Did PowerFleet's (NASDAQ:PWFL) Share Price Deserve to Gain 88%?

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, long term PowerFleet, Inc. (NASDAQ:PWFL) shareholders have enjoyed a 88% share price rise over the last half decade, well in excess of the market return of around 63% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 11% in the last year.

See our latest analysis for PowerFleet

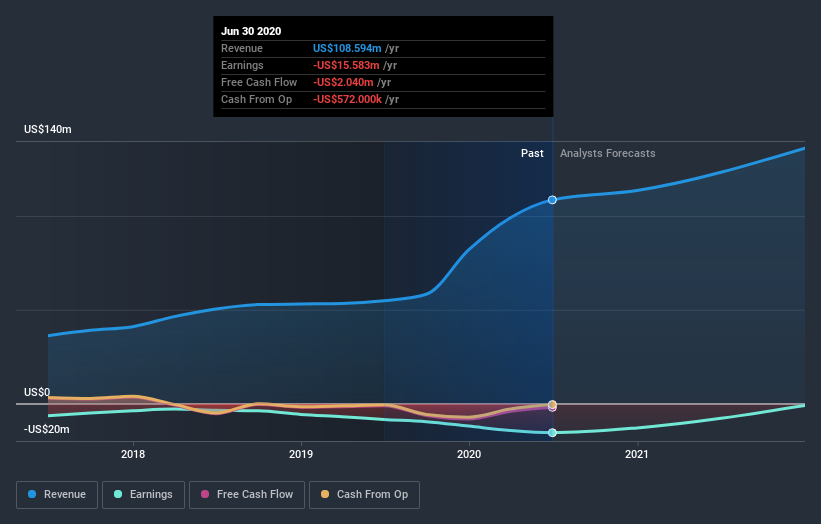

Given that PowerFleet didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, PowerFleet can boast revenue growth at a rate of 19% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 13%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at PowerFleet. Opportunity lies where the market hasn't fully priced growth in the underlying business.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on PowerFleet's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

PowerFleet shareholders gained a total return of 11% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 13% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with PowerFleet , and understanding them should be part of your investment process.

Of course PowerFleet may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance