Emerge Gaming (ASX:EM1) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Emerge Gaming (ASX:EM1) shareholders have done very well over the last year, with the share price soaring by 650%. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Emerge Gaming's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Emerge Gaming

How Long Is Emerge Gaming's Cash Runway?

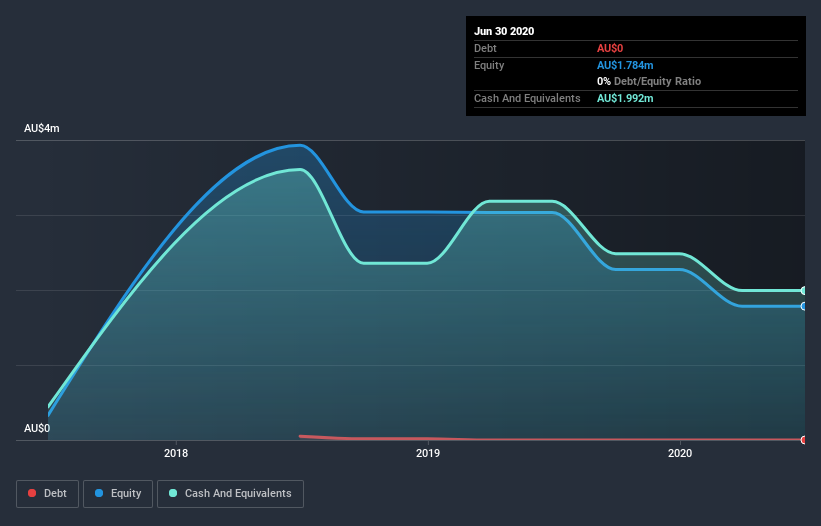

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2020, Emerge Gaming had AU$2.0m in cash, and was debt-free. In the last year, its cash burn was AU$1.2m. That means it had a cash runway of around 20 months as of June 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Is Emerge Gaming's Cash Burn Changing Over Time?

While Emerge Gaming did record statutory revenue of AU$1.0 over the last year, it didn't have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Even though it doesn't get us excited, the 42% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of Emerge Gaming due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Emerge Gaming Raise More Cash Easily?

While Emerge Gaming is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Emerge Gaming has a market capitalisation of AU$85m and burnt through AU$1.2m last year, which is 1.4% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Emerge Gaming's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Emerge Gaming is burning through its cash. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. And even though its cash runway wasn't quite as impressive, it was still a positive. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 5 warning signs for Emerge Gaming you should be aware of, and 2 of them are significant.

Of course Emerge Gaming may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance