Dominion Energy (D) Q1 Earnings & Revenues Lag Estimates

Dominion Energy Inc. D reported first-quarter 2020 operating earnings of $1.09 per share, missing the Zacks Consensus Estimate by a penny. Operating earnings were lower than the midpoint of the company’s guided range of $1.05-$1.25 per share.

The bottom line also declined from the year-ago earnings of $1.10 per share. First-quarter 2020 earnings were negatively impacted by 9 cents due to milder-than-normal weather in its service territories.

GAAP loss was 34 cents per share compared with a loss of 84 cents in the year-ago quarter.

Total Revenues

Dominion Energy’s total revenues came in at $4,496 million, lagging the Zacks Consensus Estimate of $4,733 million by 5% but improving 16.5% from $3,858 million in the year-ago quarter.

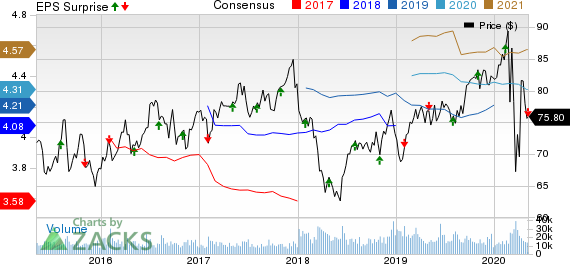

Dominion Energy Inc. Price, Consensus and EPS Surprise

Dominion Energy Inc. price-consensus-eps-surprise-chart | Dominion Energy Inc. Quote

Highlights of the Release

Total operating expenses decreased 10.9% year over year to $3,865 million due to lower electric fuel and energy-related purchases, as well as an increase in operating and maintenance costs.

Interest and related charges in the reported quarter were $490 million, up 4.5% from the year-ago period.

Segment Details

Dominion Energy Virginia: Net income from this segment was $429 million, up 18.8% year over year.

Gas Transmission & Storage: The segment’s net income was $221 million, decreasing 0.4% year over year.

Gas Distribution: Net income from this segment was $225 million, up 9.8% on a year-over-year basis.

Dominion Energy South Carolina: Net income from this segment was $94 million, up 32.4% year over year.

Contracted Generation: The segment’s net income was $59 million, down 42.1% year over year.

Corporate and Other: The segment’s net loss was $97 million, wider than a loss of $88 million in the year-ago quarter.

Guidance

For second-quarter 2020, Dominion Energy expects operating earnings within 75-85 cents per share. The company had reported earnings of 77 cents per share in the year-ago period. The midpoint of the above guided range is 80 cents, lower than the current Zacks Consensus Estimate for the period of 92 cents.

Dominion Energy reaffirmed its 2020 earnings guidance in the range of $4.25-$4.60 per share. The company had recorded earnings of $4.24 per share in 2019. The midpoint of the above guided range is $4.425, higher than the current Zacks Consensus Estimate for the period of $4.31.

Zacks Rank

Currently, Dominion Energy has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

NextEra Energy, Inc. NEE reported first-quarter 2020 adjusted earnings of $2.38 per share, surpassing the Zacks Consensus Estimate of $2.21 by 7.7%.

FirstEnergy Corporation FE delivered first-quarter 2020 operating earnings of 66 cents per share, which beat the Zacks Consensus Estimate of 64 cents by 3.13%.

CMS Energy Corporation CMS reported first-quarter 2020 adjusted earnings per share of 86 cents, which surpassed the Zacks Consensus Estimate of 77 cents by 11.7%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance