Dow's (DOW) Q1 Earnings and Revenues Top on Higher Volumes

Dow Inc. DOW logged profits (on a reported basis) of $516 million or 73 cents per share in first-quarter 2024. This compares to a loss of $93 million or 13 cents per share a year ago.

Barring one-time items, adjusted earnings were 56 cents per share for the reported quarter, down from 58 cents a year ago. The figure topped the Zacks Consensus Estimate of 47 cents.

Dow recorded net sales of $10,765 million for the quarter, down roughly 9% year over year. It beat the Zacks Consensus Estimate of $10,699.4 million. The top line was hurt by lower local pricing, which more than offset higher volumes. The company benefited from improved demand and lower feedstock and energy costs in the quarter.

Volumes were up 1% year over year driven by gains across all regions barring Europe, the Middle East, Africa and India (“(EMEAI”). Local prices fell 10% year over year in the reported quarter. Prices were flat on a sequential comparison basis as slight gains in EMEAI were offset by modest declines in the U.S. & Canada and the Asia Pacific.

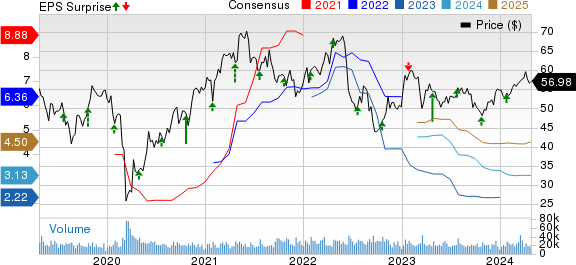

Dow Inc. Price, Consensus and EPS Surprise

Dow Inc. price-consensus-eps-surprise-chart | Dow Inc. Quote

Segment Highlights

Packaging & Specialty Plastics: The division’s sales fell 11% year over year to $5,430 million in the reported quarter. The figure was below our estimate of $5,731.9 million. Volumes were down 3% year over year due to declines in the hydrocarbons and energy business while local prices fell 8%. DOW saw improved demand for polyethylene in flexible food and specialty packaging and for functional polymers in mobility and consumer end markets.

Industrial Intermediates & Infrastructure: Sales for the unit declined 11% year over year to $3,008 million. The figure surpassed our estimate of $2,891.6 million. Local prices fell 14% in the quarter. Volumes rose 4% on gains in polyurethanes and construction chemicals.

Performance Materials & Coatings: Revenues from the division fell 5% year over year to $2,152 million. The figure was above our estimate of $1,957.4 million. Volumes rose 4% while local price went down 9%. Volumes increased on gains in the U.S. & Canada and Latin America.

Financials

Dow had cash and cash equivalents of $3,723 million at the end of the quarter, up around 12% year over year. Long-term debt was $16,170 million, up around 10% year over year.

Cash provided by operating activities from continuing operations was $460 million in the reported quarter, down from $531 million in the year-ago quarter.

Dow also returned $693 million to shareholders in the quarter through dividends and share buybacks.

Outlook

Moving ahead, Dow said that demand in key end-use markets such as packaging, mobility and energy applications are trending higher sequentially, which is in sync with its expectations at the beginning of the year.

The company expects its high-value organic growth investments and advantaged portfolio to allow it to deliver earnings growth and increased shareholder value as the economic recovery gains strength. This provides DOW with the financial flexibility to advance its Decarbonize and Grow and Transform the Waste strategies, which are expected to deliver more than $3 billion in underlying earnings improvement annually by 2030.

Price Performance

Shares of Dow are up 8.4% over a year compared with the industry’s 5.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

DOW currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Carpenter Technology Corporation CRS and Innospec Inc. IOSP.

Denison Mines beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 300%. The company’s shares have soared roughly 95% in the past year. DNN carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have rallied around 67% in the past year. CRS currently carries a Zacks Rank #2 (Buy).

The consensus estimate for Innospec’s current-year earnings is pegged at $6.77 per share, indicating a 11.2% year-over-year rise. IOSP, carrying a Zacks Rank #2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have gained around 22% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance