Does Van Lanschot Kempen (AMS:VLK) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Van Lanschot Kempen (AMS:VLK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Van Lanschot Kempen with the means to add long-term value to shareholders.

See our latest analysis for Van Lanschot Kempen

How Quickly Is Van Lanschot Kempen Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Van Lanschot Kempen has achieved impressive annual EPS growth of 39%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

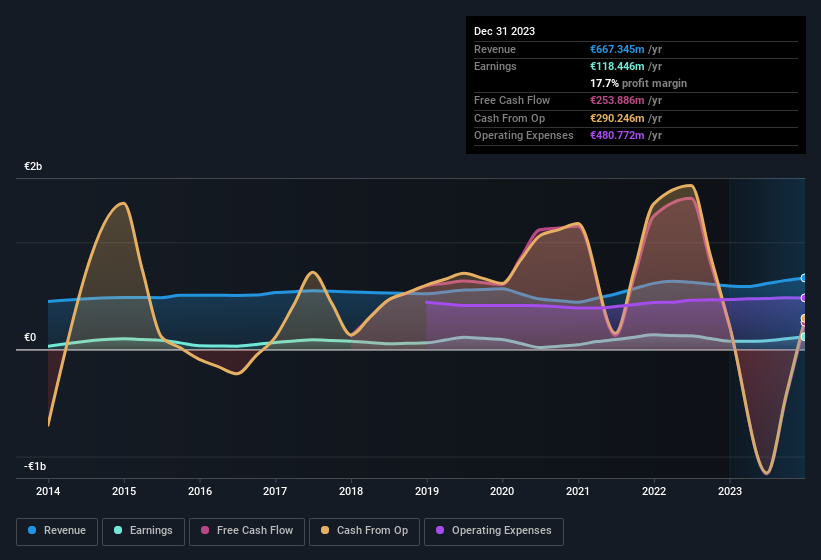

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Van Lanschot Kempen's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Van Lanschot Kempen remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 13% to €667m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Van Lanschot Kempen's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Van Lanschot Kempen Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Van Lanschot Kempen shareholders can gain quiet confidence from the fact that insiders shelled out €713k to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the CEO & Chairman of the Management Board, Maarten Edixhoven, who made the biggest single acquisition, paying €240k for shares at about €28.10 each.

Along with the insider buying, another encouraging sign for Van Lanschot Kempen is that insiders, as a group, have a considerable shareholding. Holding €55m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

Does Van Lanschot Kempen Deserve A Spot On Your Watchlist?

Van Lanschot Kempen's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Van Lanschot Kempen belongs near the top of your watchlist. Still, you should learn about the 2 warning signs we've spotted with Van Lanschot Kempen.

Keen growth investors love to see insider buying. Thankfully, Van Lanschot Kempen isn't the only one. You can see a a curated list of Dutch companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance