Emerson's Zedi Business Buyout to Aid Automation Solutions

Emerson Electric Co. EMR yesterday announced that it successfully completed the buyout of Zedi Inc.’s software and automation businesses. Financial terms of the acquisition have been kept under wraps.

Based in Calgary, Canada, Zedi’s software and automation businesses have a workforce of 155 people. Zedi provides a cloud supervisory control and data acquisition (SCADA) platform that is helping customers in monitoring sensors, devices and applications.

Details of Buyout

As noted, the SCADA platform, via its monitoring (cloud-based), control and optimization, will help oil and gas producers to raise production and work toward lowering operating costs. This buyout will be part of Emerson’s Automation Solutions segment and enhance its product offerings in the oil and gas production industry.

It is worth noting here that the company’s Automation Solutions segment provides measurement instrumentation, control & safety systems, asset management, valves, actuators & regulators, electrical components & lighting, and precision welding & cleaning services. The segment generated nearly 65% of the company’s revenues in the second quarter of fiscal 2019 (ended Mar 31, 2019).

Snapshot of Emerson’s Inorganic Initiatives

We believe that the above-mentioned transaction is consistent with Emerson’s policy of acquiring meaningful businesses to gain access to new customers, regions and product lines.

In the first half of fiscal 2019 (ended Mar 31, 2019), the company used $243 million for making six acquisitions in the Automation Solutions segment. Earlier to these, Emerson acquired Aventics in July 2018.

Acquired assets boosted the company’s sales by 6% in the second quarter of fiscal 2019 while a contribution of 5% is predicted for the fiscal year (ending September 2019).

Zacks Rank & Stocks to Consider

With a market capitalization of nearly $40.2 billion, Emerson currently carries a Zacks Rank #3 (Hold). We believe that the company’s inorganic initiatives will add more vigor to its product offerings. However, weakness in the Middle East, African and Asia operations as well as forex woes remain concerning.

Year to date, Emerson’s share price has increased 8.6% versus the industry’s growth of 7.8%.

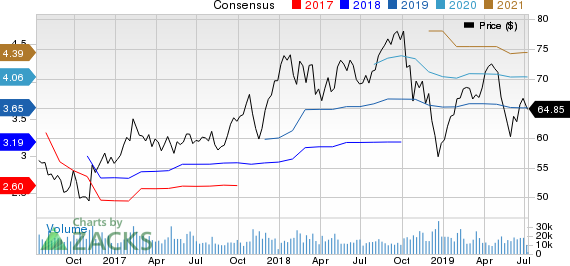

In the past 60 days, earnings estimates on the company have been revised downward. Currently, the Zacks Consensus Estimate for its earnings is pegged at $3.65 for fiscal 2019 (ending September 2019) and $4.06 for fiscal 2020 (ending September 2020), reflecting declines of 0.3% and 0.2% from the respective 60-day-ago figures.

Emerson Electric Co. Price and Consensus

Emerson Electric Co. price-consensus-chart | Emerson Electric Co. Quote

Some better-ranked stocks in the Zacks Industrial Products sector are Roper Technologies, Inc. ROP, Chart Industries, Inc. GTLS and RBC Bearings Incorporated ROLL. While Roper currently sports a Zacks Rank #1 (Strong Buy), both Chart Industries and RBC Bearings carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for all these three stocks have improved for the current year. Further, average earnings surprise for the last four quarters was positive 8.43% for Roper, 16.56% for Chart Industries and 8.36% for RBC Bearings.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance