Duke Energy (DUK) Arm Adds 150 MW of Solar Capacity in Florida

Duke Energy Corp. DUK recently announced that its two solar projects in Florida have reached completion and are ready to serve its customers with 150 megawatts (MW) of clean energy. The electricity to be generated from these two facilities has the capability to power nearly 23,000 homes.

As part of the community solar program portfolio, Clean Energy Connection, the two solar projects comprise approximately 216,000 and 220,000 single-axis tracking solar panels, respectively. Such a large-scale solar energy installation capacity takes DUK a step forward in its goal to achieve carbon neutrality in its operation by 2050 while serving customers with a reliable and more affordable energy mix.

Duke Energy’s Growth Prospects in Florida

Duke Energy Florida boasts an investment of approximately $2 billion in solar generation capacity. With this investment strategy, the company aims to add 25 grid-tied solar power plants by 2024, with nearly five million solar panels. This will boast a generation capacity of 1,500 MW, which will be enough to provide reliable energy to its 1.9 million customers.

Duke Energy’s Clean Energy Connection is a program that lets residential and business customers in Florida support renewable energy, subscribe to solar power and earn credits on their electricity bills. Such a program assists the company in growing its customer base in the Florida region.

While Duke Energy Florida appears to have been increasingly focused on investing and boosting its renewable generation capacity in the Florida region through various strategies, Florida boasts immense scope for the company’s further expansion.

Going forward, per the latest report from the Solar Energy Industries Association, Florida boasts a capacity addition of 10,868 MW in the next five years. This exhibits immense opportunities for Duke Energy Florida to continue to invest in the region and solidify its footprint in this region’s renewable energy space.

Utilities’ Focus on Solar Expansion

Utilities in the United States are increasingly investing in solar technology, mainly to decarbonize their operations. The aim to curtail climate change issues has led companies to increase their pace of transition and support rapid development. Apart from DUK, utilities that have expanded their solar portfolio are as follows:

In January 2023, WEC Energy Group WEC announced that it acquired an 80% ownership interest in the Samson I Solar Energy Center. A 250 MW project, Samson I is located in Texas.

WEC Energy’s long-term earnings growth rate is 5.8%. Shares of WEC Energy have delivered 14.4% to its investors in the past six months.

In April 2023, Ameren Corporation’s AEE arm, Ameren Missouri, received a regulatory nod to acquire a 150 MW solar facility in White County, IL.

The long-term earnings growth rate of Ameren is 6.9%. AEE shares have increased 15.9% in the past six months.

In March 2023, Entergy Corporation’s ETR arm, Entergy Louisiana, filed a request with the Louisiana Public Service Commission seeking consent for the construction of two solar projects with a combined production capacity of 225 MW. The main aim is to expand its renewable energy portfolio.

Entergy’s long-term earnings growth rate is pegged at 6%. Shares of ETR have appreciated 7.7% in the past six months.

Price Movement

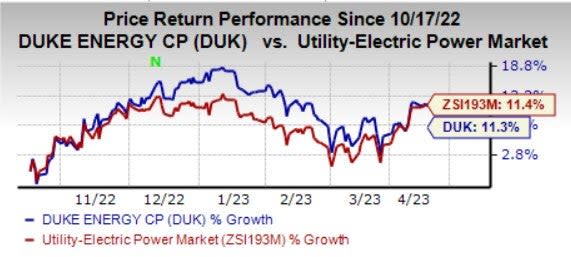

In the past six months, Duke Energy’s shares have increased 11.3% compared with the industry’s 11.4% growth.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance