Emerson Electric Q3 Preview: Can Shares Remain Charged?

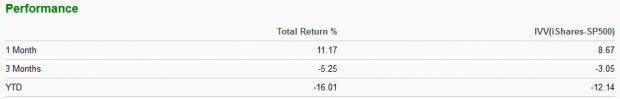

The Zacks Industrial Products Sector has been blazing hot over the last month, increasing more than 11% in value and outperforming the general market by a fair margin. The table below illustrates the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

A company within the sector, Emerson Electric EMR, is slated to release Q3 FY22 results on Tuesday, August 9th, before the market opens.

Emerson Electric Co. is a diversified global engineering and technology company providing a wide range of products and services to customers in consumer, commercial and industrial markets.

In addition, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of an A. How do things stack up for the electronics giant heading into the print? Let’s take a closer look.

Share Performance & Valuation

EMR shares have displayed excellent relative strength year-to-date, declining a slight 2% vs. the general market’s decline of roughly 12%.

Image Source: Zacks Investment Research

The share performance is remarkable over the last month as well – Emerson Electric shares have climbed a double-digit 13%, easily outperforming the S&P 500 in this timeframe also.

Image Source: Zacks Investment Research

The positive price action of EMR shares is undoubtedly a positive, signaling that buyers have defended the stock at a high level.

In addition, the company sports solid valuation levels. Emerson’s 17.7X forward P/E ratio is nicely beneath its five-year median of 20.3X but represents a slight 8% premium relative to its Zacks Sector.

The company carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Over the last 60 days, two analysts have lowered their earnings outlook, and one has upped their outlook, with the Consensus Estimate Trend remaining flat. However, the Zacks Consensus EPS Estimate resides at $1.29, penciling in a rock-solid 18% increase in earnings year-over-year.

Image Source: Zacks Investment Research

Emerson’s top-line is also in spectacular shape – the quarterly sales estimate of $5.1 billion reflects a notable 9% uptick from year-ago quarterly sales of $4.7 billion.

Quarterly Performance & Market Reactions

EMR’s bottom-line results have been fantastic; the company has chained together nine consecutive bottom-line beats. Just in its latest quarter, the company recorded a solid 9.3% EPS beat.

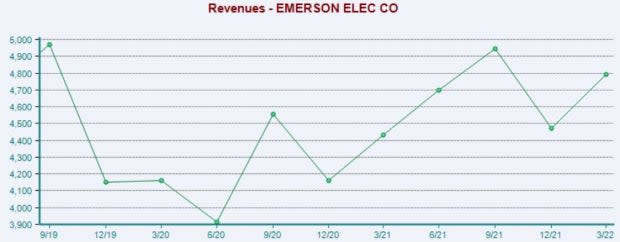

Quarterly sales results have also been stellar – the company has exceeded quarterly revenue estimates in seven of its last eight quarterly prints. The chart below illustrates the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has had mixed reactions following quarterly releases, with shares moving upwards three times and downwards three times over its last six earnings reports.

Putting Everything Together

Emerson Electric shares have displayed remarkable strength over the last month, indicating that buyers have been out in full force.

The company also sports solid valuation levels, with its forward earnings multiple sitting nicely beneath its five-year median.

Quarterly estimates reflect notable growth within both the top and bottom lines. In addition, the company has consistently exceeded quarterly estimates, undoubtedly a major positive that speaks volumes about its successful business operations.

Heading into the print, Emerson Electric EMR carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of a slight -0.04%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance