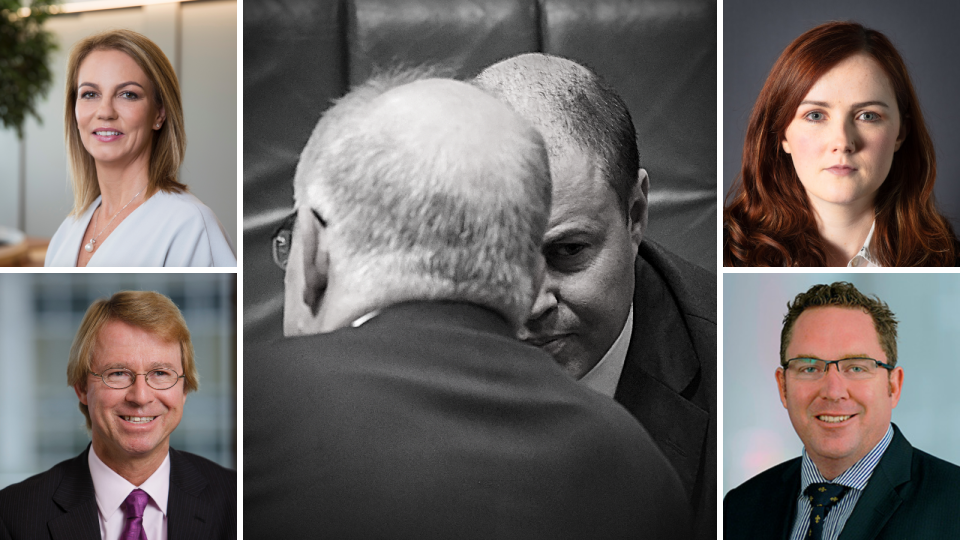

4 top economists on how the budget can save Australia

The 2020-21 Federal Budget, in Prime Minister Scott Morrison’s own words, is the “most important since the Second World War”.

The Government has already given away plenty about what’s in store, from tax cuts for small businesses to $305 million towards childcare.

Treasurer Josh Frydenberg has also hinted more than once that income tax cuts could be brought forward, but it’s not a plan that everyone believes is a good idea.

So what do the experts think? According to some of Australia’s top economists, here’s what they believe the budget needs to contain for the nation to be on its way to recovery.

Jo Masters, EY Oceania chief economist

What: Continue JobSeeker boost, but more is needed

“Recent EY analysis has found that temporary income support could come in the form of an extension to the $250 JobSeeker Covid-19 supplement beyond December and/or through a third $750 payment.

“Infrastructure spending should be substantial given our low interest rate environment … [and] has the greatest impact on reducing unemployment.

“The Federal Budget needs to ease the impending income fiscal cliff by providing some ongoing temporary support and encouraging jobs growth – a shift from JobKeeper to a wage subsidy has some merit.”

Why: It’ll bring unemployment down.

“We modelled the impact of a mix of policies on the national unemployment rate, totalling $60 billion, which included $40 billion on infrastructure spending.

“Each policy drove the unemployment rate below the RBA’s base scenario, and taken together these measures could directly reduce the national unemployment rate by around 1 per cent by the end of 2022.”

Dr Brendan Rynne, KPMG chief economist

What: Make JobKeeper better.

“The top priority in the Budget should be a fine-tuned and targeted JobKeeper program, to maximise its effectiveness and efficiency.

How: “This program would have:

the flexibility to deal with circumstances of businesses and workers in particular industry sectors, and:

a phase-out schedule that is contingent on the economic performance of businesses rather than arbitrary calendar dates.”

Shane Oliver, AMP Capital chief economist

What: Bring forward the scheduled tax cuts.

“The number one thing to do in the Budget is provide a further boost of at least $15 billion to household after tax income.

Why: “This is all about getting spending back up when confidence is still depressed and one of the best ways to do that is if people think their income boost is permanent which is why tax cuts are important.”

How: “Ideally this should come in the form of a bring forward of the already legislated Stage Two 2022 income tax cuts (which will cost about $13 billion) backdated to July this year (so tax payers can get a refund) and stimulus payments to low income earners and welfare recipients (ideally with use by dates).”

And: “Of course it should be part of a package – the other key elements of which should be tax breaks for companies to invest, more spending on infrastructure and a replacement for JobKeeper.”

But: This proposal has been criticised by other economists: analysis from Australia Institute senior economist Matt Grudnoff showed that bringing forward income tax cuts would “disproportionately” see rich, wealthy men better-off, with women to see half the benefits that men would receive.

“Giving tax cuts to the wealthy will have a very limited stimulatory effect on the broader economy, but it will significantly widen the economic divide that already exists between men and women in this country,” Grudnoff said.

Alison Pennington, senior economist, Australia Institute Centre for Future Work

What: Free universal public childcare.

Why: “A quality, universal, free, publicly-funded early child education and care system would fix the long-standing barrier to women’s full workforce participation in high childcare costs, and would deliver substantial economic and social benefits.”

What we need: “A new national childcare strategy should include the following components:

“Extend free childcare crisis arrangements for a further 12 months, with an increase in the minimum funding rate to providers from 50% of fee income to 60%-65%. This proposal would cost approximately $7 billion.

“Reinstate JobKeeper wage subsidy within the sector to support the ongoing employment of staff.

“Design and implement a new free universal public childcare system over the 12-month period. The new system should include permanent ongoing funding for preschool education for all 3- and 4-year-old children.

“Construct new high-quality public childcare facilities with an endowment of $2.5 billion allocated over three years.”

The impact: “Hundreds of thousands of working parents (especially women) would return to work faster; women’s workforce participation and long-term GDP growth would get a boost; and access to high-quality early learning to children would be expanded.

“Increased tax revenues from higher female workforce participation would allow the childcare system to literally ‘pay for itself’.

“A new childcare system would support the creation of an estimated 50,000 new direct jobs in the sector, and help secure the jobs of the over 160,000 people – mostly women – who already work in the sector. Construction of new childcare facilities would create an additional 6,500 jobs in construction over three years.”

Rolling coverage: For more Yahoo Finance stories on the 2020 Federal Budget, visit here.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance