Douglas Emmett Inc (DEI) Reports Decline in Q1 Earnings and Revenue

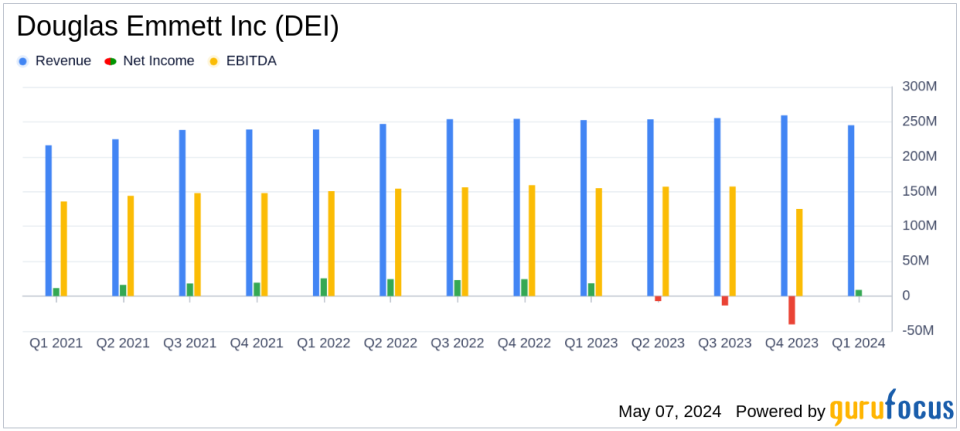

Revenue: $245.0 million for the quarter, a decrease of 2.9% year-over-year, falling short of estimates of $251.32 million.

Net Income: $8.9 million, down 51.5% compared to the same quarter last year, significantly above the estimated net loss of $13.88 million.

Earnings Per Share: Reported at $0.05 per diluted share, surpassing the estimated loss per share of $0.13.

Funds from Operations (FFO): Decreased by 8.7% to $90.1 million, or $0.45 per fully diluted share, primarily due to higher interest expenses and lower revenues.

Adjusted Funds From Operations (AFFO): Dropped by 8.2% to $74.7 million.

Same Property Cash NOI: Slightly increased by 0.7% to $146.1 million, reflecting lower expenses including property tax refunds.

Dividends: Paid a quarterly cash dividend of $0.19 per common share on April 16, 2024.

Douglas Emmett Inc (NYSE:DEI), a prominent real estate investment trust specializing in office and multifamily properties in prime markets of Los Angeles and Honolulu, disclosed its quarterly financial results on May 7, 2024. The company released its findings through an 8-K filing, revealing a downturn in both revenue and net income compared to the previous year.

Financial Overview

For the quarter ended March 31, 2024, DEI reported revenues of $245.0 million, a decrease of 2.9% from the same period last year. This decline was primarily attributed to lower office occupancy and reduced tenant recoveries, despite some offsetting factors such as increased revenue from new residential units and higher in-place office rents. The net income attributable to common stockholders sharply fell by 51.5% to $8.9 million, or $0.05 per diluted share, mainly due to elevated interest expenses coupled with the reduced revenue, although mitigated somewhat by decreased operating expenses.

The company's Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) also saw declines, dropping by 8.7% and 8.2% to $90.1 million and $74.7 million, respectively. However, DEI's same property Cash Net Operating Income (NOI) showed a slight improvement of 0.7%, reaching $146.1 million, reflecting lower expenses including property tax refunds.

Operational Highlights

DEI's leasing activity remained robust with the signing of 214 office leases covering 1.2 million square feet during the quarter. This included significant renewals such as a 250,000 square foot lease in Beverly Hills. The company's multifamily portfolio reported nearly full occupancy at 98.9%. On the balance sheet, DEI ended the quarter with strong liquidity, holding $556.7 million in cash and cash equivalents, and maintained a healthy dividend payout with a quarterly cash dividend of $0.19 per common share.

Market and Future Outlook

Despite the current challenges, DEI's management remains cautiously optimistic. The first quarter FFO per share exceeded expectations due to lower operating expenses, and management anticipates higher straight-line revenue throughout the year. However, they expect these benefits to be offset by rising interest expenses, leaving full-year guidance for Net Income Per Common Share - Diluted between $0.04 and $0.10, and FFO per fully diluted share between $1.64 and $1.70.

Douglas Emmett Inc's performance this quarter reflects the ongoing challenges in the real estate market, particularly with respect to office space demand amidst evolving work trends. The company's strategic focus on high-quality assets in supply-constrained markets, coupled with its robust leasing activity, positions it to navigate through these market dynamics effectively.

Investor Implications

The current financial performance and strategic positioning of DEI suggest a cautious approach for investors. The company's ability to maintain high occupancy in its multifamily units and manage operational costs effectively will be crucial in sustaining its financial health and supporting its dividend payments. Investors should closely monitor the evolving market conditions impacting office space demand and the company's subsequent adjustments to its operational strategies.

Explore the complete 8-K earnings release (here) from Douglas Emmett Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance