Does Kaman (NYSE:KAMN) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Kaman Corporation (NYSE:KAMN) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Kaman

What Is Kaman's Net Debt?

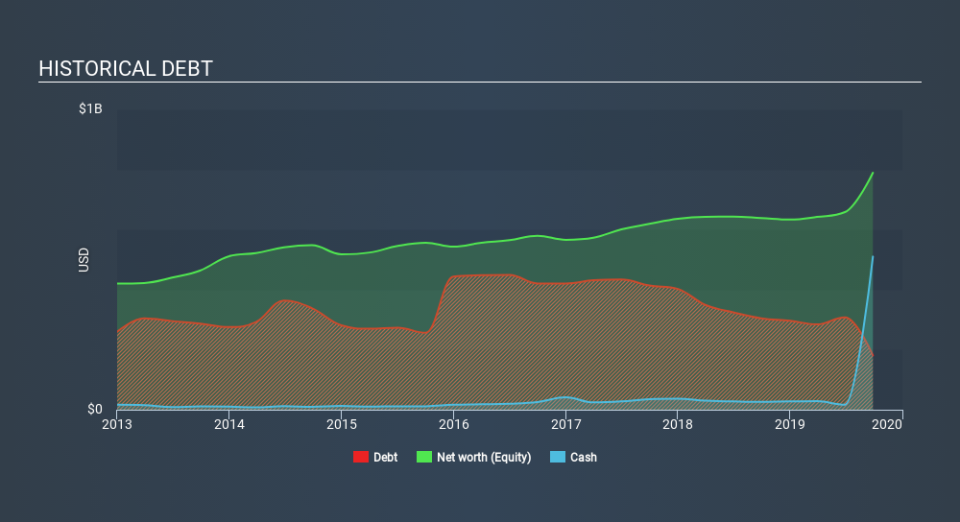

You can click the graphic below for the historical numbers, but it shows that Kaman had US$180.7m of debt in September 2019, down from US$304.3m, one year before. But on the other hand it also has US$510.0m in cash, leading to a US$329.3m net cash position.

How Strong Is Kaman's Balance Sheet?

The latest balance sheet data shows that Kaman had liabilities of US$238.6m due within a year, and liabilities of US$402.8m falling due after that. On the other hand, it had cash of US$510.0m and US$251.1m worth of receivables due within a year. So it can boast US$119.6m more liquid assets than total liabilities.

This surplus suggests that Kaman has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Kaman boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, Kaman grew its EBIT by 74% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kaman can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Kaman has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Kaman produced sturdy free cash flow equating to 56% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case Kaman has US$329.3m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 74% over the last year. So is Kaman's debt a risk? It doesn't seem so to us. Another factor that would give us confidence in Kaman would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance