Did You Manage To Avoid Hilton Grand Vacations's (NYSE:HGV) 23% Share Price Drop?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

While not a mind-blowing move, it is good to see that the Hilton Grand Vacations Inc. (NYSE:HGV) share price has gained 13% in the last three months. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 23% in the last year, well below the market return.

Check out our latest analysis for Hilton Grand Vacations

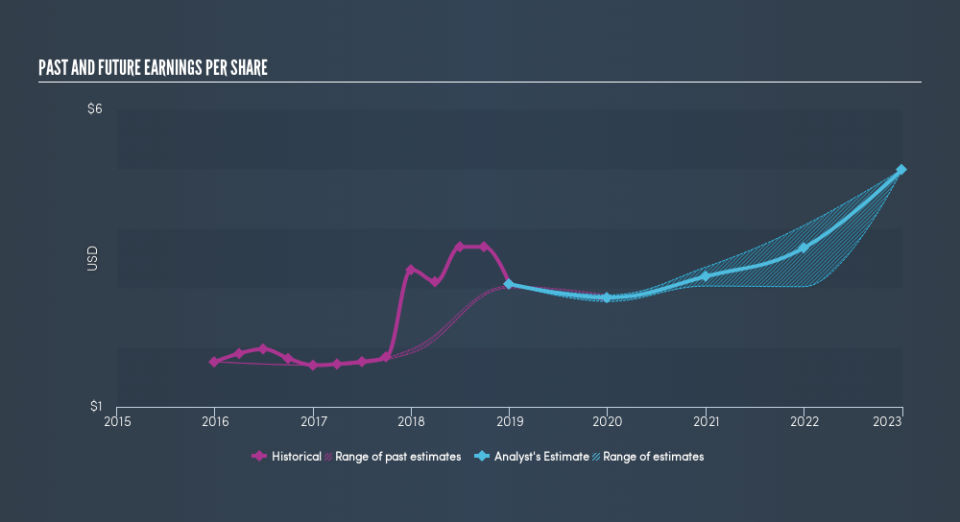

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Hilton Grand Vacations reported an EPS drop of 7.3% for the last year. The share price decline of 23% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 10.67.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Given that the market gained 12% in the last year, Hilton Grand Vacations shareholders might be miffed that they lost 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Hilton Grand Vacations by clicking this link.

Hilton Grand Vacations is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance