Dropbox (DBX) to Report Q3 Earnings: What's in the Offing?

Dropbox Inc. DBX is slated to release third-quarter fiscal 2019 results on Nov 7.

Notably, the company beat the Zacks Consensus Estimate in the trailing four quarters, the average beat being 50%.

In the second quarter, the company reported non-GAAP earnings of 10 cents surpassing the Zacks Consensus Estimate of 8 cents per share. Revenues of $402 million outpaced the Zacks Consensus Estimate of $401 million and improved 11.7% on a year-over-year basis.

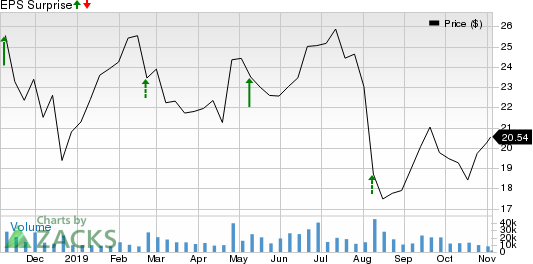

Dropbox, Inc. Price and EPS Surprise

Dropbox, Inc. price-eps-surprise | Dropbox, Inc. Quote

Q3 Estimates

The Zacks Consensus Estimate for third-quarter earnings is pegged at 11 cents, unchanged over the last 30 days. The consensus mark for sales stands at $422.89 million, suggesting an improvement from 17.4% from the year-ago reported figure.

Factors at Play

Dropbox’s continuous efforts to strengthen cloud-based and AI technologies are likely to have driven the top line in the third quarter. The company’s focus on helping users access and synchronize files, and utilize applications through multiple devices has been enhancing user experience and consequently the third-quarter performance.

Further, strong focus on product innovation and introduction of new products are anticipated to have provided the company a competitive edge against peers. These are anticipated to get reflected in the third-quarter top line.

Dropbox has completed the acquisition of HelloSign. The companies together have been providing enhanced experience to Dropbox users, and simplifying workflows for millions of customers. Dropbox has also been announcing various partnership programs of late. The company’s partnership with Microsoft, Google, Salesforce, Adobe, and Zoom is making it easier for people and organizations to work with files on the go. Dropbox’s acquisition synergies and strong expansion drive are anticipated to get reflected in the third-quarter results.

In fact, these aforesaid factors have been helping Dropbox in winning new customers.

However, increasing investments on product enhancements and other growth strategies are likely to have limited margin expansion in the third quarter.

What Does the Zacks Model Say

Our proven model doesn’t conclusively predict an earnings beat for Dropbox this time around. The combination of a positive Earnings ESP and Zacks Rank #3 (Hold) or higher increases the odds of an earnings beat. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Dropbox is -6.25%.

Zacks Rank: Dropbox currently carries a Zacks Rank of #2 (Buy).

Stocks With Favorable Combination

Here are a few stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

Activision Blizzard, Inc ATVI has an Earnings ESP of +24.3% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CVS Health Corporation CVS has an Earnings ESP of +0.05% and a Zacks Rank #3.

Chesapeake Energy Corporation CHK has an Earnings ESP of +8.24% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chesapeake Energy Corporation (CHK) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance