Did You Participate In Any Of Cycliq Group's (ASX:CYQ) Fantastic 183% Return ?

It might be of some concern to shareholders to see the Cycliq Group Limited (ASX:CYQ) share price down 13% in the last month. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 92% in that time.

See our latest analysis for Cycliq Group

Cycliq Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Cycliq Group actually shrunk its revenue over the last year, with a reduction of 46%. Despite the lack of revenue growth, the stock has returned a solid 92% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

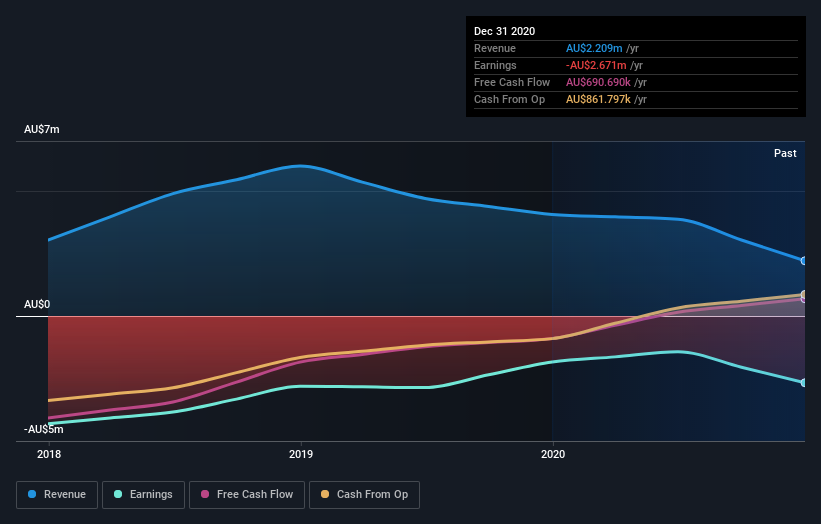

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Cycliq Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Cycliq Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Cycliq Group's TSR, at 183% is higher than its share price return of 92%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Cycliq Group shareholders have gained 183% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 20% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Cycliq Group is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

Cycliq Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance