full earnings report and non-GAAP reconciliations provided by Ennis Inc.

Explore the complete 8-K earnings release (here) from Ennis Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance