Earnings To Watch: Confluent (CFLT) Reports Q1 Results Tomorrow

Data infrastructure software company, Confluent (NASDAQ:CFLT) will be reporting earnings tomorrow after the bell. Here's what to look for.

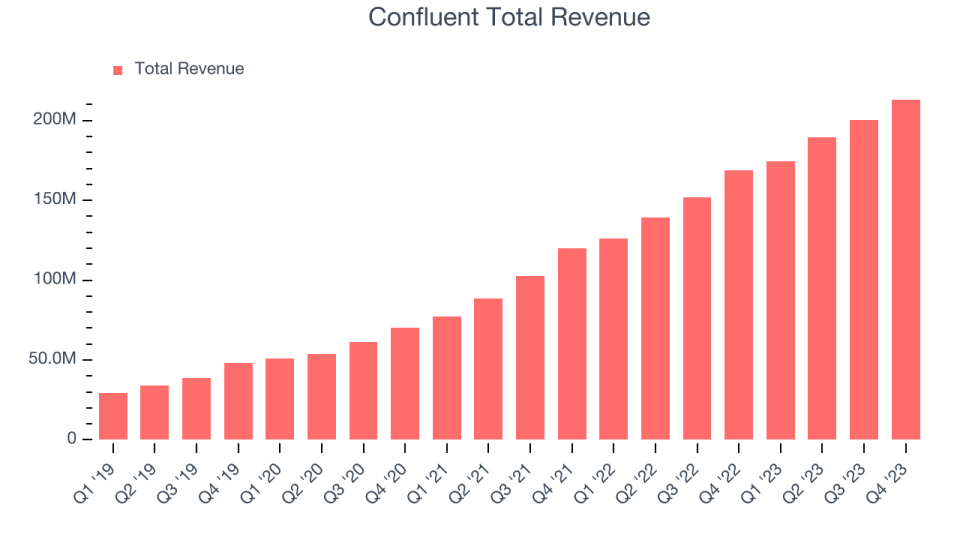

Confluent beat analysts' revenue expectations by 3.7% last quarter, reporting revenues of $213.2 million, up 26.4% year on year. It was a decent quarter for the company, with a meaningful improvement in its gross margin but management forecasting growth to slow. It added 44 enterprise customers paying more than $100,000 annually to reach a total of 1,229.

Is Confluent a buy or sell going into earnings? Read our full analysis here, it's free.

This quarter, analysts are expecting Confluent's revenue to grow 21.5% year on year to $211.8 million, slowing from the 38.2% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.02 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Confluent has a history of exceeding Wall Street's expectations, beating revenue estimates every single time over the past two years by 4.2% on average.

Looking at Confluent's peers in the data and analytics software segment, only Commvault Systems has reported results so far. It beat analysts' revenue estimates by 5.1%, delivering year-on-year sales growth of 9.7%. The stock traded up 3.2% on the results.

Read our full analysis of Commvault Systems's earnings results here.

Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 thanks to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the data and analytics software stocks have fared somewhat better, they have not been spared, with share prices down 3.1% on average over the last month. Confluent is down 4.6% during the same time and is heading into earnings with an average analyst price target of $34 (compared to the current share price of $28.7).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Yahoo Finance

Yahoo Finance