Don't Buy Djerriwarrh Investments Limited (ASX:DJW) For Its Next Dividend Without Doing These Checks

Djerriwarrh Investments Limited (ASX:DJW) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Djerriwarrh Investments' shares before the 5th of August in order to receive the dividend, which the company will pay on the 27th of August.

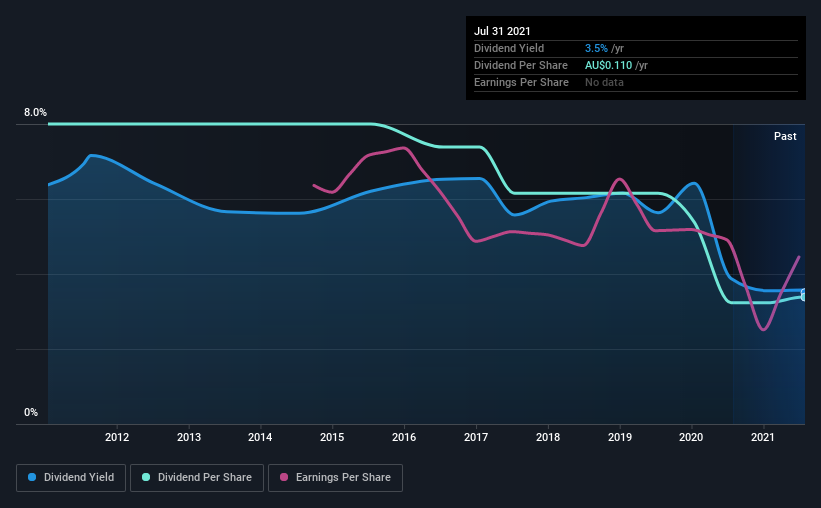

The company's upcoming dividend is AU$0.058 a share, following on from the last 12 months, when the company distributed a total of AU$0.11 per share to shareholders. Looking at the last 12 months of distributions, Djerriwarrh Investments has a trailing yield of approximately 3.5% on its current stock price of A$3.14. If you buy this business for its dividend, you should have an idea of whether Djerriwarrh Investments's dividend is reliable and sustainable. So we need to investigate whether Djerriwarrh Investments can afford its dividend, and if the dividend could grow.

See our latest analysis for Djerriwarrh Investments

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. It paid out 82% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Djerriwarrh Investments paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Djerriwarrh Investments's earnings per share have fallen at approximately 6.4% a year over the previous five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Djerriwarrh Investments's dividend payments per share have declined at 8.2% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

To Sum It Up

Is Djerriwarrh Investments worth buying for its dividend? We're not overly enthused to see Djerriwarrh Investments's earnings in retreat at the same time as the company is paying out more than half of its earnings as dividends to shareholders. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

With that being said, if you're still considering Djerriwarrh Investments as an investment, you'll find it beneficial to know what risks this stock is facing. For instance, we've identified 3 warning signs for Djerriwarrh Investments (1 doesn't sit too well with us) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance