Did You Manage To Avoid Speedcast International's (ASX:SDA) Devastating 78% Share Price Drop?

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. We wouldn't blame Speedcast International Limited (ASX:SDA) shareholders if they were still in shock after the stock dropped like a lead balloon, down 78% in just one year. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We note that it has not been easy for shareholders over three years, either; the share price is down 77% in that time. The falls have accelerated recently, with the share price down 38% in the last three months.

See our latest analysis for Speedcast International

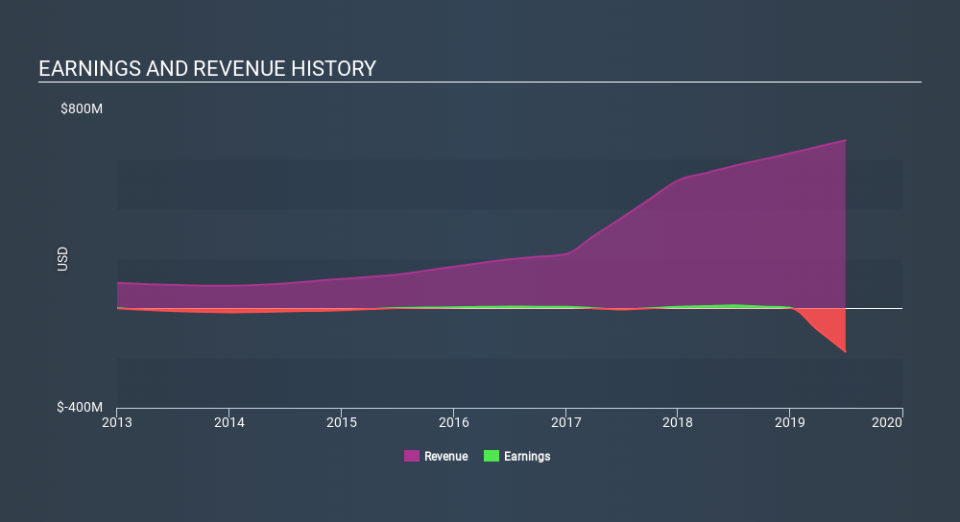

Because Speedcast International is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Speedcast International saw its revenue grow by 18%. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 78% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Speedcast International will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Speedcast International's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Speedcast International shareholders, and that cash payout explains why its total shareholder loss of 78%, over the last year, isn't as bad as the share price return.

A Different Perspective

Investors in Speedcast International had a tough year, with a total loss of 78%, against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Speedcast International is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance